Over the two last months, gold prices have risen by 15% (+42% YoY). Despite...

investments

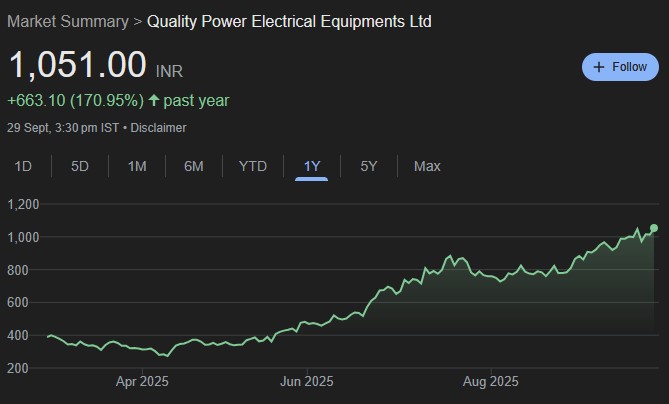

High entry barriers in HVDC, FACTS, 400 kV AC, 765 kV AC and UHV...

Radico Khaitan is one of the recognised IMFL company in India with portfolio of...

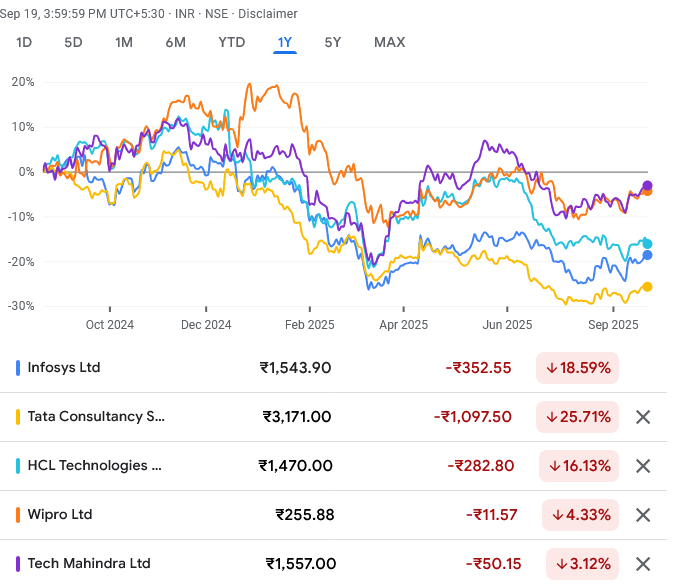

The stronger performance over FY24–25 (16%/19% PAT growth seen in FY24/FY25) has not really...

We initiate coverage on EPACK durable with BUY rating based on its commendable value...

Minda Corporation is evolving from a conventional auto component manufacturer into a high-value, technology-driven...

With RoE/RoCE above 26% and a net cash status, LOTUS stands out as the...

South Indian Bank is old south based private sector bank headquartered in Thrissur, Kerala....

We expect the company to report 17%/18% CAGR in Revenue/EBITDA over FY25-28E, aided by...

Our top picks are INFY, backed by superior pricing power, consistent execution, and a...