My recent summary about the company

Key points

- Cloud computing industry has strong tailwinds, growing at 20-30% per year.

- E2E targets SME companies and startups as customers.

- E2E Networks offers much lower cost offerings (2.5-3 times cheaper, the company claims) versus the ‘hyperscalers’ AWS, GCP, Digital Ocean and Azure.

- Revenue has been increasing every quarter since March 2020 from Rs 2.2 cr to Rs 4.9 crores now.

Details

- Investor Presentation (May 2022) is the main source of information about the company.

- 2021 Annual Report

- Screener page

- Began in 2009 before cloud computing had taken off. Developed its service for start-ups.

- SME IPO in 2018, which was oversubscribed by almost 70 times. Transitioned to the NSE main board in April 2022.

-

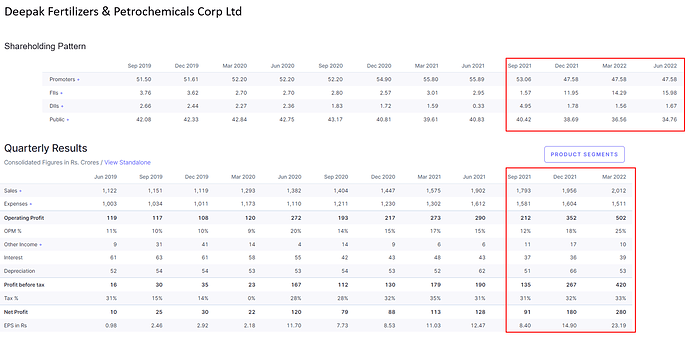

Shareholding Pattern (June 2022):

- Promoters: ~59%

- Tarun Dua (Promoter and Managing Director): ~55%

- Blume Ventures Fund: ~11.8%

- Airavat Capital: ~4.8%

- Holding of major shareholders has not changed much since the IPO.

- Promoters: ~59%

- Focus has moved to SMEs as opposed to the startup ecosystem.

- One of the big customers transitioned out in 2020, resulting in big loss of revenue. The client concentration since then has reduced. No customer contributes more than 3-4% of the revenue. There are nearly 2000 active customers now.

- R&D costs are lower since they target customers who pay less, and enjoy simpler user experience UI and UX. R&D costs are a major component of expenses in such companies.

- Depreciation is high because computer systems have a low lifecycle of around 3 years.

Pros and Cons

- Pros

- Strong tailwinds in the industry. India is traditionally a price-sensitive market and E2E’s offering is among the lowest.

- Track record of working with a number of startups while they were small.

- Minimal customer concentration risk now.

- Cons

- Less trusted player compared to the hyperscalers. Will be severely affected if the hyperscalers reduce prices.

- Change in technology may render E2E’s current technology obsolete and require them to make substantial investments which could affect the Company finance and operation.

- Competitive industry. Company may be severely affected in an industry downturn.

- Key person risk—may result in strategy bias.

Disclosure: Invested from lower levels.