According to the latest newsletter by Solidarity Investment Managers, if one wants to target a better return from the market, about 33% of the portfolio has to be invested in non consensus ideas which are out of favour at present. These are in companies facing some growth challenges at present or getting punished due to a strategic error, but with strong market positions/ability to correct errors. “Over time, we believe these companies will fix their current growth issues. They will then benefit from both growth and multiple re-rating as the current pessimism is re-priced. This should provide the Alpha kicker to the portfolio,” it is stated.

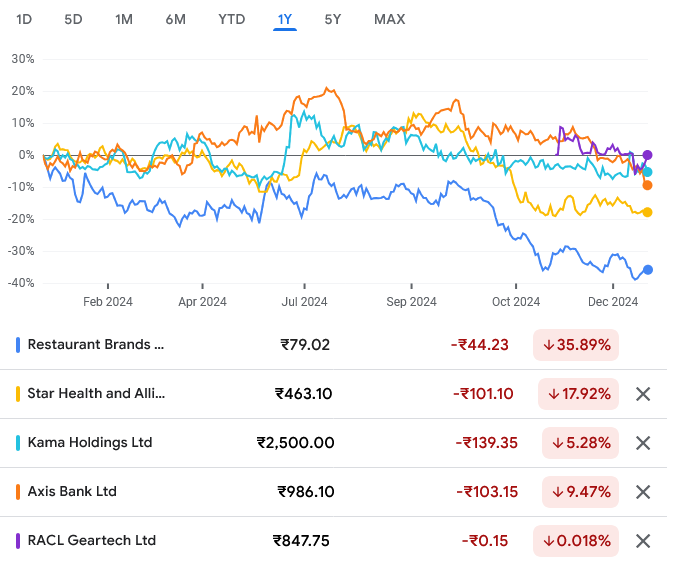

The four contrarian stocks added by Solidarity Investment Managers to its portfolio are the following:

Restaurant Brands Asia

RBA is getting punished because the market is ascribing a negative value to its Indonesia business which is still burning cash ~3 years after RBA acquisition. It still needs cash support from India which has also been affected due to the slowdown in the QSR industry. “We bought RBA for its India opportunity and track record and were willing to take a leap of faith that the Indonesian business will be worth at least its acquisition price,” it is stated.

STAR Health

The Health Insurance industry is getting impacted because of both higher medical inflation7 and higher frequency of claims post Covid. STAR Health has consistently missed the Claim Ratios guidance they believe the business should operate at. Hence, the market is unclear about the steady state economics of this business and is questioning the credibility of the management team. There is complete investor apathy.

“Our contrarian view is that high Claim Ratios are not a STAR issue alone but an industry wide issue. This is not well understood as STAR has been the only listed Health Insurer and accounting practices differ across insurers making comparisons hard. More Hospital bed additions should reduce medical price inflation and price increases should bring Claim ratios to normalized levels over time. There is excessive pessimism in the price for a high Terminal Value business which can grow profits 15-18% for extended periods of time. STAR Health can be a ~16-18% ROE business vs the ~18-20% ROE business on IFRS that we originally believed. Once steady state economics are established, high Terminal Value deserves a 22-25x PAT multiple on IFRS profits,” it is stated.

KAMA Holdings

KAMA Holdings is the Holding co of SRF Ltd. SRF derives bulk of its value from its Chemical segment which is facing short cyclical growth headwinds from slowing global Agri demand, inventory rationalisation and China dumping. Near term growth remains weak. Kama trades at a poorer Hold Co discount than Bombay Burmah where, unlike SRF, historical dividends from Britannia have not been shared with minority shareholders.

“Our contrarian view is that SRFs Chemical business enjoys strong edge (leadership in high entry barrier Fluoro chemicals, strategic manufacturing relationships with Global Agri majors) and the current earnings pressure is temporary reflecting the business cycle and Chinese dumping. SRF continues to make large Cap Ex investments which can deliver >15% earnings CAGR this decade,” it is stated.

Axis Bank

Axis Bank has significantly improved its Deposit franchise over the last few years with now only a marginal difference in Cost of Funds vs ICICI. However, the market still believes their Credit underwriting needs more discipline as their communication at present indicates more stress in Unsecured Loans vs their peers (ICICI/HDFC Bank).

“Our contrarian view is that Axis is evolving into a more conservative lender supported by amongst the lowest Cost of Funds in the industry, and lower base vs larger peers which allow it to choose its risk profile. It has significant provision buffers which should allow it to double profits every 5 years while maintaining ROEs of ~16%. Hence, there is a credible road map to 15% IRR over 5 years from profit growth trajectory alone without the aid of any valuation re-rating. However, there is a reasonable possibility of a better upside. While Axis Bank rightly deserves a discount to ICICI, the 40% discount reflects excessive pessimism. If Axis can follow the transformation of ICICI, we can expect a significantly higher IRR as multiples will re-rate higher than the 1.9x Core Price/Book today,” it is opined by Solidarity.