Posts tagged Value Pickr

Kotak Mahindra Bank – Low Cost Liability Banking Franchise (04-05-2024)

I would tend to agree with this observation.

ICICI Bank and ICICI Direct web site was down for more than 4 hours just few days back (I do not remember the exact date), so these technical glitches are across the Banks.

Sometimes those are not reported widely by Media.

Hence, as long as business is good, an investor should focus on the business fundamentals.

Off course in this case, fundamentals will be impacted to some extent but keep faith in your conviction and management’s capability to overcome such tough situations.

Probably they were little less cautious earlier and Hope that, they will learn a lesson and turn around the situation like many other banks.

Disclosure : Invested in Kotak Bank in the past 2-3 years.

Multi-Disciplinary Reading – Book Reviews (04-05-2024)

When To Sell Paperback – 1 December 1999

by Justin Mamis (Author)

A classic book that was updated and revised in 1994, now with an updated foreword written by the author. A meaningful analysis, a few rules to follow, how to choose good charts, and numerous case histories. Guidelines to follow which help you to be self-reliant.

AGI Greenpac- on the cusp of growth? (04-05-2024)

So from the con-call it appears that Management doesn’t anticipate a scenario where the ruling is not in their favor (as in there doesn’t seem to be a plan B with regard to future growth). So let’s hope their confidence holds good. One point that I couldn’t quite grasp was the condition subsequent to acquisition of HNG to sell their Rishikesh unit (400 TPD capacity) which is a voluntary modification action from AGI. Anyone can shed more light on this?

Meghmani Finechem – Underrated multibagger? (04-05-2024)

Why would a B2B product be sold via 2/3 channels in between? Seems weird. CPVC is mostly used in pipe making if I’m not wrong.

Ugro Capital – Opportunity To Invest in a Fintech-like Company Below Book Value (04-05-2024)

I of course don’t know what the market is thinking but the book value per share growth rate is quite ordinary for this stock. This is due to constant and large share dilution that is happening.

In my understanding this is what matters in the financials.

INOX Wind (04-05-2024)

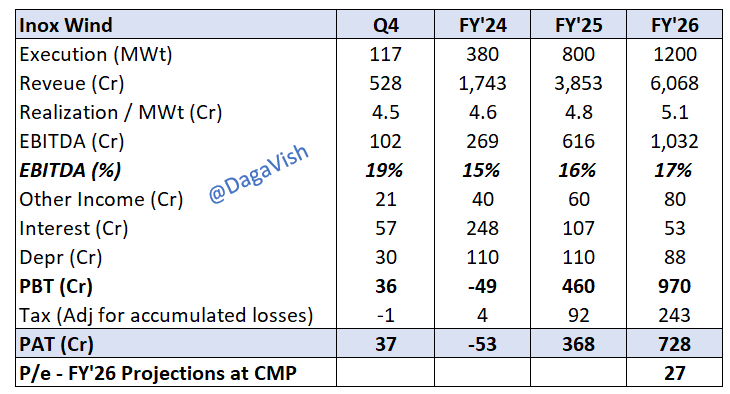

Basis the Q4 results & Management commentary on concall, have tried to extrapolate the financials for the coming years. Basis the same, at 20k Cr Mcap, it is valued at ~27x FY’26 projections. However, orderbook gives an opportunity to execute more + New order additions in FY’25 can add more to FY’26 topline.

Key assumptions:

- Realizations hold at Rs.5 / MWt for next 2 years

- EBITDA guidance of 15%+ for coming years

- Mgt. has guided for debt free by H1 of FY’25 and no further capex in the next 2 years considering capacity is already built for 2-2.5 GWt. Hence the overall interest and depr cost should start tapering down as we go ahead.

Disc: Invested

Lt foods (daawat) (04-05-2024)

Whether a company is selling commodity is indicated by the ROE that the business is making. In case of LT foods it is consistently making 16 ROE and the operating margin has not gone below 10 in last 10 years. Market is cautious of Rice companies after KRBL fiasco, but if the business continues to deliver, I think it is a candidate for rerating

Is China investible? (04-05-2024)

Hang Seng index is in a bull market thanks to these stocks | Invezz

Although its premature China investments have started doing good for me in my personal portfolio.