Trading addiction is real. Talk to someone : a therapist, mentor, or friend. Focus...

investments

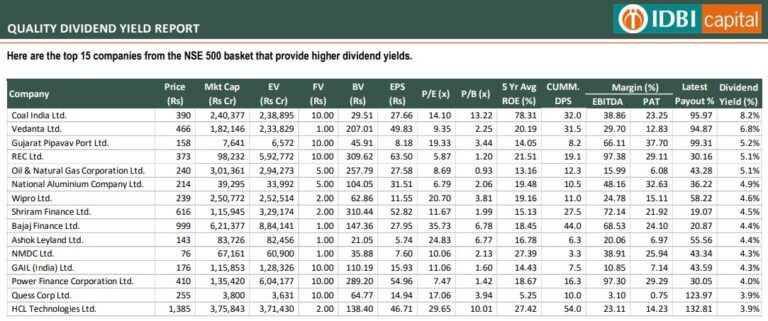

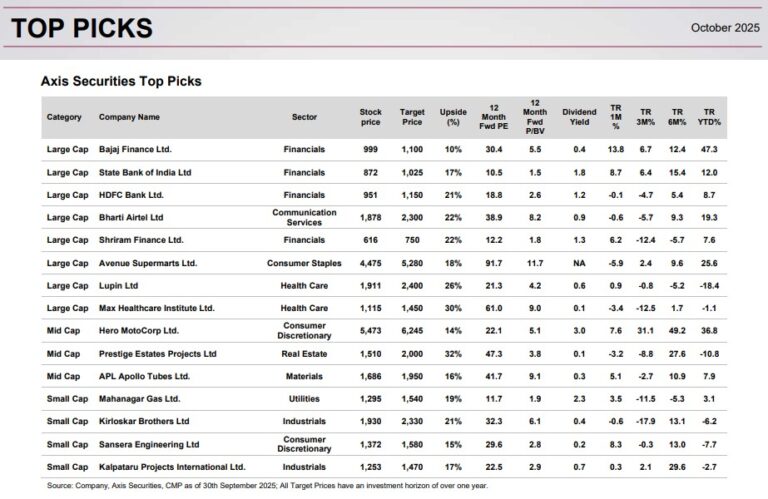

top 15 companies from the NSE 500 basket that provide higher dividend yields

When asked about his process for selecting companies, Kacholia outlined a systematic approach that...

Hindustan Copper has emerged as one of the biggest domestic beneficiaries. With no major...

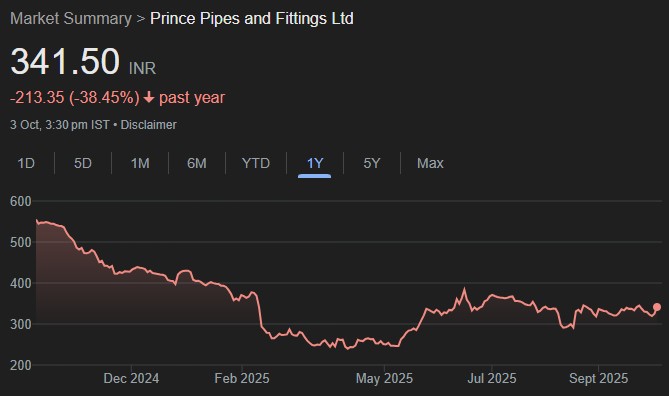

Prince pipes is working on improving its working capital cycle, focusing on reducing its...

Tata Capital’s upcoming IPO has been priced at ₹326 per share, but according to...

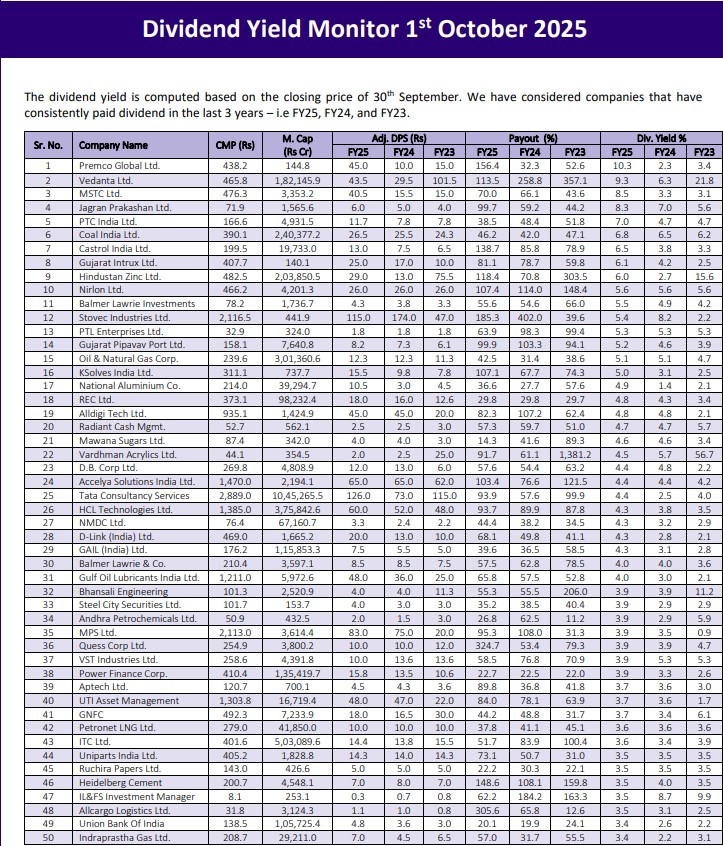

The dividend yield is computed based on the closing price of 30th September. We...

Valuation remains inexpensive (~33x FY27E). We assign 40x for earnings CAGR of 19.4% over...

MIIL and its three senior executives are barred from accessing or dealing in the...

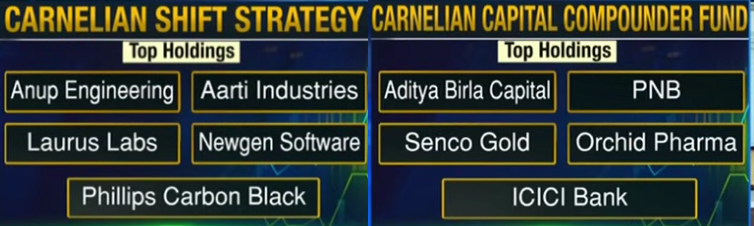

Our focus remains on Growth at a Reasonable Price, ‘Quality’ stocks, Monopolies, Market Leaders...