Finally good news for E2E networks, they can now participate as primary bidder with Meity lowering turn over to qualify…

Posts in category Value Pickr

SG Mart- Can it successfully create a marketplace? (28-09-2024)

Did anyone attend the AGM? Can you please share notes?

Ascendant’s Portfolio (28-09-2024)

Hi, regarding Abbot, it’s just a play on the products & experience of parent MNC(200B USD), and the revenue potential in India. Wouldn’t say as much of a valuepickr pick though, quite well known and established.

I will try to add the rationale for Bosch in some time.

Using Artificial Intelligence/Machine Learning to improve Decision Making Skills and enhance Predictive Analysis (28-09-2024)

Few thoughts about financial reporting and possibilities of ML models:

- Research has shown that companies that introduce a lot of changes to their reports between quarters are more likely to have negative stock price performance during the following period, see Cohen, 2020 and Adosoglou, 2021

- The downward price effect is usually not happening right at disclosure time, rather some time after it, when other news emerge, such as publishing of negative outlook etc.

- In other words, the information about risks etc. might have been provided in quarterly reporting, but in a more subtle way than a straight headline, for example. Therefore, it might have not been registered by investors, and is ignored in their decision making i.e. the stock price

- Implication from this is that an investor should be aware of sudden changes in the content of a company’s reporting, if the stock is intended for a long holding period. It is especially the case when a change has happened, but it hasn’t affected the pricing immediately.

- ML models can be used to quickly determine if semantically meaningful content change has happened.

Here is one case example, from a Finnish large cap Neste, using the tool at finsim:

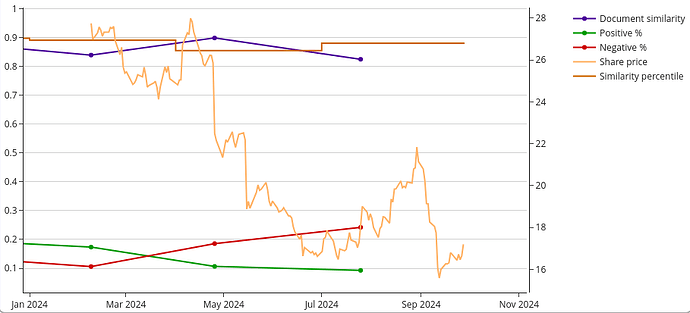

In the graph there are some developments of Neste’s year 2024.

- Dots represent quarterly reports, from Q4/23 to Q2/24. The brown reference line shows a similarity-score that 50% of companies don’t surpass during the quarter.

- It can be seen, that in Q1 the share price has plummeted after the release, most likely due to subpar numbers. Note also the rise of negative tone.

- However, a bigger slide in price happened some time after the release, when a lowering of outlook for the year was released. This could have been conveyed in Q4/23 report, which had little bit lower similarity-score than usual (84% similarity compared to Q3/23)

- In Q2, a more prominent effect was seen. At first, the markets responded with optimism, and the share price had an upward trend after the first days. Then, about month later another lowering of guidance happened.

- Here the similarity-score is around 82%, lower than usual, along with growing proportion of negative tone. Again, the Q2-report might have had some different wordings about risks etc, which were realized later during Q3.

At least in hindsight, the possibility of additional risks related to the company could have been picked out by using the similarity metric, and then delving into the details of the disclosure. In the Cohen study there is a similar type of example, they highlight the changes line by line, and show another turn of events. Here is also an interview, in which the study is discussed in more detail:

Ranvir’s Portfolio (28-09-2024)

Sir one key point you forget to mention is that they get the right to use the brand name of APOLLO, for free, which in itself is a big positive for the company as APOLLO has strong presence in the market as well as in the minds of the customers.

Companies with 20%+ growth guidance for next few years (28-09-2024)

Yes, it is strange, but the website of ITC Labs also showing the same status. So either they are changing something or website might have been hacked or even worse, they didn’t renew their domain.

Anyways, not a welcome move.

Srivari Spices and Foods Limited (28-09-2024)

Can I apply for more right issue through bank then I own in my demat, will I get extra if someone missed to appy?

Investing journey of an imperfect investor (28-09-2024)

Have completely exit Technoelectric and Frontier Springs with some reduction in Jash as part of profit booking wrt small caps. I’m still heavily invested in Macpower, Shilchar, Ethos, Jash and Windlas but am not adding onto any new positions or new stocks and waiting for market direction wrt small caps.

Samhi Hotels – Turnaround with Tailwinds (28-09-2024)

I believe the Fed rate cut, can benefit highly leveraged players like, Samhi hotels, as per last quarter they had a debt of ~1800 crores and next 200 basis points cut by central bank by end of next year can will reduce the interest cost around ~36 crores/annum, this should get reflected in numbers by the end of FY2026/2027.