One correction to Jitendra’s post , and few more points

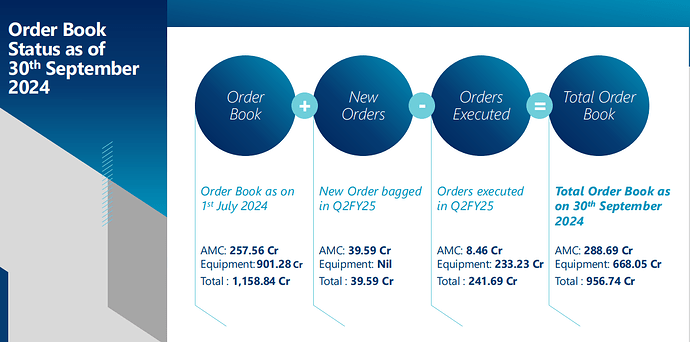

1- Correction – the fresh orders expected in H2 FY 2025 (until 31st Mar 2025) are for 1200 crores (not 3500 crores). 3500 crores is their order pipeline.

Other points

1- Expect the receivables to come down significantly in this and next quarter. In the current Trade Receivables amount, major chunk is from recent times.

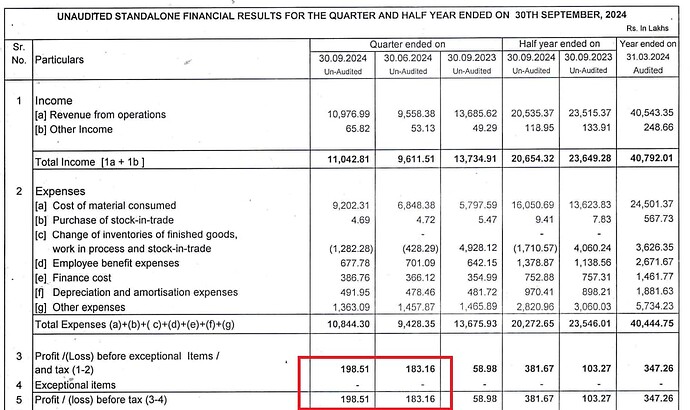

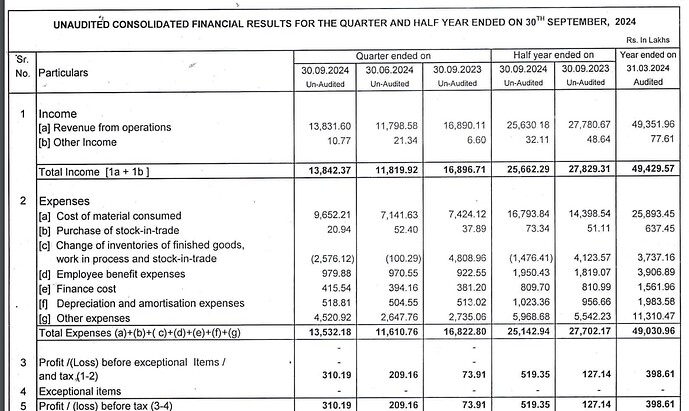

2- Company is confident of clocking at least 900 crores this year. Despite a lot of questions around 500 crores is already done in the first two quarters, so the H2 should be just 400 crores?’, the management stuck with their guidance. They simply do not want to over commit and under deliver (like last year).

3- The management believes that they would be able to clock 50% CAGR post current year for the next three years. The EBITDA would be 35% and PAT margin 25%.

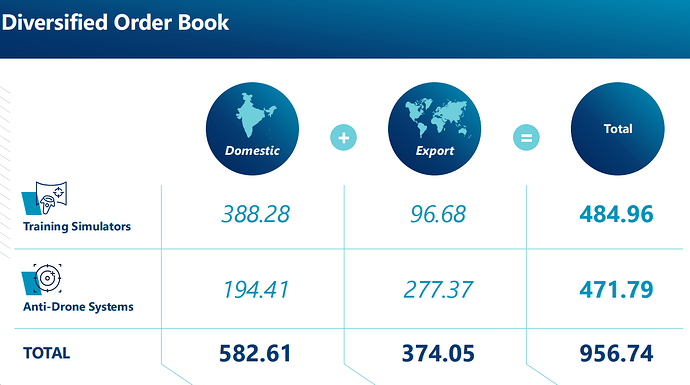

4- The management believes that their products in Simulators category is top notch, and even in the ADS (Anti Drone Systems) they are very competitive.

5- They are primarily an IP company. They get 85% of goods from suppliers and only 15% is manufactured by them. This asset light model helps them keep fixed costs in check, which helps them during dry order periods. They would have similar model in US.

6- The company is keen on acquisition but does not want to rush into it. Mr. Ashok emphasized that he would be extra careful putting any money and not do acquisition just for the sake of it.

Overall, my sense is that the company is on strong footing. They trust their skills and products. While the Ukraine-Russia war may end because of Trump, the need/market for the simulators, anti-drone systems, remote controlled weapons and surveillance is only going to go up. Key monitorable would be order book; they need to get wide & deep traction for their products and build many years’ worth unexecuted order pipeline.

Cheers,

Krishna