RKL’s revenues and PAT are expected to grow at CAGR of 19% and 38%...

TATVA expects SDA revenue growth to sustain, with new customers’ offtake in CY26 and...

The company is also into CDMO services (~7% of FY25 revenues) catering to a...

The company is on track to expand its production capacity from 5 Mn ton...

ITC Hotels registered resilient performance in Q3FY26 aided by strong wedding, MICE and corporate...

ITCH currently has a portfolio of 213 hotels - 152 operational and 61 in...

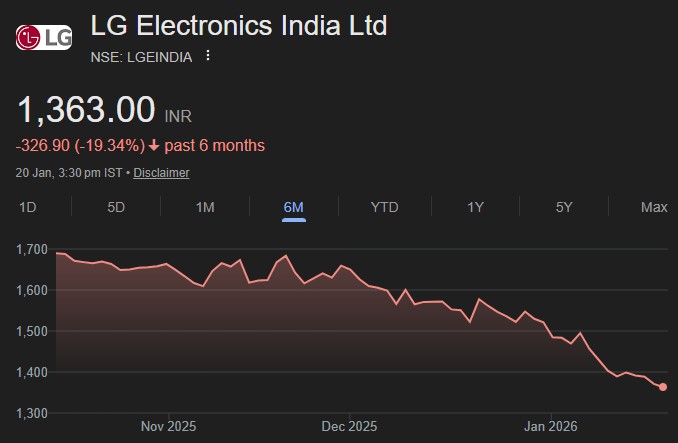

LGEIL benefits from its parentco’s massive scale, focus on technology and R&D (annual R&D...

Of the 40GW of projects with pending PPAs, industry channel checks suggest ~17GW...

Logistics revenue increased to INR 1.9bn in Q3FY26, driven by higher domestic and EXIM...

Management is targeting a 120-150bp CI improvement in core business (with a similar improvement...