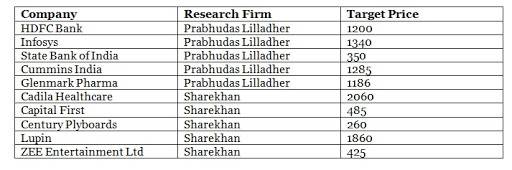

Kshitij Anand of ET has spoken to experts like Dhawal Mehta, Somerset Capital Management, Sharekhan, Prabhudas Lilladher, etc and collated a list of stocks to buy now for a period of 6-12 months:

HDFC Bank Ltd: Target price Rs 1,200

HDFC Bank delivered a 25 per cent YoY growth in core revenues, led by a strong growth in NII and robust core fees/FX income/recovery from written-off accounts. Core other income grew 28% YoY and HDFC Bank had treasury gains of Rs 1.26 bn during the quarter, which boosted overall other income growth to 33% YoY.

HDFC Bank made floating provisions of Rs 650 mn, taking the total quantum of such provisions to Rs 15.9 bn. The brokerage firm maintains its ‘BUY’ rating with a target price of Rs 1,200.

(Image Credit: ET)

Infosys: Target price Rs 1,340

Infosys’ Q1FY16 performance was ahead of expectation on all counts, with FY16 USD revenue guidance being revised upward and Aspiration 2020 reiterated. Infosys’ initiatives over the last one year are showing some signs of early success.

State Bank of India: Target price Rs 350

State Bank of India has been reporting declining trend in slippages for the past few quarters in a row, which is a big positive. However, higher restructuring and bad loan sale to ARC had diluted the performance.

Bank management opined of early signs of revival in project lending, while push into retail will be the focused area in FY16. The brokerage firm retains a BUY with a target price of Rs 350 which corresponds to 1.8x Mar-17 ABV.

Cummins India Ltd: Target price Rs 1,285

The stock is trading at 28.8x FY17E earnings. Cummins continues to be the best franchise in the Capital goods space. Outlook for Cummins continues to be positive, given the strong ramp-up in exports and likely improvement in market position, post changes in emission norms. Low capacity utilisation of 50-60% also leaves upside surprise on margin once volumes improve.

Glenmark Pharmaceuticals Ltd: Target price Rs 1,186

Compared to its peers such as Sun Pharma Advance Research, and Dr Reddy’s for their investments in R&D of NDDS/NDA products with potential of much lower revenues, the brokerage firm finds value of Glenmarks’ annual investments of US$ 45-50 mn, for NCE/biologics remains non-existent in the company’s current valuation.

To derive comparable EPS of Glenmark with peers, they have added back US $50 mn R&D costs of NCE/NBE research, post adjustment of tax benefits/shields to core earnings. Prabhudas Lilladher forecast adjusted EPS of Rs 36.4, Rs 50, Rs 66.7 in FY15E, FY16E and FY17E, respectively.

Cadila Healthcare Ltd: Target price Rs 2,060

Cadila Healthcare is set to enter a high-growth trajectory, thanks to its aggressive product filings in the USA and Latin America, a recovery in its joint venture business, and the launch of niche products in the Indian market, including the generic version of Gilead Sciences’ Hepatitis C drug, Sofosbuvir, in India under the brand name SoviHep.

Sharekhan expects the company to record overall revenue and profit CAGR of 21% and 36% over FY2015-17 respectively from the base business. The OPM of the company will see a sustained expansion of over 600 bps in the next three years, mainly on the back of stronger traction in the branded business in India and Latin America, a better generic pricing scenario in the USA and optimisation of capabilities in the joint venture business.

Sharekhan recommends a BUY rating on the stock with a price target of Rs 2,060, which implies 20x its FY2017E EPS.

Capital First Ltd: Target price Rs 485

Capital First is among the leading non-banking finance corporations with assets under management of Rs 11,975 crore mainly in the small and medium enterprise and consumer segments (consumer durables, two-wheelers, mortgages), contributing 84% of the total AUMs.

Sharekhan expects Capital First to deliver an earnings growth of 46% CAGR over FY2015-17 led by a 28% CAGR in the net interest income. Due to the recent capital raising, the return on equity (RoE) estimates for FY2016 and FY2017 may get diluted by 200-250 basis points, though the RoA may continue to improve.

A likely easing of interest rates or a pick-up in the economy will boost the company’s growth. Considering the robust growth outlook, healthy asset quality and experienced management team, they believe that the stock trades at a reasonable valuation (1.9x its FY2017E BV).

Century Plyboards Ltd: Target price Rs 260

Century Plyboards (Century) is a leading player in the fast-growing plyboard and laminate segment, with an overall market share of around 25% of the organised plyboard market and an estimated size of Rs 4,500-4,800 crore annually.

Sharekhan believes that Century, with its top-of-the-mind brand recall, is well positioned to ride the economic revival-driven recovery in demand and increase its market dominance in the plywood and laminate segments.

A robust revenue growth and margin expansion would enable the company to deliver a strong growth ahead. The brokerage firm expects it to post 25% earnings CAGR over FY2015-17.

Lupin Ltd: Target price Rs 1,860

A vast geographical presence, focus on niche segments like oral contraceptives, ophthalmic products, para-IV filings and branded business in the USA are the key elements of growth for Lupin.

Lupin is expected to see stronger traction in the US business on the back of the key generic launches in recent months and a strong pipeline in the US generic business (over 95 ANDAs pending approvals including 86 first-to-file drugs) to ensure the future growth.

The key products that are going to provide a lucrative generic opportunity for the company include Nexium (market size of $2.2 billion), Lunesta (market size of $800 million) and Namenda (market size of $1.75 billion) that will be going out of patent protection in CY2015.

ZEE Entertainment Ltd (ZEEL): Target price Rs 425

Among the key stakeholders of the domestic TV industry, Sharekhan expects the broadcaster to be the prime beneficiary of the mandatory digitisation process initiated by the government.

ZEEL is well placed to benefit from the digitisation theme and the overall recovery in the macro economy. Also, the success of the newly launched channel, ‘&TV’ and recent acqustion of Odia GEC channel ‘Sarthak TV’, would augur well and improve the company’s position in the general entertainment channel space.

Wonderful mix and love all .Waiting for dust to settle …

Wish you all Happy Independence day !!