is this the first time a procedure like this is being done, or has this happened before(for correct price discovery)

Posts in category Value Pickr

Rajesh’s portfolio (21-10-2024)

They will share more details. I am very bullish on future, DYOD

KPI Green- Turning Sunshine Into Cashflows (21-10-2024)

Another subsidiary Sun Drops Energia Private Limited where promoter has taken stake… they dont even mention at what price… etc… most likely will list this company also at huge premium… again retail shareholders being shortchanged…

Aditya Birla Capital – A complete Financial Inclusion (21-10-2024)

AB Capital In Focus – strong numbers by subsidiary

Aditya Birla Housing Finance Q2FY25 Earnings

NII up 22% QoQ to Rs 281 cr

PAT up 22% QoQ to Rs 80 cr

Profit beat of 11% vs. Morgan Stanley estimates

Aditya Birla Housing is a subsidiary of Aditya Birla Capital

Subsidiary accounts for 10% of consolidated profit and ~8% of SOTP value

Profit up 22% QoQ mainly because of higher revenues

Gross Stage 3 (-30bp QoQ) and Net Stage 3 (- 28bp QoQ) improved significantly

Balance sheet loan assets grew 46% YoY

#AdityaBirlaCapital #AdityaBirlaHousing

Shilchar Technologies – Power & Distribution Transformers – Sunrise Sector? (21-10-2024)

Investor call this Friday post results on Thursday. Will be interesting to see. Last time they had announced a big capex plan.

GFL Limited & Inox Fluorochemcicals Limited (21-10-2024)

could you explain in a little bit of detail and the pdf announcement

Mahanagar Gas Ltd – a natural monopoly (21-10-2024)

Mahanagar gas is the subsidiary of GAIL, GAIL is valuation is comparatively higher than its long-term average over 5 years.

I see Mahanagar gas is fairly priced in my view. let’s see.

FII/DII activity – and what we can make out of that! (21-10-2024)

Hello Friends,

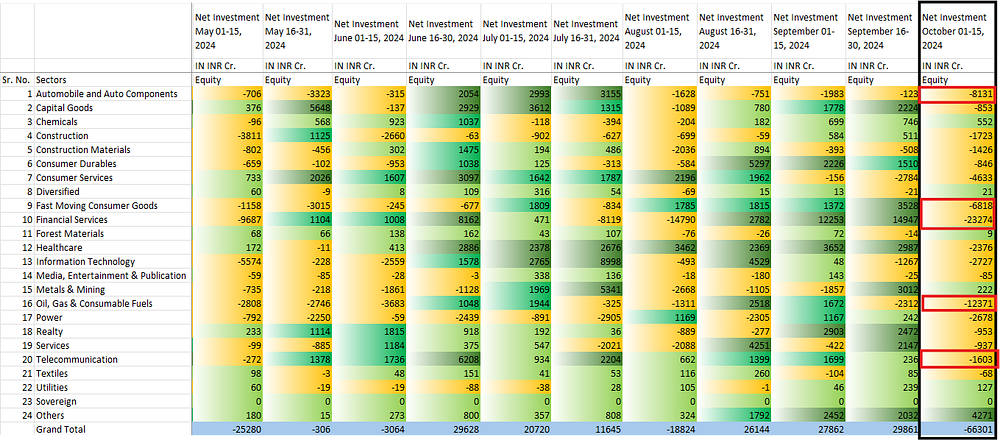

The data of net investments by FII’s are out from 1st October to 15 October.

This fortnight was one of the darkest fortnight for the Indian equities market. Due to Geopolitical tension around the globe between Israel-Iran and the China stimulus, we have experienced a huge chunk of net outflows from major 17 sectors out of 24 sectors.

The data provided in the image is for 11 fortnights starting 1st May to 15th October. In the 11 fortnights we have acquired a net inflow of 32,085 crores. However in the same duration, excluding the lates fortnight we had clinched net inflow of 98,386 crores. In just 15 days we almost lost 66,306 crores of Investments.

The most affected sectors for this fortnight are

- Financial Services: – 23,274 crores

- Oil Gas and Consumable fuels: -12,371 crores

- Automobile and Auto components: -8,131 crores

Collaboratively these three sectors have contributed to 66% of net outflows for this fortnight.

Chemical sector sees promising investments as this sector has been securing net inflows for the past 4 fortnights continuously. This shows a positive sign in the chemical sector.

Newgen Software (21-10-2024)

Low code platform merely means that a customer can expand the software functionalities or build new applications using user friendly libraries (for example using drag and drop features to build a new process). That itself is not unique and most of the product companies call their platform as low code (like many have started calling them AI-enabled).

The main solution they offer is content management where you can digitize, review, govern and manage your content through its lifeycle. Most of the content in the organizations tend to be in unstructured format (pdf, word, ppt, jpeg, email etc) which accounts for roughly 90% of the total digital content that an organization creates. So that’s a big opportunity itself. Which is why I’m saying that they are currently in a good space. But that doesn’t mean their offering is differentiated or moated.

It’s a highly competitive space and range bound operating margins reflect that and you don’t see any operating leverage playing out in last 6-8 years although revenues have been steadily increasing.

Pls don’t think I’m criticizing Newgen or undermining their solutions. I’m just saying that one should take buzzwords like GenAI, lowcode, open architecture etc with a pinch of salt. As long as there is demand growth from end consumers all players in this space will do well including Newgen.

Disc- Also invested in the stock but not biased.