“Low risk event” What do you mean by that?

Do you mean the loan is actually on the P&L of Fusion so after 2-3 months anyway from the rights issue atleast fusion will return it back to lenders so lenders carry the risk only incase fusion micro is not able to avoid bankruptcy?

Posts in category Value Pickr

IDFC First Bank Limited (19-11-2024)

Vasa Denticity aka Dentalkart – The Indian Amazon of Dental supplies ?! (19-11-2024)

Sharing my notes from latest updates from investor ppt, concall and from my own insights:

-

Company is venturing into manufacturing of crowns, bridges, veneers, dentures and other orthodontic products via its Smile Labs ventures. This market has huge TAM of $1.7 Bil USD growing at 11% CAGR

-

Smile Labs was acquired and Vasa owns 60% of it. It was doing a revenue of 5 Cr before acquisition

-

Company wants to digitize the entire design and manufacturing process and also reduce the turnaround time which should act as a major differentiator.

-

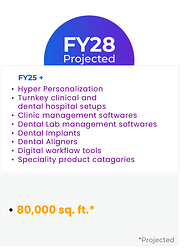

Their 2028 vision looks aggressive and showcases the management’s vision to grow far beyond the current limited TAM of consumables and selling Chinese equipment. Planning to double warehouse area.

-

They have also revamped their mobile app and website to drive more traffic and optimize conversion rates. It still doesn’t feel as smooth as some other e-commerce apps, reminds me of Aliexpress app.

-

Reducing delivery timelines has led to some increase in delivery days.

-

Company’s vision is to have 35k SKUs (currently 20k SKUs). They are inspired by Henry Schein, which is a 9.5 Bil US based company

-

Own brand mix is 50%, has been the same for past 3-4 quarters. Aim is to reach 70% by 2027-2028. This includes exclusive brand partnerships as well as white label sales. But it doesn’t matter that much because margins are same for both own branded and other products.

-

Guidance: Company had given a guidance of 70% sales growth in FY25, which seems unlikely. Promoter said that this was their internal target and he shouldn’t have disclosed this. Personally, I had invested considering a 45% sales growth by looking at their historical customer traffic, unique customers and TAM, so my thesis remains intact but still disappointing to see

-

On FY26, the promoter said a non-committal growth figure of 30% and didn’t give a solid comment on the 500 Cr sales figure for FY27 that was mentioned in a previous concall. I don’t consider this as unrealistic if their orthodontics venture takes off.

-

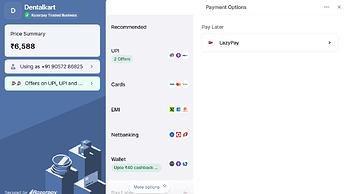

Company has launched BNPLfor 25-50k sales items and company is planning to partner with an NBFC to allow customers to finance purchases up to 10 lacs (basically setting up an entire dental clinic). But BNPL is hidden under “more options” section below other payment methods, so I am not sure if they would see the boost that they should get from this.

-

Company is planning to open service centers in Tier-1 cities for large ticket equipment

-

Main pro in this company that I feel is that the CEO is young, hungry and has clarity and vision. I know, these are all soft factors but execution is key especially in e-commerce businesses and all the TAM in the world is worthless if you can’t execute

Advait Infratech: A detailed analysis (19-11-2024)

They have heard it.

Danish Power Ltd (19-11-2024)

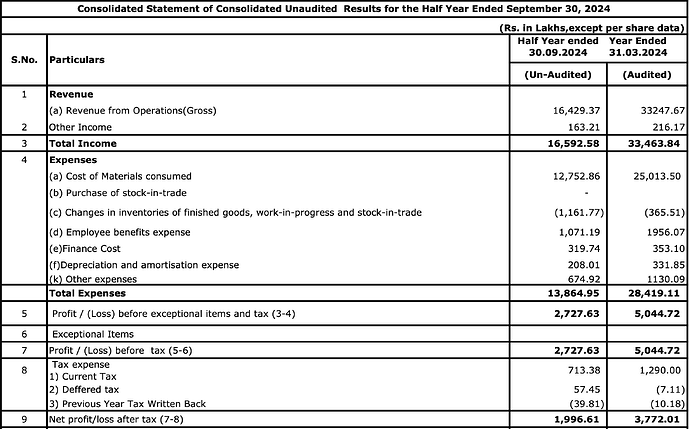

Danish Power declared H1FY25 results today and the numbers look solid. Sadly they didn’t publish H1FY24 numbers which could have shown the correct comparative picture here. I hope they come up with a concall or presentation which can throw more light on this.

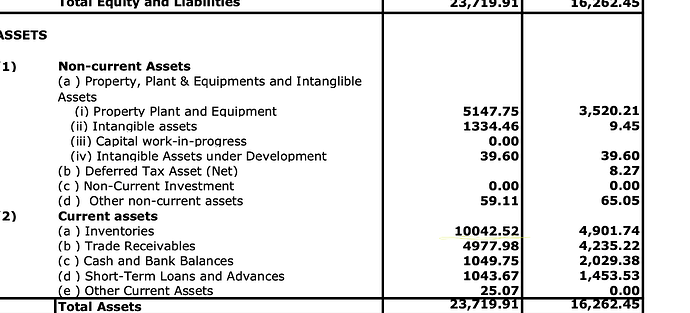

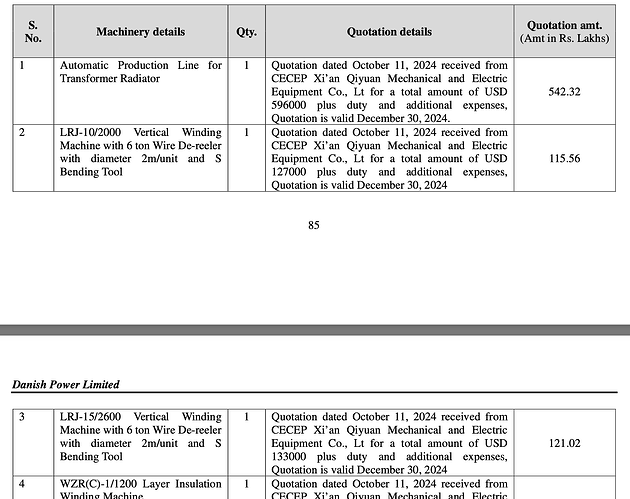

More than the results, one exciting thing I found is inventory of more than 100 crores in balance sheet.

Now question is how do we see it. The answer lies in the only interview of the management they did before IPO https://youtu.be/wIKuSoOAwsg?t=472 (7:52) wherein Shivam Talwar, MD of the company clearly stating that many of the customers delays the delivery of the transformers due to installation related issues during the monsoon and also due to budgetary allocations, H2 is always bigger for not just Danish but for entire transformers’ industry. Since the demand scenario in the inverter transformer space is out of question, I guess, the big inventory built up is just waiting for dispatch in 2nd half of the FY, which alone will explode the numbers for H2.

Having followed the transformers industry for last couple of years, what I found is Q1<Q2<Q3<Q4. To put this into perspective let us compare half yearly numbers of some listed transformers companies for FY24.

Shilchar H1-173 crores, H2- 223 crores (despite they ran at full capacity for entire year)

Indotech H1-189 cores, H2- 314 crores

TARIL H1-413 crores, H2- 882 crores

Voltamp H1-703 crores, H2- 912 crores

Not just for a year, this is a general trend for last few years. So it looks like the companies in this sector do 60%-70% in 2nd half year.

Now, if we see the results of Danish coupled with strong inventory built up, the numbers look strong.

Danish has capacity of installed capacity of 4680 MVA for transformers and if they do 30 crores of revenue from panels (assuming no growth from last year’s revenue), with strong order book (RHP has the order book data) I think the company is on course to do revenue of Rs. 400-425 crores this year which translates to EBITDA of around Rs. 75-80 crores and Net profit of Rs. 55-60 crores for FY25 with existing capacity (not taking into account the capacity expansion which will go live in last quarter).

What lies ahead?

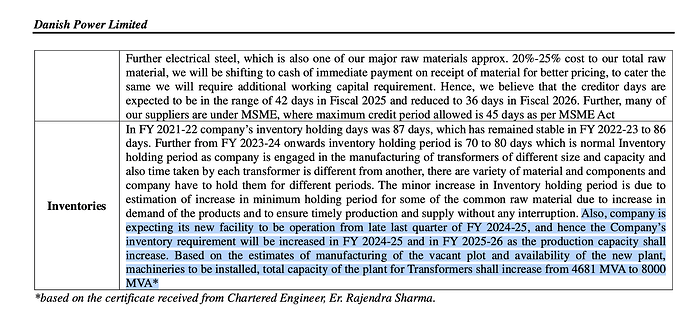

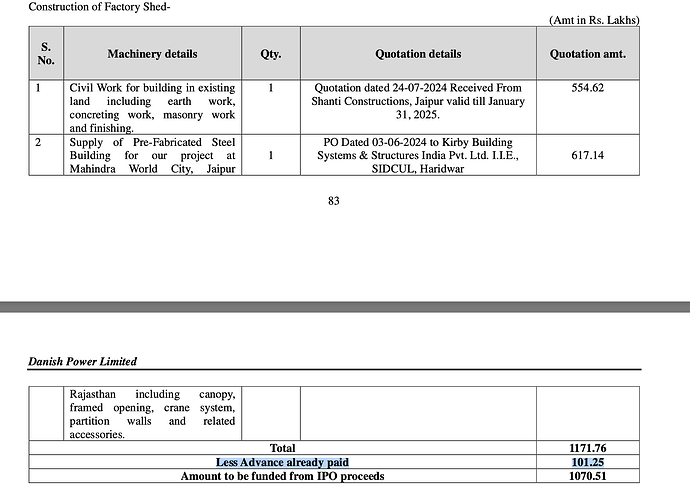

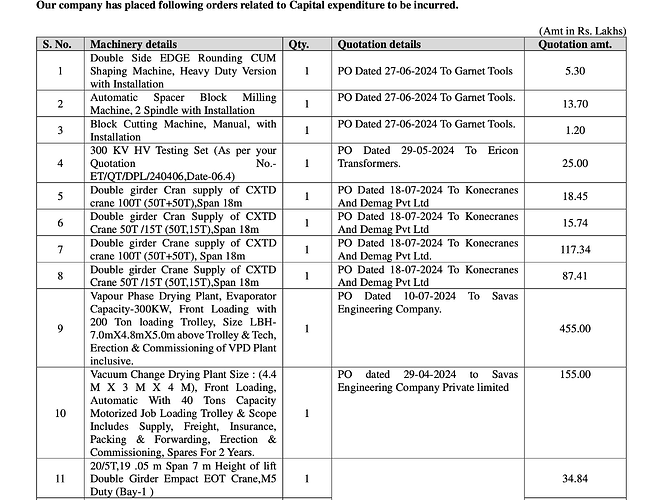

Company has successfully raised 198 crores through IPO for working capital, repayment of loan and capital expenditure. They are expanding their capacity to 8000 MVA.

Civil construction has already began for and machinery is ordered so it can be safe to assume that capex will go live by end of this financial year.

With enhanced capacity, Danish Power can do revenue of more than 800 crores (transformers and panels). Even if new capacity runs at optimum utilisation and existing capacity runs at full capacity, company can do revenue of around 700 crores in FY26, which seems to be quite realistic at the moment.

What sets Danish apart:

- Management: There is nothing much about the management, but whatever little is available at YouTube, LinkedIn and elsewhere, they are impressive, specially MD Shivam Talwar. The family seems to be domain expert (have a look at listing ceremony https://youtu.be/Oa_voOsrvRE?t=994 )

- Geographical presence: Danish is Jaipur based company which has inherent geographical advantage since Rajasthan is the biggest hub of big solar park. The company can deliver the transformers quicker and cheaper.

- Working capital management: From the data available, it seems that the management of Danish is efficient is working capital management. Apart from Silchar, no company comes close to Silchar in working capital management and hence the better margins that the industry peers.

These points make Danish Power an exciting company, however, valuation seems to be stretched at TTM level but if we look at FY26 projections, the company seems to be cheapest in entire transformer space.

Disclaimer: Invested, biased.

Nitco ltd – will it turnaround? (19-11-2024)

Yes. It’s again going on for restructuring.

Kovai Medical Center and Hospital – Health and Wealth (19-11-2024)

Worth reading, covered different aspects of Kovai.

Disc. : invested from lower levels

Salzer Electronics (19-11-2024)

Thanks for Notes !!!

Sky Gold ltd. – Will it reach the sky? (19-11-2024)

Is there a way to find out the buying and selling prices of these shares. Curious as to why now only. None of these stocks have given any returns in over a year.

NPST – Technology Provider for UPI Tech (19-11-2024)

This, to my mind is the MOAT for us investors IMHO. To have a management which knows their job, is aggressive, and also takes care of investors is a rare combo, that too in a small cap.