(post deleted by author)

Posts in category Value Pickr

Buy Unlisted Shares (12-11-2024)

Any tracking Spray Engineering Devices in Unlisted market…view on this .

Bajaj Finance Limited (12-11-2024)

This demerger IPO topic is discussed already.

Cigniti – Special situation in cheapest IT stock with top notch management (12-11-2024)

Special Situation: Open Offer + Merger via share-swap

Summarizing the special situation opportunity in Cigniti Tech:

Current Situation

- Coforge owns 28% stale in Cigniti

- Coforge has made an open offer to acquire up to additional 26% in Cigniti.

- 12 November 2024 is the last date of open offer, Coforge will have 51%-54% shareholding in Cigniti. (There cannot be another open offer for next 1 year)

What happens after this? Coforge will have two options during the next 1 year

-

Option a) Run Cigniti as an independent company until next open offer 1+ years later

-

Option b) Do a merger of Cigniti with Coforge via share swap → The share swap ratio would require approval from minority shareholders.

-

The share swap ratio would require approval from majority of non-promoters

-

Example: Despite holding a 75% stake in Butterfly Gandhimathi, the promoter –Crompton Greaves, failed to secure public investors’ approval for its proposed merger with the company. This is because 72.61% of non-promoters voted against the merger since share swap ratio offered was deemed low.

-

Similarly, if the share swap ratio proposed by Coforge is not deemed appropriate by non-Promoter (i.e. Minority shareholders), then it can be rejected by non-promoter shareholders.

-

Hence, Coforge is likely to offer a fair valuation to minority shareholders

-

Does the current stock price represent a fair value that will be acceptable to minority shareholders? Looks unlikely. Reasons explained below:

-

How’s Cigniti’s Business doing?

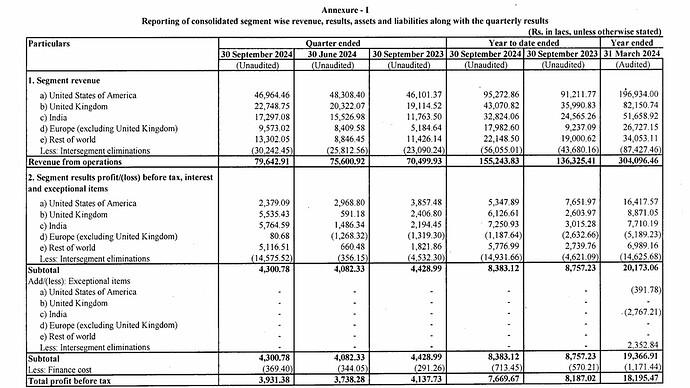

- Historical Operating Performance on Growth, profitability and ROE

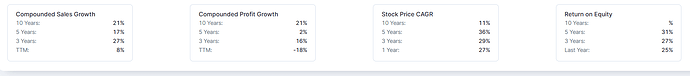

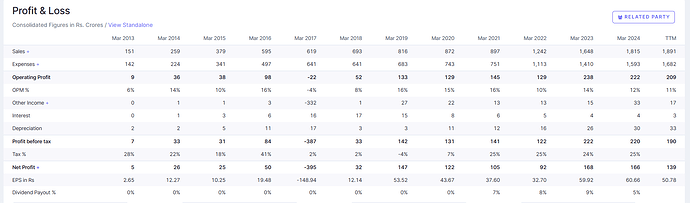

- Over last 3-years and 5-years, the revenue growth has been 27% and 17% CAGR; this can be considered very good. There are small acquisitions done. Organically the business has grown revenues at 13-14% CAGR over past few years

- PAT growth last 3Y/5Y is weaker at 16%/2% CAGR as margins have come down – this is getting resolved and margins are strongly recovering as explained in next section.

- ROE is v healthy 27%/31% over 3Y/5Y

- Overall, business has done reasonable good

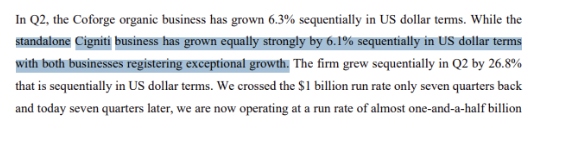

- Cigniti grew 6.1% QoQ in Q2FY25

- This is very strong across growth across all IT companies

- We can assume that Cigniti can grow at 10% going forward, given Last 5-year revenue CAGR of Cigniti is 17%

Source: https://www.coforge.com/hubfs/Transcript-of-Earnings-Conference-Call-Q2-FY25pdf.pdf

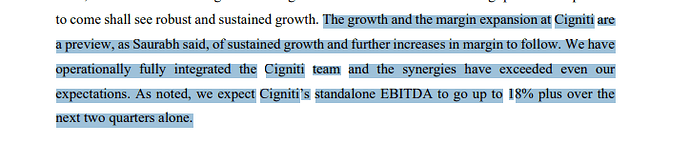

- Big turnaround in Profitability : Cigniti EBITDA margins are expected to go to 18% by Q4FY25 and will be 18%+ for FY26

- Cigniti had 12% margins in FY24.

- It is a fair assumption that Cigniti will have 18% EBITDA margins in FY26,

- This margin expansion from 12% to 18% can lead to 50% increase in EBITDA

- Valuation – Done at CMP of 1415 (Market Cap of 3,800 crores)

a) EV/EBITDA approach

- If we very conservatively assume 10% revenue growth in FY25 and FY26, FY26 revenue can be 2,200 crores. Management is very positive on revenue growth outlook of Cigniti.

- With 18% EBITDA margin on 2,200 crore, it can mean ~400 crores of EBITDA in FY26

- Cigniti is net cash company with cash of ~400 crores

- Market Cap is 3,800 crores

- EV = 3800 – 400 = 3,200 crores

- EV/EBITDA for FY26 = 3200/400 = ~8x

b) P/E approach

- FY 26 P/E Calculation

- FY26 EBITDA =400 crores

- Interest income of 20 crores @5% on 400 crores cash

- Depreciation expense of 33 crores, same as TTM reported

- PBT = 400+20-33 = 387 crores

- Tax = 97 crores@25%

- FY26 PAT = 290 crores

- FY26 P/E = 13x

- This probably makes Cigniti the cheapest company IT services, with one of the the best management team (i.e. Coforge leadership team)

-

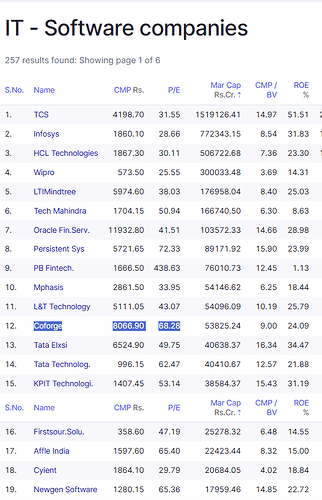

Where does the peer group in IT trade at?

- Cigniti’s parent co., Coforge, trades at TTM P/E of 68x (screenshot below)

- Even if we assume 25% EPS growth for FY25 and FY26, then parent Coforge’s FY26 P/E is 43x

Fellow VP’ers

- What’s a fair valuation for Cigniti for minority shareholders?

- Is 13x a fair multiple for Coforge to buy-out the 49/46% minority?

- Will minority shareholders accept this?

- Will they demand a better exit multiple than 13x P/E?

- If yes, will it be 20x or 25x? Or will they demand a valuation closer to Coforge’s valuation of 43x?

Disclosure: Assume that I am biased and may have vested interest in the company, hence please do your own due diligence. I may also change my mind about the company at a future date without being able to update on the forum. This should be viewed as a pure analytical exercise and assessing special situations and not as a reccomednation.

IRB INVIT TRUST- new game in the town! (12-11-2024)

One thing IRB managers have failed to eloborate on conflict of interest

IRB group has another unlisted (pvt held) InvIT within IRB Ltd. This is well capitalised with FII funds. And somehow IRB InvIT has become an unwanted child

Also a small silver lining is that IRB can take aggressive route to add assets with debt financing when bank rates cool a bit

CC @Abhinav_007

Dreamfolks services limited( DFS) (12-11-2024)

Key negative statement from concall is the potential downward revision in revenue growth targets. They had initially guided for 25% which seems to be at big risk now. Business model so far is dominated by what credit card companies determine as benefits and any reduction or pull back in benefits would impact their core model. That’s also probably one of the reasons why it does not fall in a MOAT category even though it has 90% market share in lounge business.

Overall concall was disappointing and revenue growth drop indication should reduce the PE and some of the other valuation parameters by 20% in my view.

I invested recently with 5% of my PF value with the thesis that revenue would continue to grow at 25% and margins having stabilized might bump up by couple of % over a period of 2-3 years. Anti thesis was the fact that card companies continue to pull back benefit and that seems to be playing out still so the view has gone wrong.

Hoping that card companies are at the last stage of reducing benefits which hopefully should stabilize the numbers and probably after a year the growth comes back to 25%. I guess am hoping agaisnt hope now. Anticipating some pain but might stay invested. Over a very long term probably betting on India story where travel in general increases significantly which should continue to benefit the company model.

Samarth’s Portfolio & Learnings (12-11-2024)

Hi @Samarth1

Have your done any modification to your portfolio in view of recent correction? How are you handling the correction ?

Thanks