Hi ,

Request your valuable thoughts on Ashiana housing.

Posts in category Value Pickr

StageInvesting +Elliot Waves (07-08-2022)

Jubilant Ingrevia – Life Science Ingredients (LSI) (07-08-2022)

Q1 FY23:

• ENERGY COST INFLATION: Coal was not supplied by Government as per arrangement. Because of this, coal had to be imported at sky high prices. 45cr impact. From 1st of December Government supply should resume.

Raw material input cost increase passed on but unprecedented coal prices couldn’t be passed on. Expect to pass on some cost in q2.

• VOLUME GROWTH: Speciality Chemicals revenue grew by 26% YoY driven by volume growth across product segments

Chemical Intermediates volume have grown while revenue is impacted mainly due to lower prices of key RM i.e., Acetic Acid. Acetic Anhydride volumes grew by 22% on YOY basis

• QOQ DIP IN SPECIALITY CHEMICALS VOLUME:

China 2-3 months lockdown impacted some export volumes.

They had to change Catalyst in one plant (changed every 6-7 years), that impacted some production and subsequent sales of SC.

Both of the situations are now normalizing. Expect volume growth QOQ in Q2.

• Share of revenue to customers having Agro Chemical end use grew significantly.

Speciality chemicals: Serving 15 of top 20 Global Pharma & 7 of top 10 Global Agrochemical companies

• EUROPE: Big growth in sales and market share in Europe for Acetic anhydride due to new uses for anhydride

• ANIMAL NUTRITION: Sales impacted due to avian and swine flu in US and Europe. Situation said to be improving. To normalize by quarter/year end.

• Diketene plant fully stabilized. Sales to start contributing from Q2 onwards.

• All Capex plans going as per plan.

Malhar’s Investing Thoughts (07-08-2022)

Pakistan is among Aselsan’s leading overseas customers.

Turkey is itself undergoing an economic crisis.

Economic crisis in Turkey and Pakistan can reduce purchases in future.

Personally, weapons supplier to Pakistan even is a big red flag for me.

Malhar’s Investing Thoughts (07-08-2022)

I will try and write on this thread more frequently. One area that I have been exploring in the past few weeks is global investment opportunities. I have found that outside India there are high quality structural compounders, often with higher growth rates but available at lower valuations. Let me briefly describe a few that I have been reading recently:

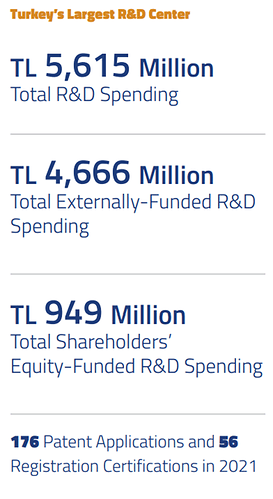

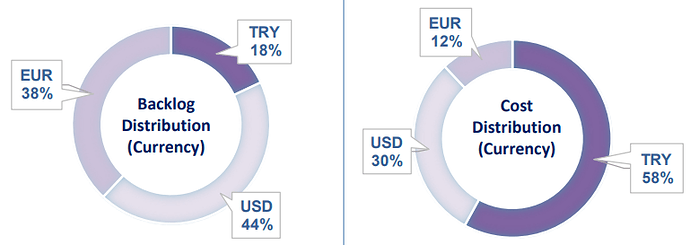

1 Aselsan-Largest defense company in Turkey, among top 50 in the world. This is also an interesting case of how reading a book (The Power of Geography by Tim Marshall) helped me connect the dots with a company. Also, they spend >20% of sales on R&D! The RoE for CY 2021 was 27.6% and the average RoE for the last 3 calendar years for 25.6%. The long-term debt to equity is almost zero. PAT growth is >25-30%.

Sales are majorly to Turkish army…

…but even for domestic sales, they take payment in foreign currencies (while incurring costs in lira)

Here’s the punchline- trailing PE is 7x!

https://www.aselsan.com.tr/032022_4232.pdf

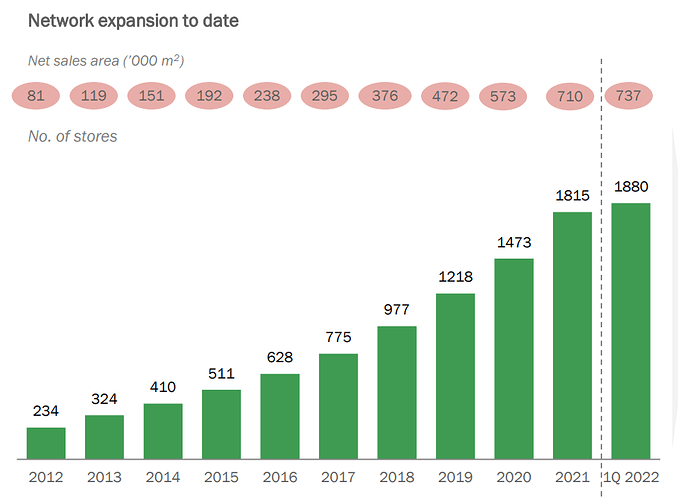

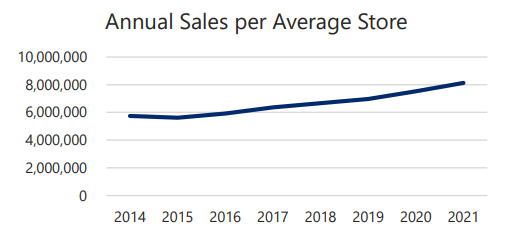

2 Dino Polska- A high growth frugal grocery retailer (supermarket chain) in Poland. Stores are majorly in rural towns, outskirts etc. Almost all stores are owned, not leased. Nil store closedowns since 2007. They have the lowest prices.

Store count growth…

…+ sales per store growth

3 Sechaba Brewery

Disc- no holdings in any of the above as of now. Will update if and when required.

Vinati Organics (07-08-2022)

Still no update on Veeral Additive plant commissioning. Hope someone will point out in next interview.

My richdreamz portfolio – visit my portfolio to learn together! (07-08-2022)

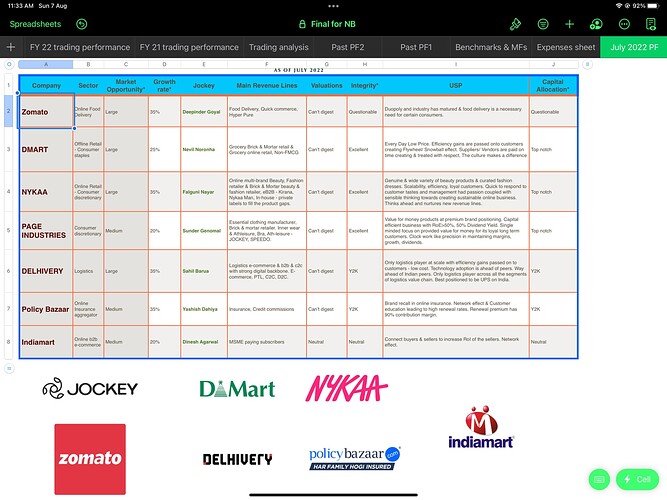

Based on price action, depressed sentiment (memes), improving narrative & fundamentals, I have re-entered 2 tech stocks over last 1-2 weeks (IndiaMart, Zomato), 2 are fresh entry (Delhivery & PB Fintech) & 1 has continued to be in PF (Nykaa).

I have provided technical charts of 5 stocks with some explanation for each.

I have exited some stocks to make way for the above & I will explain my dilemma in some of these.

Technicals also formed a basis for these decisions. Whether I will stay or exit will depend on fundamentals, mostly.

Nykaa: Not a re-entry but increased position by couple of %ge points between 1325-1400 over last 3 months.

The top line story of the company remained as strong as ever despite some lingering doubts over e-commerce slow down as evidenced in US. But given the relative under penetration in India, from the results of the companies it looks that theory may not be applicable to Indian companies yet. The BPC business is very much profitable while the cash from this business is being invested in Fashion business. I imagine fashion business will turn profitable in 4-6 quarters. I, for now, am not giving much value to b2b business, Nykaa Man, Nykaa International.

For me EV/sales of 9 times FY24E is palatable. Page industries (though strictly not comparable because Page is 85% Manufacturer while Nykaa is 85% online retailer) trades at EV/sales of 10. Both are expensive and are way out of zone for value investing.

In fact, none of the companies I discuss in this post are anywhere near normal valuations.

On this point, each person should be aware of the following:

-

What kind of companies are you invested in?

-

What is your strong point? Is it a) Finding micro caps and ride it till maturity? b) Invest in growth at reasonable valuations, like 12% grower at 20 PE? c) Companies like DMart, Page stature and have the ability to sit for long period of time and digest steep corrections in between as steep valuations give way to corrections on any persistent disappointment. Etc

-

Have a vision & trigger points for a company and wait for them to play out over time and increase allocation as each trigger point plays out.

-

Combine technical & fundamental aspects & invest/ trade or exit as the opportunity arises. Here, the key is be unemotional on losses.

-

SIP in a mutual fund like PPFAS.

I do not have the ability to find the diamonds in the dust and even if I do, I cannot wait to see stocks not doing anything for 5 years and then go up 10 times. I really think, the kind of stocks you choose should more or less align with your own personality/ behaviour.

As I wrote earlier, I waited patiently for technical structures to form and wanted to get in in tech stocks. Whether they will stay or not will depend on how the story is evolving.

Also, comparing Page industries vs. Lux price action (OR) Titan vs. Kalyan jewellers price action is a case study in itself.

Delhivery:

As I wrote in Page thread, I bought this around 495 with good allocation. The research reports have written the story on this company really well but most of them find the valuations unappealing. So has been the story for DMart & Page. The companies that show really high growth & leave the competition in dust will get high valuations. Can’t debate on this much. But <1% of the listed companies deserve such valuations. So, if you pay such valuations for a mediocre company, losses are abound. I made this mistake in Symphony in 2018 & quickly lost 20% then when results were not forth coming. What DMart is doing in offline grocery retail, Delhivery is trying to achieve in logistics where it is using technology & scale to squeeze in efficiencies and then pass on that gains partly to customers/ businesses. I personally think, the competition has been caught napping on its wheels. Let’s see how this story plays out.

PB Fintech: The core insurance business has turned EBIDTA positive ex-ESOP costs. The credit business eventually would follow but I do not know how big credit business can be though the opportunity size here is larger. How ever, insurance business where the renewal premium comes at 90% plus contribution margin is a big thing for me. Currently 25% of the revenue is renewal premiums and is growing at 40% rate. The revenue from this will flow directly to bottom line. Once credit business turns EBIDTA positive, things will take off. The investment for its new businesses will come from the interest from its cash only. Steady state margins would be at 40% and so this will trade at premium EV/Sales to Nykaa. Nykaa cannot have 40% margins.

For investors comparing EV/ Sales WITHOUT taking into account the steady state margins is not the right approach, I think.

IndiaMart: The story from my side is known, after selling this it fell 25% and my PF increased and I was getting 40% alpha and the numbers would start improving from now on. The high cost employee base is now baked in almost and profit growth will now follow revenue growth. The addition of 9000 plus customers in 2 consecutive quarters appeared positive (management guided for 10% slippage in this new addition, though). The allocation here is not much though.

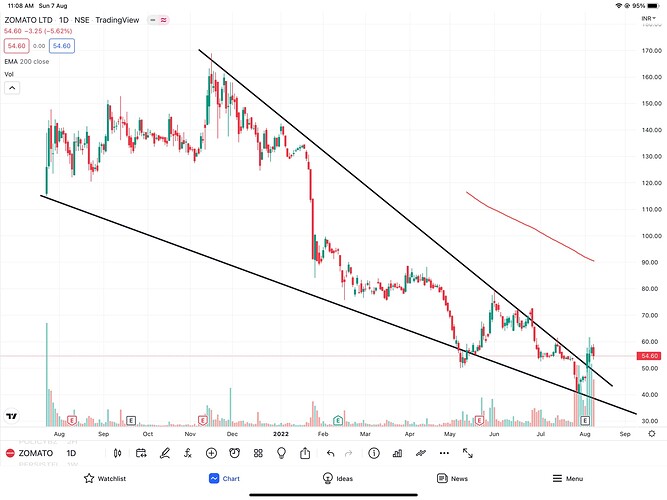

Zomato: NOT happy with the way Blinkit acquisition is done. Absolutely not. This may or may not turn out to be gold mine for Zomato, but I cannot forgive the management for their closed communication on this. But I think market punished this way too much. I like the food delivery business. I will be opportunistic in this stock, strictly following stop loss or if fundamentals deteriorate further or any other big band acquisition. Once bitten twice shy. How ever, I believe the fundamentals & positive narrative would start from here.I also do not like management’s talk of decades long business building narrative. The allocation here is > IndiaMart but lesser than Dmart/ Page/ Nykaa/ Delhivery.

Technicals:

As written earlier, technicals & sentiment also played a role in buying some of the above. Most are forming falling wedge patterns.

IndiaMart, Zomato, PB Fintech: Just peeked out of falling wedges and for the patterns to play out the prices has still have to go up by 10-15% for pattern confirmation. In the interim there could be re-tests to take out last hope people etc.

Delhivery: The price moved out of IPO base and is setting up for a big move in either direction. Let’s see.

Nykaa: The price has been coiled for 3-4 months and will move swiftly in either direction.

I have clear picture of how falling wedge & coiled patterns played out in Bajaj finance, IndiaMart in 2020 & 2021 respectively. I’m not juxtaposing these 2 on the above but the price action from a falling wedge could be good from technical perspective.

Hawkins:

The market is not according even medium valuations for this company despite consistent performance. Probably, market still remembers 2011-2015 period? Also, the market size not being big & market is still waiting for new category from a decade from this company. Entering a new category NOW is really difficult compared to a decade ago. Now, Havells, Crompton etc are aggressive and they have wherewithal w.r.t. financial, distribution. How ever, I expect Hawking to move towards 7200-8100 zone looking at technical picture. I will root for this company, even though I have exited.

United Spirits: Probably some more time & this should sizzle if they can achieve that high growth in P&A segment. Above 1000 this will blast, technically speaking.

HDFC Life: Slow mover & I have lost patience because too many things to understand and so conviction building is getting difficult.

I’m tracking United Spirits still for re-entry.

At the end of the year, I will put past 3 years performance with data to rationally see if I’m doing monkey business & shift my money to MF or if I should keep doing what I’m doing.

Below is how I keep myself motivated by reading the synopsis on each company & if they hold true.

Kamlesh’s Smallcap Portfolio (07-08-2022)

Hi Kamlesh,

What’s your strategy for Hari Om Pipes?

Heranba Industries (07-08-2022)

I like the growth in revenues which is in line with management’s commentary.

However there are a few items in the AR which spook me.

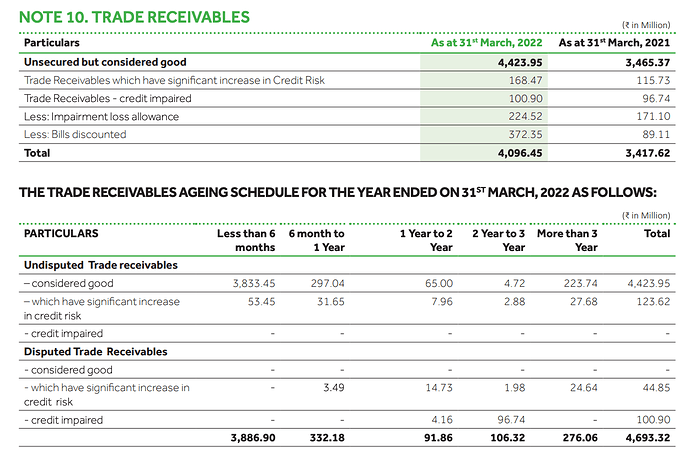

- Receivables: This is quite bad for Heranba and I read above in this VP thread that management has guided that issue will start correcting by end of FY22.

Net receivables increased from 341cr to 409cr. To put things in perspective, the PAT is 189cr.

Then there is 22cr credit impairment allowance, which is 11% of PAT.

Receivables with significant increase in credit risk + credit impaired = 27cr. This most likely will be next years credit impairment allowance.

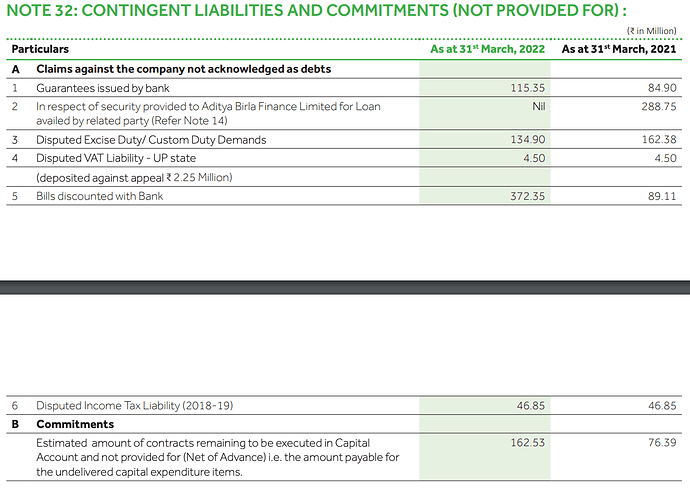

Then there is bills discounted of 37.2cr. From what I understand the company sold receivables worth 37.2 cr to a third party/ bank. Will touch this again at the end of this post.

-

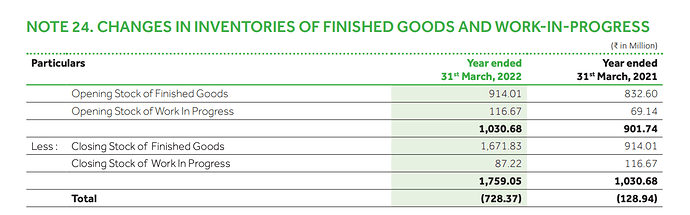

Inventory buildup of 73 cr. Is this inventory mismanagement?

-

Contingent liabilities & discounted bills

#5 reads that there is a contingent liability on the Co for 37.235cr. This means that the company is still liable for recovery of this amount even though it sold the receivable to a bank.

Can anybody please educate me if this is the correct understanding?

disc: invested, not a large position

Opportunity in GOI 10yrs BONDs (07-08-2022)

If a person is in 30% tax bracket bond may not make lot of sense as post tax he would make 5.5 % return . It’s a good substitute for bank f.d .

I feel rate hikes are mostly priced in and there may be 20-50 bps upside pricing left in bonds.

Most of private companies listed bonds like hdfc icici trade some where close to 7 % Yield .

New bonds coming up will offer a better yield.

Also keep in mind most of bonds which have high yield come with 10 year or so maturity hence the higher yield

Disc - Views are personal