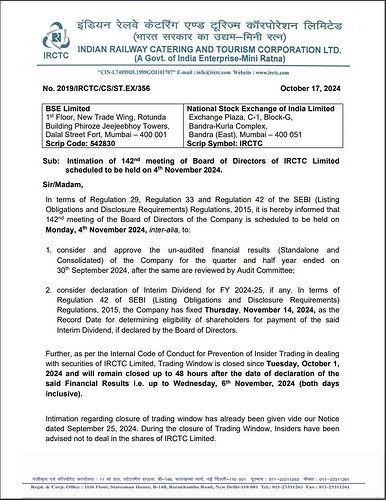

Company declared interim dividends

Posts in category Value Pickr

Avenue Supermart: a compounding machine? (20-10-2024)

Karnataka is planning to levy 1% on all quick commerce transactions for a gig workers welfare fund. Apart from the existing delivery charges, packing charges, late night charges, GST on them, if this gets approved 1-2% extra fees has to be paid on top of the order amount. I think all quick commerce companies would see some impact if more and more states adopt such fees.

Avenue Supermart: a compounding machine? (20-10-2024)

Trent’s Zudio can lease any commercial building and start operations right away. but DMart has to own land construct building and open a full fledged store to operate. We cannot compare Zudio’s growth with DMart’s GM&A segment. If you look at the margins both operate an a similar operating margins of around 15-16%.

High inflation, lower consumer discretionary spending can be attributed to the slower growth, but in the long run DMart’s footfall can become a major competitive advantage over Trent.

My personal shopping experience with Zudio is mostly like one time visit, to experience the new store and new merchandise, the quality is sub par. Once the newer stores mature, the footfalls will be stagnant, same-store sales growth will decline and lease rental expenses will hit the margins hard in the long run.

Avenue Supermart: a compounding machine? (20-10-2024)

What are your views about competition from Zudio.

DMarts Growth in general merchandise and apparel has been decreasing since COVID. This in turn has further impacted the margins.

What are the exact reasons behind this and there has been no clear road map as to how will DMart handle this.

Cummins – Generating Power (20-10-2024)

Received couple of downgrades recently – Marketmojo and Goldman sachs

Electronics Mart India Limited- EMIL (20-10-2024)

My views on the stock Electronics Mart India (Bajaj Electronics):

-

Electronics Mart India (EMI), a Hyderabad based company. Started in 1980 by Pavan Kumar Bajaj who has no connection with the Bajaj Group’s Rahul Bajaj family.

-

The owner of Bajaj Electronics stores in Telangana and Andhra Pradesh and Electronics Mart stores in Delhi/ NCR region.

-

The largest Electronics retailer in South India and the 4th largest in India, following Reliance Digital, Croma and Vijay Sales.

-

The company launched IPO in 2022 at a price of 60 and now trading at 215. The stock has been in consolidation phase from the last 1 year with a range between 180-240.

-

Market leader in AP & Telangana, and expanding into other areas post IPO.

-

Has a consistent track record of growth, profits and is aiming to add around 25+ stores each year going forward venturing into other states and tier 2 & 3 cities.

-

Their strategy is to enter a market, penetrate deeply and become a market leader which is a strong moat over its competitors. (Similar to DMart’s cluster based expansion approach)

-

My preferred store to shop for any large electronic appliances, bought 2 TVs and 3 ACs and impressed with their customer loyalty.

-

They will match the price to the best price available from the Online stores Amazon/ Flipkart.

-

Have seen 2 new stores opened in my area recently.

-

There doesn’t seem to be any red flags as far as I know.

-

Currently available at fair valuations and is in a consolidation phase since last 1 year.

-

This could be a potential consistent compounding stock for the long term investors.

Disclosure: accumulating in small quantities with a long term view.

Avenue Supermart: a compounding machine? (20-10-2024)

I think the risks have been mostly factored in the recent price correction. I don’t see any red flags for long term, if the company survives the quick commerce competition it is bound to give decent returns for long term investors.

Avenue Supermart: a compounding machine? (20-10-2024)

A great list of all the positive for the company but do you also have a list of risks that the company faces