I would not rely on FED’s statements, remember first there was no inflation, then the inflation became “transitory”…and now (oops) the inflation is at multi decade high (in US) and hence FED is on a war footing to increase the interest rates…I rather go by the banks track record, and management’s expectations that they can continue to grow at the same/higher rates. What happens in US economy will for sure have some impact on the bank too…but in the long run that wont and should not matter.

Posts in category Value Pickr

Sharda Cropchem – Can it get into indian market in a bigger way? (29-07-2022)

Dear Harsh, we would like to hear from you about the current headwinds in business which Sharda cropchem is facing. As far as We know you follow Agrochemical sector very closely. I have positions in Agrochemical sector through Meghmani Organics. MOL results of this quarter are very much superb looking at its valuation. What’s your take on Sharda cropchem valuation with current business headwinds.

Deepak Fertilizers and Petrochemicals (29-07-2022)

Negative news for the Company Income Tax order for Rs 569 Cr …

Polycab India ~ Connection Zindagi Ka – W&C, FMEG and EPC Player (29-07-2022)

Any specific reasons for 30% drop in revenues from previous quarter Q4?

HDFC Bank- we understand your world (29-07-2022)

To continue with the above thesis, mostly cuz fundamentally the business is on track…

The chart breached 3 month high, broke an important resistance of 1400, coupled with FII change of stance, makes the chart bullish.

Can this take the share price to all time high? Now it’s possible. This breakout, after a base formation seems fairly decisive. Icici, SbI are within 5% range of their all time highs.

FED hv hiked rates as expected, and have hinted no fear of recession. So, no bad news is expected.

Banks have had a good last couple of quarters, hence could be back in fovour.

Burger King ~ Whopper of an Opportunity (29-07-2022)

Burger King Indonesia has acquired franchise rights for Popeyes and plans to open 300 outlets in Indonesia in next 10 years.

IMO it’s a positive news for restaurant brand investors

For India, I think Jubilant foodworks has the franchise rights for Popeyes.

Force Motors – racing ahead! (29-07-2022)

Can you please elaborate on this, so that other people can also benefit.

Investing Basics – Feel free to ask the most basic questions (29-07-2022)

Experiences from my recent filing…

I had to file ITR2 and AIS promptly brought the LTCG. It was 1.4L.

Good thing is I had STCG loss from my US equity (company RSU) and also STCG loss and LTCG loss carried forward from the previous years. That offsetted my LTCG to zero.

That is in a way bad since upto 1L there’s no tax. And now it got offsetted for no benefit.

However it brought down my taxable income and I was lingering above the slab where surcharge increased dramatically. So in total the LTCG offset to zero saved me quite a lot of taxes.

Income tax department would want you to declare the LTCG even if it is below 1L for their benefit of increasing surcharge if that amount makes you cross a tax slab ![]()

Tanla Platforms ~ Leading player in the fast-growing CPaaS market (29-07-2022)

@Vileh , your note makes a lot of sense, and I totally agree with your thesis, rather than cg issues, shady past, Forbe’s article etc. Just adding to your note is a surprise big hit to their margins in Q1, which the street was not prepared for. However, management’s con call stated that Q1 was just one off kind hit and there might be a little carry over of margin hit in Q2 as well. But rest of the FY should be back to normal. I think Q2 will be a key watch out if what management says is true.

52 week highs and all time highs strategy (29-07-2022)

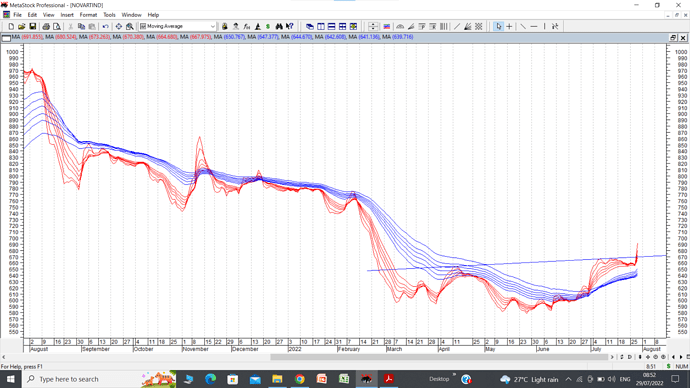

Q1 fy 23 is the first after many quarters in Novartis where profitability has shown significant improvement. We have to be sure that it is not one off and part of a larger trend. Since management does not seem to be doing concalls, there is no way of verifying this, except to wait for next qtr results or track prices and see if they tell us something. As of now, we have an inverted head and shoulders breakout from the bottom with a big gap up. Gap up is from 666 to 712. Usually there is an attempt to fill such a huge gap up atleast partially. So it would be prudent to wait for stock price to cool off before rushing in to take positions. Employee expenses have come down from 28 cr in q1 fy 22 to 20 cr in q4 fy 22 now to 9 cr in q1 fy 23. This benefit looks sustainable. Attached daily GMMA chart of Novartis, showing the inverted head and shoulders breakout I mentioned.