Good Show, New Capex to lift visibility …

About the stock: Aeroflex Industries Limited (AERIND), incorporated in 1993, is engaged in the business of manufacturing and supply of metallic flexible flow solutions made with stainless steel

• Product range includes stainless steel corrugation products (braided and non-braided) such as hose, double interlock flexible metal hoses, composite hose, stainless steel hose assemblies, teflon/PTFE hose, fittings

• Q3FY25 revenue Mix: ~77% from exports, ~23% from domestic markets

• Consolidated revenue of the company has grown by ~30% CAGR in the last 3 years during the period FY21-24 while EBITDA and PAT have grown by ~40% CAGR and ~91% CAGR respectively over the same period

Investment Rationale:

• Higher share of Assembly /Domestic revenues drives topline growth: The share higher margin assembly segment stood at 49% in Q3FY25 vs. 40% in H1FY25. This reiterates the fact that the company is in the right direction to take the assembly segment share to 70% in next 2-3 years. More so the company is also incurring a capex of increasing the assembly stations from 40 to 70 by FY26E which will lead to better product mix and higher margins. On other hand, the share of domestic stood at 23% as execution related to domestic projects gained momentum in the quarter. Going ahead, with increasing penetration in the US markets, new product development and traction Hyd-Air engineering will drive revenue CAGR at 21% over FY24-FY27E.

• New capex to enhance visibility in the long run: The company in Q3FY25 announced new capex plans to enhance visibility in the medium to long term. In the SS hoses segment the company after augmenting the capacity to 16.5 m metre in FY25E has further planning to add another 3.5 m metre capacity by FY26E coupled with adding of 30 new assembly stations (taking the count to 70) and automation of welding process. This will require a capex of Rs 54 crore. In the new product segment, the company is planning to put a capacity for manufacturing miniature metal bellows at a capex of Rs 23 crore. All this capex will be funded from internal accruals and drive growth over FY26E-FY27E. This capex will margin accretive as miniature metal bellows command margins of 30-35% while assemblies have 20-25% margin profile.

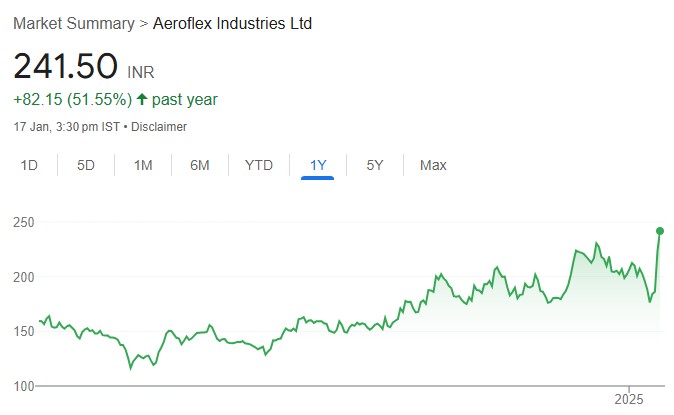

Rating and Target Price

• With strong traction in export/domestic markets, new capex and expansion in margins, we expect the company to deliver a strong CAGR of 21% and 28% in revenues and PAT, respectively over FY24-FY27E. The lean balance sheet and strong cash flow generation will improve ROCE to 25.3% in FY27E from 22.5% in FY25E which will ensure the company commands rich multiple.

• We value the company at 38x FY27E EPS to arrive at a fair value of Rs 280 with a Buy Rating.