In the remittance and the hook business they have very strong competition from other fintech companies. In the casa business, there is a lot of traditional banks employing BC services and providing saving accounts at 0 fees. For instance, Fino provides BC services to Union bank. If you want to dig deeper from my experience Indian Bank has been trying hard to extend the BC services. So, the competition is already providing the services at discounted prices. Fino have been constantly increasing their reach with more merchants and it is convenience for the customers and clear subscription charges rather than hidden charges like minimum balance charges and folio charges,

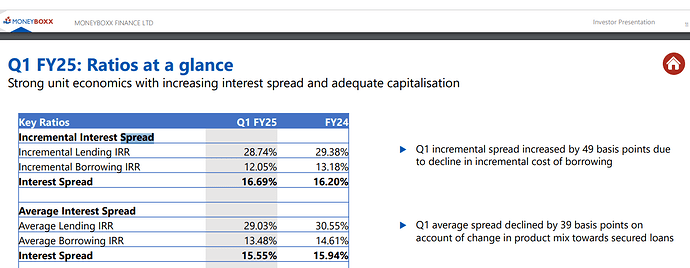

Average deposits is up 37 % yoy and is at 1659 crores. Right now they have to deploy these funds in T- bills and bank deposits. Once they get the SFB license the can lend these funds to the public. Moneyboxx finance could be a pointer at spread.

Indicator of spreads from Moneyboxx Investor presntation

There are few excellent write ups on Moneyboxx in this forum, if you want to dig deeper there.

the cost of funds for Fino was 2.1 % a few quarters back, you can get an idea of NIM from that. As a payment bank they cant take a deposit of more than 2 lakhs, but that would change with SFB licence. They may have to offer a higher rate on fixed deposit but that may still be attractive on an overall revenue basis