Long term compounders

Decadal economic trends present opportunities India’s GDP is expected to double from its current level of USD 3.57trn (in FY24E) to USD 7trn in 2030. This will be a result of inherent demographic advantages along with consistent policy support. We observe that there are decadal economic trends underway in the country, which are fueling the business growth of companies in various sectors. These trends are:

Rising discretionary spending pool and premiumization: The middle class of the country is expected to get more populous and richer, driving demand for discretionary goods and services. From 158 mn households in 2018, the middle class is poised to grow to 300 mn by 2030, representing 78% of overall households.

Formalization of the economy: Low-ticket discretionary sectors have a higher presence of unorganized players. However, consolidation is underway, led by factors such as rising affordability, technology upgradation, GST, RERA, e-way bill, internet penetration and the recently launched ONDC. This consolidation process is expected to benefit organized players across multiple sectors.

Digitization: Internet penetration and data consumption in the country have climbed up very fast led by declining data costs. This has fueled the ambitions of aspiring entrepreneurs and given rise to a blossoming startup ecosystem (114 Unicorns so far). Policy supports such as UPI and ONDC are key reinforcing catalysts for these businesses. New age business models will continue to gain prominence and disrupt incumbents using the digital India stack.

Financialization of savings: Rising financial literacy and pursuit of higher IRR with liquidity are leading investors to move away from real estate/ FDs to more sophisticated asset classes such as MFs, equity, LI, PMS/AIF/private credit and derivatives. Despite cyclical market volatility, Asset/wealth management, market intermediaries will continue to see healthy trend growth rates.

Capex/infrastructure investments: The central government has been focusing on investment-led GDP growth in the country. Its impact can be witnessed in the sectors of defense, roads, railways, and renewable energy. Further, it aims to nudge the private sector to invest in capex, given their healthy balance sheets and optimistic long-term demand outlook. Electric vehicles, manufacturing, alternate energy and semiconductors are sectors with expected capex rise. Thus, sectors like capital goods, infrastructure and cement will benefit from the current capex cycle.

Green energy adoption: India is on the cusp of shifting to a green energy ecosystem from a fossil fuels-dominated one. This will involve green energy capacity creation of 340 GW by 2030 at a projected expenditure budget of INR 20 trn. Renewables (Solar, Wind), Green hydrogen and EV are key beneficiaries.

Manufacturing/China plus one: India can benefit immensely as global companies aim to diversify their supply chain and manufacturing away from China due to geopolitical tensions, trade war and rising labour costs. While it is a large lucrative growth opportunity, India must compete with other Southeast Asian countries to get its share in the business of the global giants. Auto ancillaries, Chemicals, Textiles, and Electronics manufacturing remain well poised to benefit from this trend.

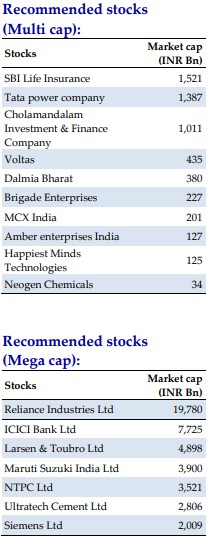

To benefit from the tailwinds of the above-mentioned trends, we have identified a list of stocks from our coverage universe which can compound their earnings consistently over the next 3-5 years while maintaining healthy return metrics and balance sheets.