Posts in category Value Pickr

Multi-Disciplinary Reading – Book Reviews (10-10-2023)

Excellent writeup. This is not a widely read popular book. But great read with a lot of original ideas as summarized by Phreak above.

Multi-Disciplinary Reading – Book Reviews (10-10-2023)

Excellent writeup. This is not a widely read popular book. But great read with a lot of original ideas as summarized by Phreak above.

Bye Bye Diesel Petrol, Welcome Biofuel- Global Biofuel Alliance- A paradigm shift in sustainable energy, Carbon foot print and economic strategy- various options before India (10-10-2023)

LNG – is the fuel for future for long-haul trucking.

Bye Bye Diesel Petrol, Welcome Biofuel- Global Biofuel Alliance- A paradigm shift in sustainable energy, Carbon foot print and economic strategy- various options before India (10-10-2023)

LNG – is the fuel for future for long-haul trucking.

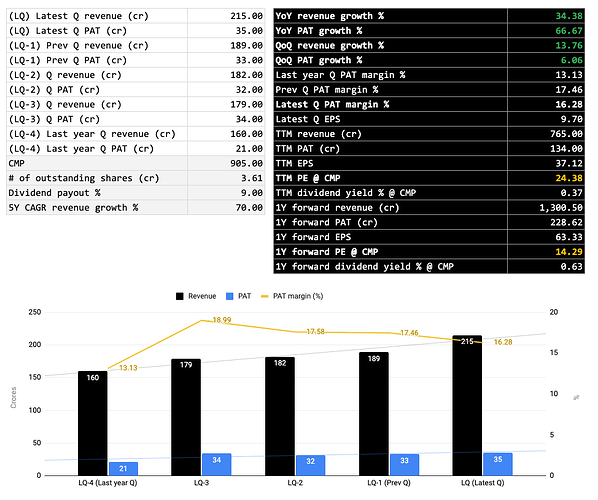

KPI Green- Turning Sunshine Into Cashflows (10-10-2023)

KPI Green posted a good set of Q2FY24 numbers. The order book looks decent in terms of future growth.

-

Revenue grew 34% YoY and 14% QoQ

-

PAT grew 67% YoY and 6% QoQ

-

PAT margin declined a bit QoQ but is stabilizing in the range of 15%-17%

-

346+ MW projects executed so far till H1FY24

- 313+ MW cumulative projects executed till FY23

- 33+ MW projects executed in H1FY24 alone (10% of total execution till FY23)

-

541+ MW total orders in hand (1.56x of total orders executed so far, )

- 385+ MW new orders received in H1FY24 (1.1x of orders executed till H1FY24)

- Consists of two big orders: 240 MW under GUVNL tender and 145 MW from Ayana Renewable Power Four Pvt Ltd

- 156+ MW backlog until H1FY24

- 385+ MW new orders received in H1FY24 (1.1x of orders executed till H1FY24)

-

887+ MW orders already secured out of 1000 MW target by 2025

- Only need 110+ MW additional orders to hit the target (looks very much possible!)

-

ICRA reaffirmed A- (Stable) credit rating for long term at an enhanced rated amount

-

Segments:

- 18% revenue share of IPP (vs 22% in Q1FY24)

- 82% revenue share of CPP (vs 78% in Q1FY24)

-

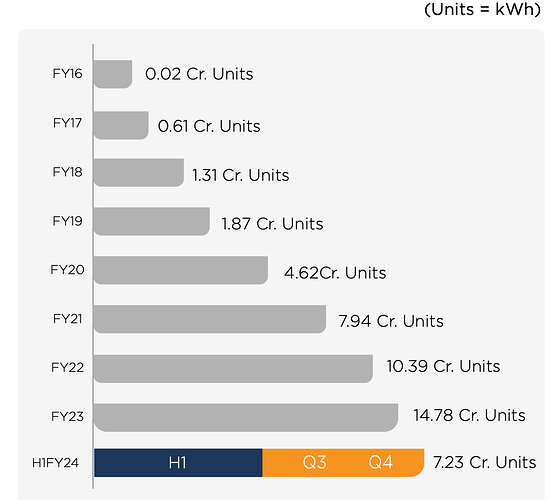

Unit generation growth under IPP is steadily increasing

-

Increasing moving towards hybrid model (solar + wind energy) which help grid stability due to reliable, efficient and sustainable approach to energy generation. It enables commercial optimization of transmission charges and the effective utilization of grid capacity.

- 145+ MW hybrid CPP orders received during Q2FY24

- 185+ MW hybrid CPP orders as on H1FY24

KPI Green- Turning Sunshine Into Cashflows (10-10-2023)

KPI Green posted a good set of Q2FY24 numbers. The order book looks decent in terms of future growth.

-

Revenue grew 34% YoY and 14% QoQ

-

PAT grew 67% YoY and 6% QoQ

-

PAT margin declined a bit QoQ but is stabilizing in the range of 15%-17%

-

346+ MW projects executed so far till H1FY24

- 313+ MW cumulative projects executed till FY23

- 33+ MW projects executed in H1FY24 alone (10% of total execution till FY23)

-

541+ MW total orders in hand (1.56x of total orders executed so far, )

- 385+ MW new orders received in H1FY24 (1.1x of orders executed till H1FY24)

- Consists of two big orders: 240 MW under GUVNL tender and 145 MW from Ayana Renewable Power Four Pvt Ltd

- 156+ MW backlog until H1FY24

- 385+ MW new orders received in H1FY24 (1.1x of orders executed till H1FY24)

-

887+ MW orders already secured out of 1000 MW target by 2025

- Only need 110+ MW additional orders to hit the target (looks very much possible!)

-

ICRA reaffirmed A- (Stable) credit rating for long term at an enhanced rated amount

-

Segments:

- 18% revenue share of IPP (vs 22% in Q1FY24)

- 82% revenue share of CPP (vs 78% in Q1FY24)

-

Unit generation growth under IPP is steadily increasing

-

Increasing moving towards hybrid model (solar + wind energy) which help grid stability due to reliable, efficient and sustainable approach to energy generation. It enables commercial optimization of transmission charges and the effective utilization of grid capacity.

- 145+ MW hybrid CPP orders received during Q2FY24

- 185+ MW hybrid CPP orders as on H1FY24

Cosmo Films – Diffentiated player in commodity business (10-10-2023)

i have no holdings in any Polyfilm stocks. Further to that, will not comment on any stock.

2016 views in any cyclical stocks may not be valid today as far as cycle goes. For that matter, even a 2022 comment may not be valid.

Cosmo Films – Diffentiated player in commodity business (10-10-2023)

i have no holdings in any Polyfilm stocks. Further to that, will not comment on any stock.

2016 views in any cyclical stocks may not be valid today as far as cycle goes. For that matter, even a 2022 comment may not be valid.