Correction to Opportunity: Large Caps & Quality Remain in Focus

Axis Top pick basket declined by 9% in Feb’25 in a highly volatile month that witnessed rather mixed performance across the sector, market cap and style indices. The start of 2025 has been one of the toughest in recent times on account of the underperformance of the domestic market vis-à-vis other emerging and developed markets. Led by volatility, the broader market adopted a more cautious approach during the month. Mid and Small Caps declined by 11% and 13%, respectively, while Nity-50 declined by 6% MoM. The mixed performance exhibited by sector and style indices points towards some degree of underlying change in the market regime. Nonetheless, our Top Picks basket managed to deliver an impressive return of 265% since its inception in May’20, which stood significantly higher than the 139% return reported by Nifty-50 over the same period.

We are reducing the Dec’25 Nifty target to 24,600

Base case: We believe the Indian economy remains well-positioned for growth, serving as a stable haven amid global economic volatility. We remain confident in India’s long-term growth story, supported by its favorable economic structure, rising Capex, and the consumption boost from the recent Union Budget, which is expected to drive higher credit growth for banks. This is expected to support double-digit earnings growth, ensuring that Indian equities can deliver strong double-digit returns over the next 2-3 years. Against this backdrop, we foresee Nifty earnings to post excellent growth of 14% CAGR over FY23-27. Financials will remain the biggest contributors for FY25/26 earnings. However, the trade policy uncertainty, rupee depreciation, and relatively higher valuations vs. other emerging markets, even after the correction, will continue to pose risks to the market multiple in the near term. Based on these factors, we reduce our base case Dec’25 Nifty target to 24,600 by valuing it at 19x on Dec’26 earnings.

The current level of India’s VIX is below its long-term average, indicating that the market is currently in a neutral zone (neither panic nor exuberance). While the medium to long-term outlook for the overall market remains positive, we may see volatility in the short run. Hence, we recommend investors to use the current dips in a phased manner and build a position in high-quality companies (where the earnings visibility is quite high) with an investment horizon of 12-18 months.

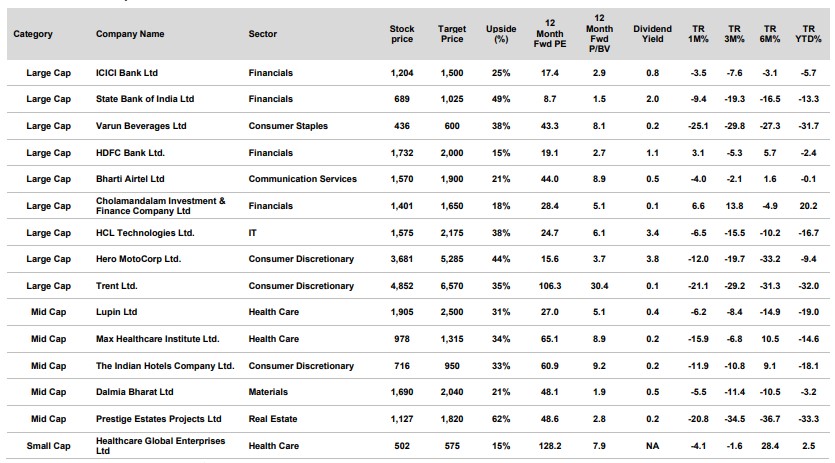

Based on the above themes, we recommend the following stocks: HDFC Bank, ICICI Bank, Dalmia Bharat, State Bank of India, HCL Tech, Lupin, Trent Ltd, Hero Motocorp, Max Healthcare, Indian Hotels, Healthcare Global, Varun Beverages, Bharti Airtel, Prestige Estates, Cholamandalam Invest and Finance