Aditya Birla Capital Limited (ABCL) is a diversified financial services group that operates in various businesses including non-banking finance, housing finance, life insurance, standalone health insurance, asset management, stock and securities broking, wealth services and asset reconstruction. ABCL has envisioned the ‘One ABC One P&L’ approach, which focuses on a business strategy that revolves around the three levers i.e One Customer, One Experience and One Team. ABCL has been prioritizing creating seamless, technology-driven loan processes by utilizing its group-level ecosystem.

Post management change in Jul’22 with Ms. Vishakha Mulye at the helm as MD & CEO, ABCL has reimagined its business offering and initiated a tech transformation journey to leverage its ~35 mn customer base and ~200k channel partners at the group level. For the lending business, the company has guided a roadmap for doubling FY23 AUM in Aditya Birla Finance and Aditya Birla Housing by FY26E. In FY24, Aditya Birla Finance AUM reached Rs 1,05,639 cr and Aditya Birla Housing Finance AUM is at Rs 18,420 cr. So far, in 1QFY25, Aditya Birla Finance has registered an AUM growth of 25% YoY at Rs 1,07,306 cr and Housing Finance has registered an AUM growth of 33% YoY at Rs 20,399 cr.

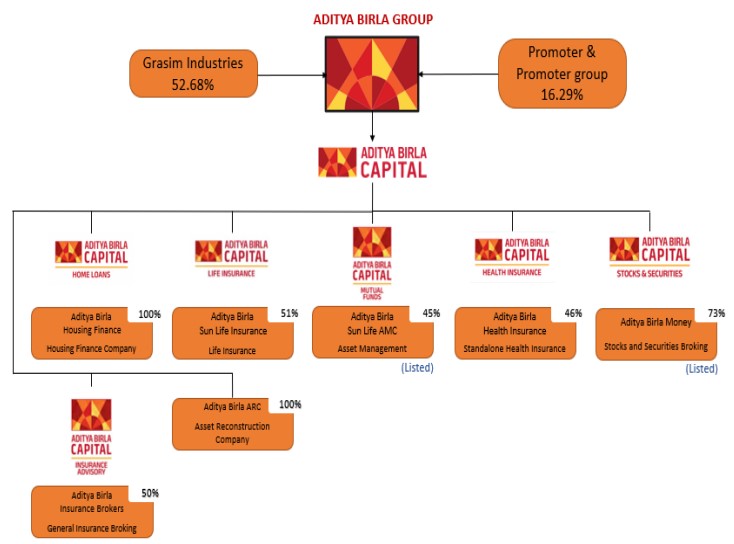

Distinct businesses in the Group

NBFC: Aditya Birla Finance Ltd. [ABFL] loan growth strategy focuses primarily on the MSME sector with a steadfast emphasis on secured business. The company is determined to double its FY23 AUM (Rs 80,556 cr) by FY26E while also strengthening its Return on Assets (ROA). The key strategies involve prioritizing secured loans for MSMEs, expanding branch presence, effectively leveraging digital channels for sourcing, introducing innovative new products, utilizing analytics for cross-selling and enhancing portfolio quality through analytics-driven collections.

Housing Finance: Aditya Birla Housing Finance Ltd. [ABHFL] is experiencing strong momentum in disbursals and loan book growth, leading to an increase in market share with a steady enhancement in return metrics. The focus remains unwavering on portfolio quality. ABHFL has built significant capacity over the past few quarters by making investments in digital properties, technology, people and distribution. The demand for housing continues to remain very strong in India and the recently announced measures by the government such as expansion of PMAY and investments in affordable urban housing will create ample opportunities in the housing finance sector. These investments will enable ABHFL to capture opportunities and further enhance its market share. For the Housing Finance company, the AUM is expected to grow at the rate of 30% in FY25E & FY26E.

Asset Management Business: Aditya Birla Sun Life AMC Ltd. [ABSLAMC] has strengthened its sales, mutual fund and AIF investment team and has witnessed improvement in fund performance in the last few months. The company has been taking proactive initiatives to increase the traction in SIPs. The focus has been on building a larger SIP book size and ensuring customer loyalty while creating long-term value for investors. The company has registered a 19% YoY growth in the AUM reaching Rs 3,52,542 cr in 1QFY25. The share of equity in the portfolio mix stood at 44%, debt at 37%, Liquid at 15% and Alternate assets at 4%.

Life Insurance: Aditya Birla Life Insurance [ABSLI] is a 51:49 joint venture between the Aditya Birla Group and Sun Life Financial Inc., Canada. It is currently one of India’s leading private life insurance companies. ABSLI offers a range of products across the customer’s lifecycle, including children’s future plans, wealth protection plans, retirement and pension solutions, health plans, traditional term plans and unit-linked insurance plans (ULIPs). For 1QFY25, Individual First Year Premium (FYP) grew by 19% YoY to Rs 644 cr. Group new business premium grew by 41% YoY to Rs 1,498 cr and Net VNB (Value of New Business) margin stood at 6.50%.

Health Insurance: Aditya Birla Health Insurance Ltd. [ABHIL] is one of the fastest-growing Standalone Health Insurance (SAHI) players in FY24. It is driven by its ‘Health First’ business model, backed by a strong brand and differentiated product offerings. It is well placed to capitalise on the growth opportunity in the health insurance space. For 1QFY25, Gross Written Premium (GWP) grew by 35% YoY to Rs 1,041 cr, with Retail premium growth at 51% YoY. Market share among standalone health insurers (SAHI) increased by 92 bps YoY to 12.5%. The combined ratio improved to 112% from 118% in 1QFY24.