Mr. Bezos, who also owns The Washington Post, recently quashed the newspaper’s endorsement of Vice President Kamala Harris.

Posts tagged All News

Voltamp Transformers (06-11-2024)

I think the transformer story is in tact.

Voltamp won the new order, though not very big.

Shivalik Bimetal Controls Ltd (SBCL) (06-11-2024)

Disappointing result…waiting for management commentary

Mahesh’s Portfolio (06-11-2024)

Hello everyone

Its a long time since I updated. Have been continuing with my old strategy of monthly SIP.

And its 12 years since I started equity investing this way. Some of the learnings I would like to share.

One thing that I always was intrigued was to know how compounding works in case of equity investing. The rise in the market thrilled me and the fall made me nervous. I had bookish knowledge to small degree but the doubts were always there. If I keep investing in stocks the way I did, (Method which I explained in the previous posts) will it really help to achieve a decent return? This question always was there at the back of the mind. More important question was really does compounding work the way its been glorified in stock market investing?

Afterall with a FD it is a more straight forward affair. At the end of every year the interest keeps on adding to the principal. Its only of late that I have begun to understand the beauty of compounding in equity investing.

In the early years of investing, say after 4 to 5 years the rise in returns is fast and fall is faster. Infact after 8 years of investing, during covid, my return almost became zero. Since then the bull run has helped to get a return of around 19%.

The last one month has been heavy on the portfolio. and the returns which was 19.5% last month has come down to 18.5%. No doubt in absolute terms I did have a big notional loss, But the percentage point reduction is less.

This I think is the power of being in the market for a long term.

Five years ago a similar fall would have bought down the returns by 5 to 6 percentage points.

I am writing this only with one purpose, may be some young investors out there who may be experiencing the volatility and concerned about the returns, we need to understand with time in the market the returns become more consistent and less volatile.

This journey is not without challenges. So many obstacles will come. But the important thing is don’t stop the monthly investment.

As the celebrated investor and the founder of Vanguard group John Bogle says, “Stay The Course” and we should do well!

Olectra Greentech – Electric Bus Opportunity (06-11-2024)

Thank you and glad to know it is your blog. It helped me. Having gone through many concalls, now I feel things may change as different building blocks fallen in place.

My concern is that lack of orderbook growth in this FY. If it is only due to timeline to service it, I am not concerned. From last 3 concalls I do hear more or less consistent guidance…

I am surprised JBM in general tight lipped, leave alone concalls, but even investor presentations are not released.(I couldn’t find, Iay be wrong).

Tata motors – do they report EV buses like they report EV passenger cars ?

I took a bet and keeping fingers crossed for Q3 and then Q4 results. If they miss big way, by this year end results, I will exit. Else, it should reward well and valuation will cool down.

Tracking the progress is easy here as moving parts are less compared to other three listed competitors. Any other listed competition @siddybee apart from Tata, Ashok Leyland, JBM Auto for EV bus space ? Even if Ashok Leyland or Tata motors execute well, it is still small part of their overall game…but if olectra wins it will win big and our investment can multiply many fold.

Disc: invested at current levels

Investors subscribe Sagility India IPO 52% times offer size on day 2 (06-11-2024)

The initial public offer of Sagility India Ltd, a technology-enabled services provider in the healthcare space, received a 52 per cent subscription on day two of bidding on Wednesday.

The initial share sale received bids for 20,09,58,500 shares against 38,70,64,594 shares on offer, as per NSE data.

The portion for retail individual investors (RIIs) fetched 2.24 times subscription while the quota for non-institutional investors got subscribed 24 per cent. The qualified institutional buyers (QIBs) part received a 7 per cent subscription.

Sagility India Ltd on Monday said it has mobilised over Rs 945 crore from anchor investors.

The issue, with a price band of Rs 28-30 per share, will remain open for public subscription until November 7.

The Bengaluru-based company’s IPO is entirely an offer for sale (OFS) of 70.22 crore shares worth Rs 2,106.60 crore at the upper end of the price band. Promoter Sagility BV is selling its stake through the OFS.

The entire proceeds from the public is

Ashok Leyland – A major CV player (06-11-2024)

Ashok Leyland (AL) is one of the largest players in the commercial vehicles space. Think of buses. Big trucks. Tractor trailers. Pickup trucks (LCVs). And recently AL has taken exposure to electric buses + e-LCVs through it’s subsidiary — Switch Mobility.

You can the full article here

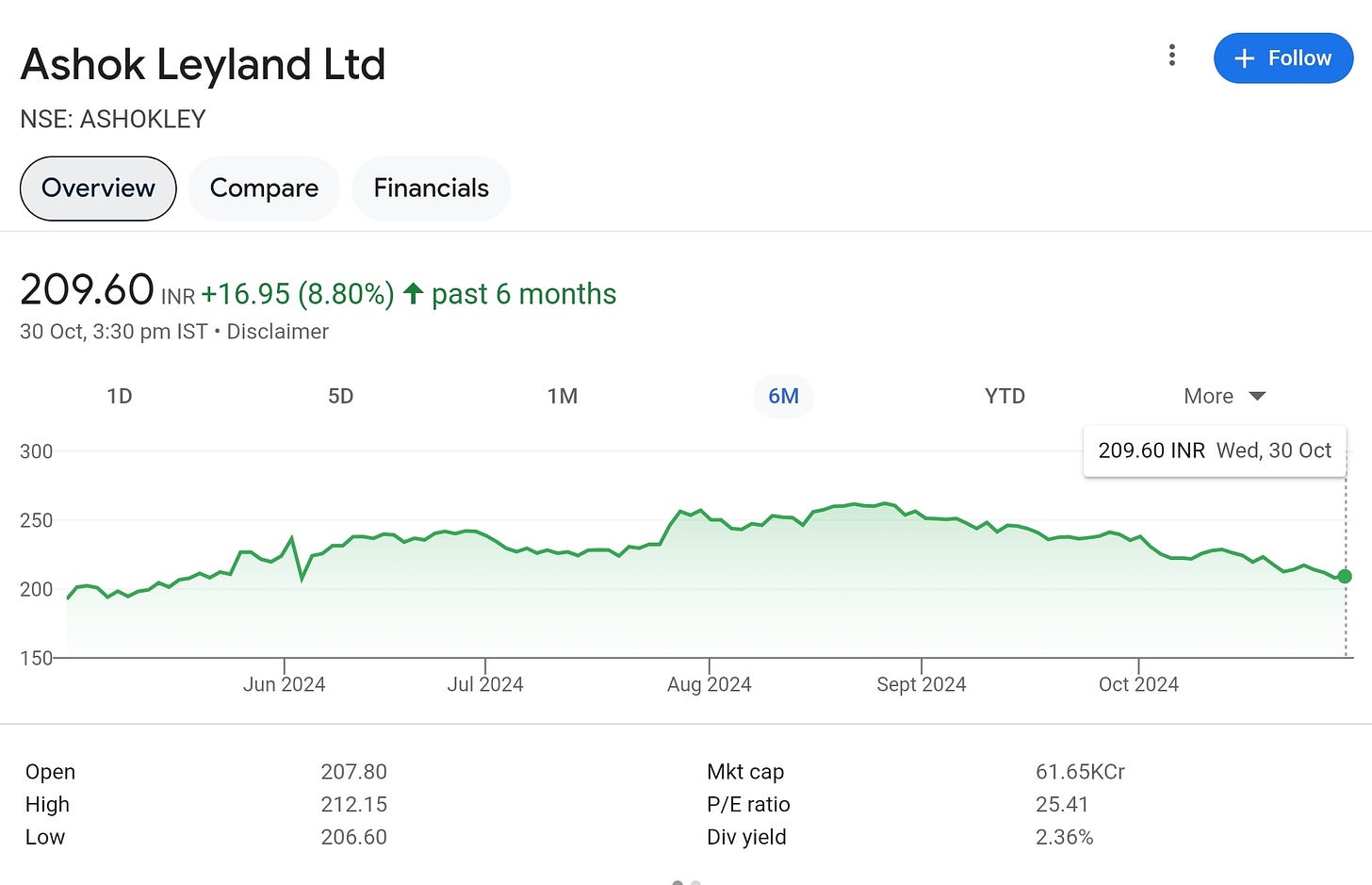

6 month price movement of Ashok Leyland

The stock has remained range bound, however the low PE ratio compared to peers indicates that investors are valuing AL as a traditional CV player — leaving some room for growth.

Q1 business update:

- Core business — MHCV [Medium & Heavy Commercial Vehicles] industry volumes grew by 10% in Q1FY25. AL’s MHCV volumes grew in line with the market, resulting in retention of market share of 31%.

- AL is confident of increasing market share in trucks + buses. Host of new product launches are lined up in FY25, which will beef up market share & price position.

- LCV volumes [domestic] increased by 4% in Q1 to 15,345 units. LCV variants cover only 50% of the market at this point — intention is to launch new products to increase coverage to 80% of the market. 6 new LCV launches are lined up in FY25, out of which 2 new LCV variants have been launched in Q1.

Note: this is not AL’s market share in the LCV segment. 80% refers to the ‘addressable market’.

- In the ICV segment — new launches are expected in the school bus + staff bus segment. Market coverage is <20% at the moment and AL wants to expand this.

- CV export volumes grew by 5% in Q1. Middle east continues to see strong demand. AL is getting strong traction in Africa. The company is looking at new markets to expand.

- Tractor trailer penetration in India is <20% whereas globally it is close to 60-70%. AL is expecting good growth in this segment.

- There is huge replacement demand building up in the MHCV segment due to an aging fleet. >37L commercial vehicles are there on Indian roads out of which only 27% are BS VI complaint. Sooner or later, the aging fleet has to be replaced which should lead to a bump in sales for AL.

- Electric portfolio — AL sells e-buses and e-LCVs through it’s subsidiary Switch Mobility. Electric trucks are sold directly by Ashok Leyland.

- Slow transition to eLCVs is underway. Switch started delivering it’s first eLCV [called IeV 4] in the market which received a good response. A few days back, another variant ‘IeV 3’ was also launched.

- The # of e-buses delivered were not mentioned in the earnings call, but Switch has an order book of 1,300 e-buses. If you’re in Mumbai, you can regularly see their double decker e-bus.

- Capex of INR 500 – INR 700 expected in Switch Mobility + to build EV capabilities / setting up centre of excellence in software, electric drive unit (EDU) and battery packs.

- Other biz segments — pertains to defence, spare parts & other business segments.

- Sales of defence vehicles have crossed >1,000 vehicles in Q1. Revenue has increased by 3X compared to the previous FY. Intention is to further double the defence business in the next 2-2.5 years.

The management did not give a concrete sales # for the defence business though.

- In the spare parts business, revenue increased by 10% overall YoY.

- Power solutions volumes were lower than last year by around 20% owing to a very high base in Q1 of last year due to emission change announcements.

- Financial performance — Q1 performance was decent. Revenue was up 5% YoY. EBITDA up 11%. PBT was up 13%. EBITDA margins were stable at 10.6%.

- Other expenses shot up due to one time expenses incurred towards development of Centre of Excellence for battery packs, electric drive units and EV related software.

- Material costs were at 72.2% of topline, lower by 1.5% compared to Q1 of last year. Steel prices remained soft, and cost saving efforts helped AL reduce material costs.