Hello, I am from Ahmedabad, May I request you to add me in the VPR whatsapp group of Ahmedabad. How can I contact you or DM you without showing my mobile number on the forum. Kind regards and Thanks

Posts tagged Value Pickr

Pidilite Industry : Fevicol ka Jod (11-11-2023)

i think its experienced based and knowing myself as investor. we should not look at what we lost in say nbfc as success stories will be everywhere and we cannot be everywhere…its more personal decision and i am perfectly fine in not having ridden a bajaj finance…not so fine in having lost the page industry story though…

BMW Industries Ltd (Steel Service center) (11-11-2023)

Sir what is their CRM segment?

Sir howcokw their margins are high and return ratios low? A

Do TSL has any other SSC?

Thanking you Sir

Deep Industries (DIL) (11-11-2023)

Some of the Points, I would like to see in future: (Base on presentation)

1.Implementation of fully mobile units, facilitating swift relocation to any part of the country within a few months. Proactive forecasting of contract renewals enabling optimal resource planning in advance. Minimization of time drag for subsequent optimization and utilization of equipment between contracts for any re-engineering or client related re-configurations as they are finalized in the final 3-4 months of the prior contract period.

2. Expertise in providing Value added services for our clients which in turn improves their revenue generating ability as well as profitability at large and provides a diversified service mix for their product portfolio.

EV: Yes, more or less is same in my calculation.

Bull therapy 101-thread for technical analysis with the fundamentals (11-11-2023)

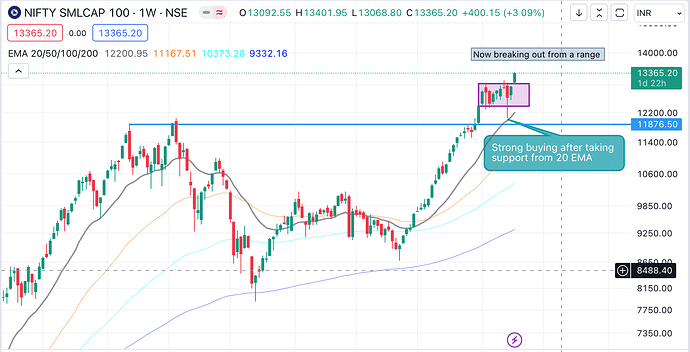

Overall view of the market:

(Market Turned bullish after Shakeout)

The last two weeks were very interesting weeks with lots of results and the market made many to turn bullish. (who turned bearish in Sept-Oct). ( I am also one of them. P:)

Above is the weekly chart of SmallCap 100 showing classic patterns with a lot of details.

Last two weeks price action was based on earnings and overall the earnings were quite better than expected. I consider (may prove to be wrong) this price action strong as it was based on strong results with all the uncertainties of war in the Middle East.

Also, by just looking at the technicals, ignoring all other facts, There was a heaving breakdown of the chart but took the support of 20 EMA and bounced back quickly.

Clearly, a shakeout move on the Index, and this move is visible on a lot of stocks so this was market-wide making it a strong comeback.

After coming back to the small box range, It spent a week there and then this week a breakout of the Range. A classic continuation of the uptrend.

Now What’s Next:

Most probably next week there will be the continuation of the uptrend in the market …but … but if there is a fall again in the range box then there will be a long pause before.

So, for me, this is not the time to sit with cash as I can see what is happening and have to make decisions based on that and not by predicting what can happen.

Here are a few of the Stocks on my radar

Now that the direction of the market is decided for me, it is time to select stocks.

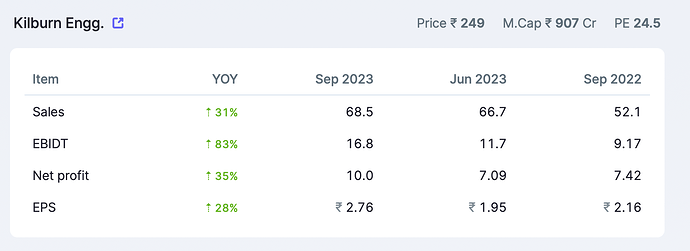

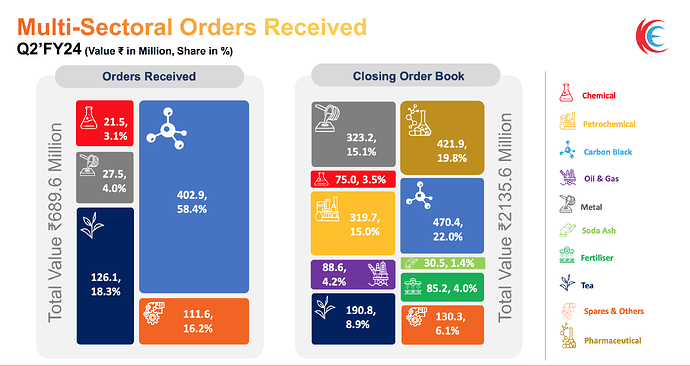

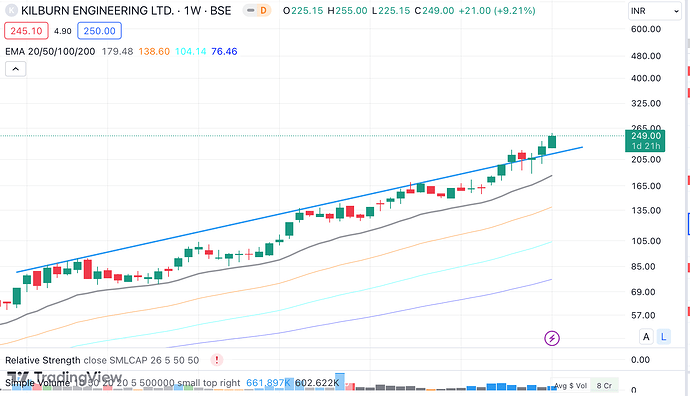

- Kilburn Engineering Ltd: The company manufactures equipment/systems for critical applications in several industrial sectors like Chemical, Steel, Nuclear Power, Petrochemical and Food Processing, etc. The company came out with good results

A proxy to capex in many sectors including oil and gas, pharma, chemical, petro, Carbon Black, metal, etc.

They have proposed the acquisition of ME Energy Private Limited which is in the segment of waste heat recovery These systems find application for thermal energy saving and/ or thermal energy cost reduction in almost all industrial processes.

What triggered me is that they are guiding for sales of Rs 500 cr by FY25 for the combined entity after acquisition. The current sales is approximately 250 cr, so effectively doubling in 1 and a half years or in 2 years. :

While current Qtr operating margins were 25% management has guided for 20% + margins for up upcoming few quarters based on the order book currently.

This is how the current order book of 200 cr plus which will be executable in the next 2 qtrs looks like

There are very few small-cap companies that have a 20% plus margin, which means that have some sort of capability and good value-added niche products.

On Charts:

Technically also the chart is breaking out from the upper trend line.

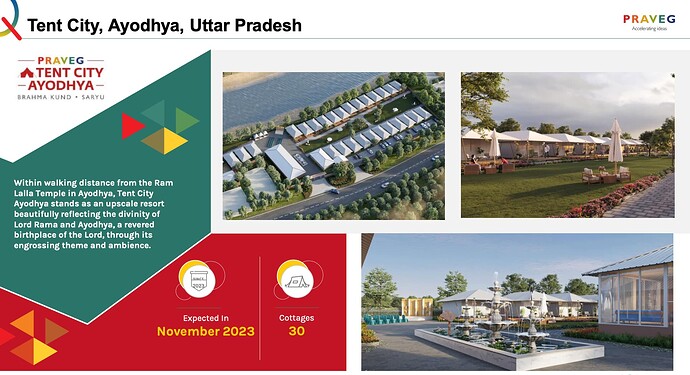

2. Praveg Ltd: Engaged in providing services to eco-responsible luxury hospitality. The Company’s resorts are located in areas of significance from a cultural and heritage point of view and places of exotic and natural beauty.

The company has a lot of upcoming plans. H2 will be stronger than H1 as most of the resorts have high occupancy in H2 due to the festive and holiday season. Also, the company is taking steps to reduce seasonality in H1.

So, the upcoming qtrs will be stronger than the previous two.

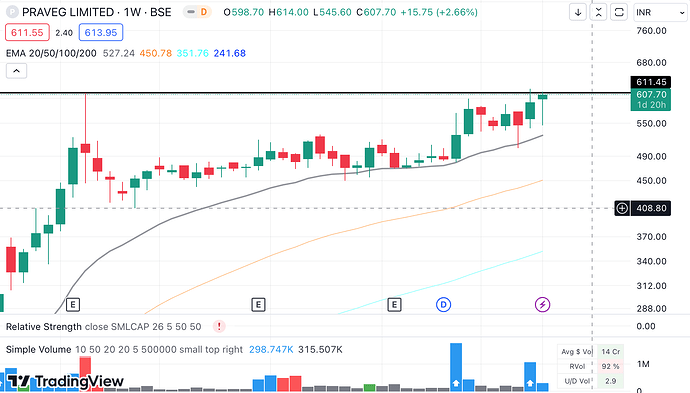

On Charts:

Trading near the breakout zone and had a very strong closing after a gap-down opening on Friday due to weak Q2 compared to YoY due to some upcoming work.

Clear Sign of shakeout.

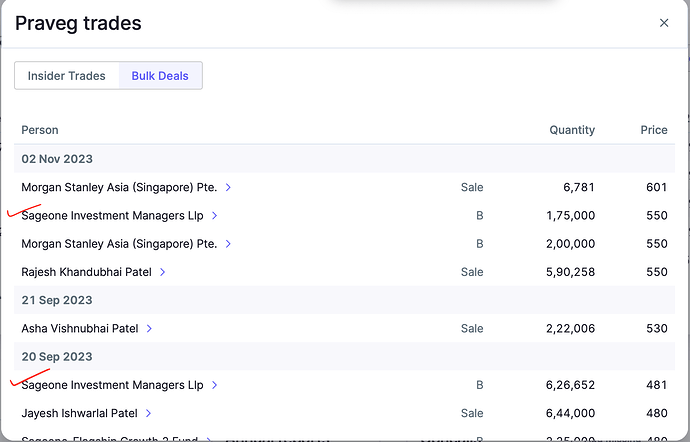

some interesting names in the recent Bulk trade of Praveg:

Buying by Sageone Fund (which is managed by Samit Vartak who is known for picking great stocks)

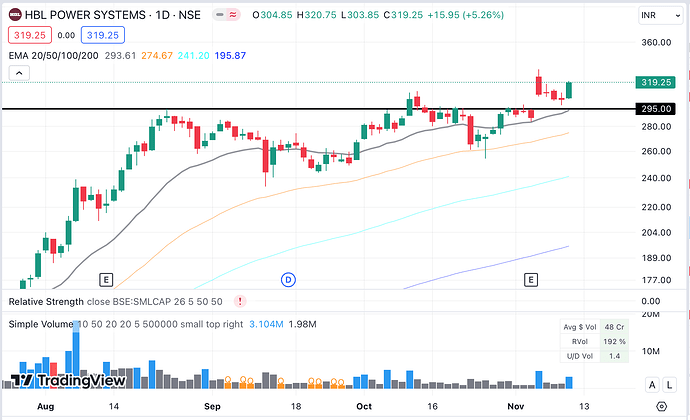

3. HBL Power: ![]() The results were very good and the sector is having strong tailwinds in its business. I am not following all those projections of analysts but the price action. Just ride the good stories with proper risk management because we don’t know how much it can rise from here with more value-added products coming from the railway and defense.

The results were very good and the sector is having strong tailwinds in its business. I am not following all those projections of analysts but the price action. Just ride the good stories with proper risk management because we don’t know how much it can rise from here with more value-added products coming from the railway and defense.

Before, the results HBL was in corrective mode and has corrected to levels of around 260 from highs of 310 but now again after the results the structure looks very good on the charts.

So, after a lot of consolidation, the price is above all its major (295) and minor resistance (310) and a good close on Fridays with volume greater than the previous weeks.

Price retested its support of 310 and also the result Gap is still unfilled thus making it stronger support.

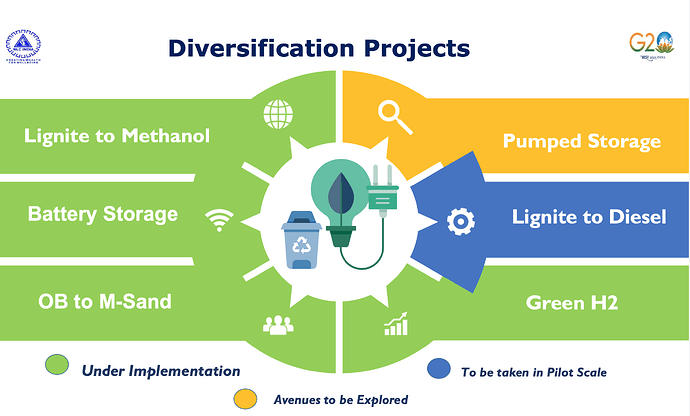

- NLC India Ltd: The combination of Mining, the power sector, and a PSU with low free float (Not like those PSUs with no profit in the last few years). NLC India is engaged in the business of mining lignite and generation of power by using lignite as well as Renewable Energy Sources.

Some of the Interesting diversification projects of the company

The public holding is continuously decreasing from 10% on Sept 22 to 6% on Sept 23. Showing institutional interest with DII holding increasing from 5% to 9% for a similar time.

Currently trading at a 13-year high zone with a retest of the breakout level of 115-120 on a monthly chart.

Stocks making multi-year highs must be on your watch list. and slowly build your position as the stock performs.

Disc: I have a small position in all of the names and planning to increase if the trade goes as expected. Hence biased. Just sharing my thoughts as a note to myself.

Infosys Limited – Are we getting a discount or no? (11-11-2023)

“Bargaining power of the Buyer” has always remained the concern for all IT service companies in India.

The competitor is always ready to offer services/software at discounted price as compared to your price, which erodes the OPM of IT service companies.

As such there is no Moat in IT services companies hence investing for very long durations like 20+ years could be a challenge.

With positive cash flow and good dividend yield, IT stocks can be used mainly as Dividend stocks for the portfolio. Only exceptions could be emerging companies offering disruptive technologies.

No investment in Infosys as of now.

BMW Industries Ltd (Steel Service center) (11-11-2023)

Reply to your questions

- They add value to semi finished steel, their arrangement has been with Tata steel as of now. They charge for for their services as per their various agreements with TSL.

- Margins are as per agreements with steel players. I think unlike contract manufacturing in electronics/pharma where asset turn is high, this sector has lower asset turn and therefore high margins. In the end ROE and ROCE matters.

- Their contracts are negotiated timely but as per discussion in yesterday’s conference call it looks like gross profits can be sustainable.

52 week highs and all time highs strategy (11-11-2023)

Time techno has been discussed many times before on this thread. It came out with good q2 fy 24 results this week. Stock price managed to close above its 4 month consolidation range of 140-160 (marked on charts) . Concall scheduled on 16 th Nov.

In the presentation, besides the usual results details, an important announcement by the management has been the following quote… The Company is in advanced stages of discussion for 2 out of 3 geographies for the said consolidation cum restructuring of overseas business and

estimating to complete the transaction including receipt of proceeds in FY 2023-2024.

This has been a long pending trigger in this company. First time management has given a timeline to this restructuring exercise. Going ahead we need to see the quantum of amount that is involved in this exercise. disc: invested.

time techno q2 fy 24 presentation.pdf (2.4 MB)

Screener.in: The destination for Intelligent Screening & Reporting in India (11-11-2023)

Gratitude for the update