Posts tagged All News

Bypoll results boost for UDF, relief for LDF, disappointment for BJP in Kerala (23-11-2024)

The Congress-led UDF celebrated victories in the Wayanad Lok Sabha and Palakkad Assembly by-polls, while the ruling CPI(M)-led LDF found relief in retaining the Chelakkara Assembly seat. Priyanka Gandhi Vadra secured a resounding win in Wayanad, while the BJP experienced a setback in Palakkad, prompting introspection within the party.

Congress posts worst show in Maharashtra, distant junior partner to JMM in Jharkhand (23-11-2024)

The Congress party faced significant setbacks in Maharashtra and Jharkhand assembly elections, raising concerns about its role within the INDIA opposition bloc. Despite the bloc’s victory in Jharkhand, the Congress’s poor performance, particularly in Maharashtra, weakens its bargaining power. The party’s focus on issues like caste census and criticism of Adani-Ambani seemed to fail to resonate with voters.

Biden’s Chief Economist Processes the Election With ‘Confusion, Guilt’ (23-11-2024)

Jared Bernstein, the chair of the White House Council of Economic Advisers, was a leading architect of “Bidenomics.”

Stock for Sale by Cabinet Members (23-11-2024)

Trump’s picks for Treasury secretary and commerce secretary both lead Wall Street firms. Here’s what that could mean for their finances and businesses.

Sahana Systems Ltd Concall (23-11-2024)

The detailed Summary of Q2FY25 Concall of Sahana Systems

- Financial Performance**

- Revenue:

- Half-year (H1 FY2024-25) consolidated revenue stood at ₹52.6 crore, compared to the prior year’s full-year consolidated revenue of ₹69 crore.

- Management expressed confidence in surpassing last year’s full-year revenue.

- Profit After Tax (PAT):

- Half-year PAT at ₹9.8 crore; full-year PAT for the previous fiscal year was ₹15.3 crore standalone and ₹18.21 crore consolidated.

- Growth Drivers:

- Increased contribution from defense and fintech segments, with significant upcoming orders in the pipeline.

- Operating Margins:

- Margins are stable, supported by the company’s high-value defense contracts and operational efficiencies.

- Margin Guidance**

- Management aims to maintain current margins, leveraging:

- Higher-value products in the defense segment, like radar and anti-drone systems.

- Scalable fintech solutions, particularly UPI-related projects for domestic and international markets.

- Focus on cost optimization in R&D and operations through partnerships with academia and research institutions.

- Business Segment Performance**

Defense Technology

- Key offerings:

- Anti-drone systems, radar systems, and electronic warfare solutions.

- Indian Army partnership for critical projects, appreciated at the highest levels.

- Recent Developments:

- Engagements with foreign governments for radar and anti-drone solutions, including a potential deal with a neighboring country.

- Pipeline:

- Large-scale orders in discussion for safeguarding sensitive locations abroad.

- Differentiator: Faster deployment and integrated software-driven solutions compared to competitors.

Fintech

- Key offerings:

- Development of ONDC switches and interoperable UPI systems.

- Significant projects with U.S.-based banks for end-user computing and large-scale banking transformations.

- Pipeline:

- Collaborations with countries to implement interoperable UPI systems to revolutionize their financial ecosystems.

- Current fintech orders include digitizing agricultural credit societies across two Indian states.

Healthcare

- Key offerings:

- No-code AI platforms, healthcare management information systems (HMIS), and digitalization of EMR (Electronic Medical Records).

- Market Strength:

- Long-standing U.S. customers in the healthcare sector since 2016.

Education Technology

- Smaller focus compared to defense and fintech.

- Involvement in government-led initiatives to transform India’s education ecosystem.

4. Management Guidance for the Future

- Revenue Growth:

- Management anticipates significant growth in FY2024-25 and FY2025-26 from new projects, particularly in defense and fintech.

- Geographical Expansion:

- Increasing international presence through government-to-government collaborations and export of fintech and defense technologies.

- Focus Areas:

- Prioritizing defense and fintech as core growth drivers, while retaining other segments for long-term relationships and smaller contributions.

- R&D Strategy:

- Collaborations with IITs and top researchers.

- Investment in advanced AI/ML technologies to stay ahead in innovation.

5. Key Risks

- Competition:

- Several players entering the anti-drone and radar ecosystem, including established defense PSUs and private firms like Zen Technologies.

- Sahana’s edge lies in faster deployment and superior software integration.

- Dependency on Government Orders:

- Heavy reliance on defense contracts and government approvals, which are subject to delays and budget constraints.

- Geopolitical Risks:

- Ongoing negotiations with foreign governments could face geopolitical hurdles or regulatory challenges.

- Fintech Adoption:

- Success in implementing UPI and ONDC systems abroad depends on the willingness and regulatory support of foreign nations.

6. Industry Trends

- Defense Technology:

- Growing demand for indigenous and cost-effective solutions due to geopolitical tensions.

- Focus on integrating advanced AI-driven solutions in warfare systems.

- Fintech:

- Massive growth in UPI transactions in India, surpassing the GDP of several countries.

- Other nations are exploring the adoption of UPI technology to modernize their financial systems.

- Healthcare and AI:

- Increasing reliance on AI-based healthcare solutions for digital transformation in global markets.

- Education Technology:

- Digitization of education systems gaining traction, driven by government initiatives.

Conclusion

Sahana Systems Ltd showcased robust performance in H1 FY2024-25, driven by its defense and fintech segments. The company remains optimistic about securing large-scale international contracts and maintaining margin stability. While it faces risks from competition and dependence on government orders, its strong pipeline and technological edge position it well for future growth. Management’s strategic focus on high-value segments and innovation will likely drive sustained growth in the coming years.

Forensics and the art of triangulation (23-11-2024)

IMO that is not the reason for its low valuation due to the following reasons :

-

The cumulative CFO/PAT from FY20-FY24 is 90% + as PAT IS 13CR and CFO is 12CR.

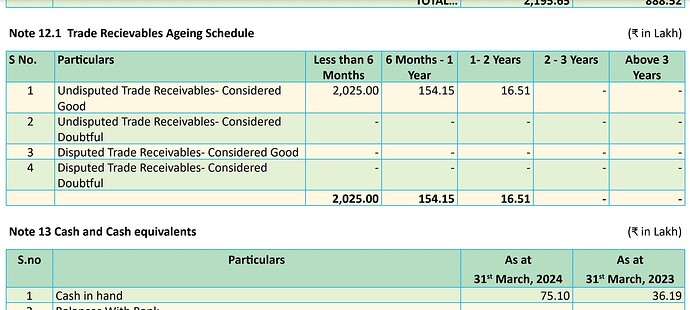

Most of the trade receivables are for a period of less than 6 months.

-

Its peer Antony waste has 30% of receivables as a percentage of sales. Urban enviro waste has 128cr sales and 34cr receivables which means it has ~26% of receivables as a percentage of sales.

-

The company is in B2G sector which is known for having high receivables but comparing with other companies its receivables still look healthy and even when most B2G companies have given negative CFO, in H1FY25 its CFO was positive.

Some more points to add

- The company doesn’t have significant related party transactions and it is in B2G sector which makes it a bit difficult compared to B2B to show fictitious sales and profits.

I would really appreciate if someone could highlight any red flag or discrepancies which this company or its management might have.

Thank you.

Disclosure not a buy /sell recommendation.