May be waiting for opportunity to buy some small companies for expansion.

Posts tagged Value Pickr

Gensol Engineering – A play on Energy Transition (Solar Energy & EV) (08-10-2024)

I have same worry about Gensol not being able to deliver on EV. They keep on saying from 2023 that EV is about to be launched. I am not sure about how many people will buy their car as personally I didn’t like the design of their EV. But i think they will first use their EV in Blu Smart and their leasing business. It should consume their EV atleast for 1-2 years of production. Gensol is one of my biggest allocation(around 6%) and it is turning out to be hope story now.

Samhi Hotels – Turnaround with Tailwinds (08-10-2024)

is that 4.4X Net Debt/EBITDA correct ??

Haven’t they guided for 3.5x , if this acquisition isn’t serviced by debt and they told that the new asset will be contributing from this quarter itself means,

how and why it has increased from 3.5 to 4.4 ?? did they change the guidance or it has changed coz they used up the cash for capex?? Thought they guided to 3.5x including the capex from internal accruals, can anybody shed light on this?? @amit151190

Shriram Pistons & Rings Ltd (07-10-2024)

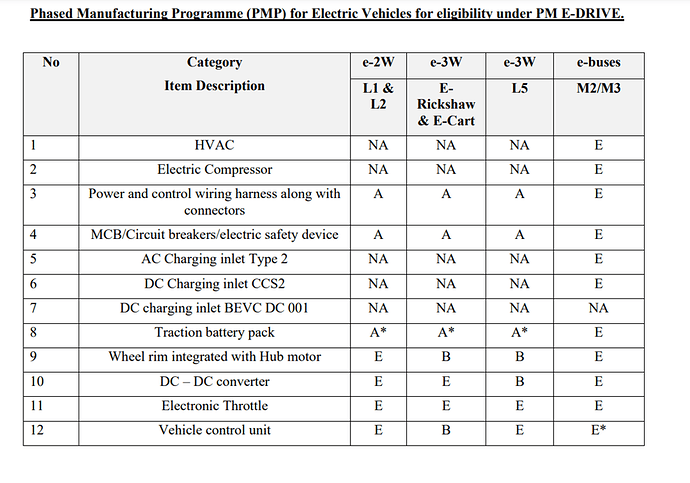

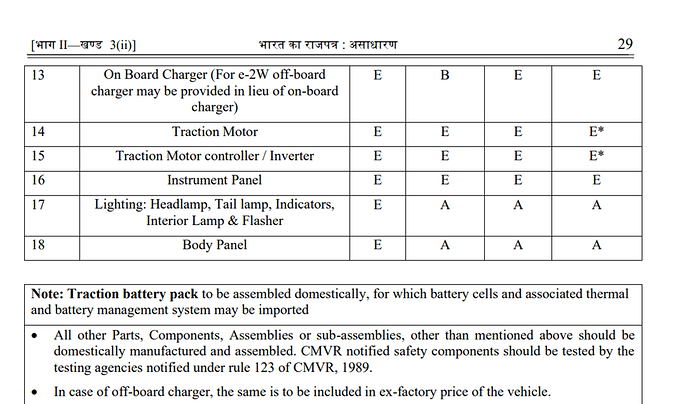

I was going through the phased manufacturing program announced recently regarding the localized procurement of EV components to be eligible under PM E-drive scheme.

As per the circular the components mentioned in PMP will be allowed to be imported. But the confusing part is that the effective date of indigenisation on all this products is over. ( dont know what this effective date of indigenisation means).

Good to see that SPR- EMFI is present in many of these components.

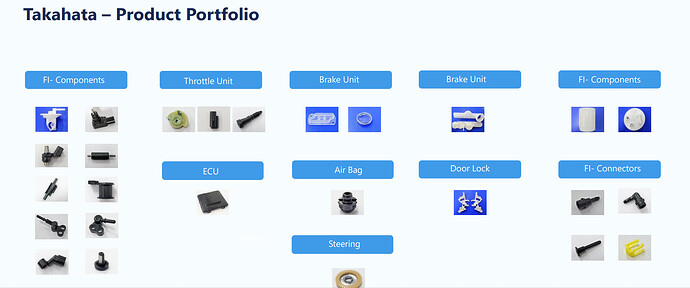

The company is the last concall also mentioned that the govt’s localisation norms have helped. SPRI EMFI is undergoing expansion which is expected to be completed by the end of the year. Also, as per concall ,Takhahata has also been able to win some business s for some of the new programs including some electric

vehicles’ requirements from a plastic injection molding standpoint, thy have been able to win businesses with some of tier 1 customers who then supply to the end markets for electric vehicles.

Govt is likely to penalise companies that flout the localisation norms. They are expected to have to return the subsidies received along with interest.

Previously Greaves,Hero Electric, Okinawa Autotech, Benling India, Revolt Intellicorp, Amo Mobility, and Lohia Auto — were found to be using imported products in violation of the phased manufacturing programme (PMP) guidelines. under Fame 2. These companies were asked to return subsidies totalling Rs 469 crore.

Some of them like Greaves, Revolt etc seems to have returned these subsidies. This time it is expected to be more stringent with localisation guideines which is expected to benefit SPR subsidiaries.

MSTC Ltd.: Growth through to E-Commerce (07-10-2024)

Thanks mate. I had started building quantity & sold it. Twice. As both the times, I wasn’t sure of value, as growth is lumpy & the stock had run up much ahead of fundamentals was what I thought. Also, the second time Coal India business went away. Not sure if we can model this business with much confidence even though it has come down significantly. Because we can’t forecast EPS over the next 2-3 years with much confidence, it becomes useless to look at TTM PE. No doubt the opportunity is huge but even the competition is coming quicker & exponentially. Management talks on too many things too vaguely. Sometimes they talk about inorganic growth without much clarity, sometimes they talk about datacentre business without any focus. A platform business, e-commerce, great balance sheet, cash rich. But how to look at future growth is the question & depending on that how to value?

Interarch Building Products – A proxy to infra Capex (07-10-2024)

What are you points in favour of choosing Interarch over Pennar industries?

Jash Engineering – Is it a multibagger (07-10-2024)

My thoughts on Jash Engineering and how the business is poised. Hope it adds value to the thread.

Water Sector rising stock:Can Jash Engineering be the next emerging winner? #multibaggerstock #stock

Disclaimer: Invested heavily in the stock and hence can be biased.

Senco Gold: Upcoming gold story! (07-10-2024)

I guess I will be able to answer your question. Let’s say that gold prices have increased, now from a consumer perspective what options do they have if they wanted to purchase new jewelry? Either they can wait to have some correction in the gold prices or they can use their own old gold jewelry + some money from their pocket to buy new jewelry. This second option comes under GEP (Gold Exchange Program).

-

Now, how it predicts the shift from unorganized to organized market?

As, mentioned the old gold that company is receiving, out of that gold 65% is the gold that is crafted by other regional unorganized jewelers. Depicting a shift from unorganized to organized sector. -

Why that gold can’t be from other competitors like Titan or Kalyan?

Simple!!! because they have hallmark which is easily traceable.

I hope you would be able to understand.

Addictive Learning Technology limited (LAWSIKHO) (07-10-2024)

2024 Alpha Ideas SME Stars – Addictive Learning Technology Ltd

Alpha meet recording

Samhi Hotels – Turnaround with Tailwinds (07-10-2024)

Thanks a lot Girish, for sharing the recording.

My understanding of the concall is as below, others can also add, if I miss any point.

- No additional debt would be taken by the company for this acquisition.

- Renovation will start from Q1’FY2026

- Current acquisition will start contributing to top and bottom line from current quarter onwards (may be around 10 cr in the top line, calculated from Revpar and rooms )

- Company has also refinanced around ~350 crores of NCDs from 13.5% annual to 9.2% annual which can help saving around 13 cr to 14 cr in interest expenses annually.

- Net Debt/EBITDA will stand ~4.4x at the end of FY’2025 , Net debt would be around 2060 crores, which means EBITDA would be 460 crores to 470 crores

- If I assume depreciation in line with last year ~120 cr and annualize the interest payment of 55.57 cr which would be ~220 crores (one can adjust the benefit of ~6.5 crores of half yearly benefit from refinancing of NCDs) PBT for the company can around ~120 crores to ~125 crores.

- Company was in losses in previous years , so I believe it may not have to pay taxes in the FY’2025

Company is available at ~32x of FY2025 earnings. Not sure about the upside but downside seems to be limited.