Archean Chemical Industries Ltd is Expanding into 1) Compound Semiconductor (Silicon Carbide) and 2) Zinc-Bromide Battery Technology in Energy Storage

Twin Tailwind from Dual Expansion:

• ACI is investing GBP 15 million for a 21.33% stake in Clas-SiC Wafer Fab Limited, a UK-based Silicon Carbide (SiC) wafer foundary specializing in SiC MOSFETs and diodes. This investment secures technology exclusivity in India, enabling Archean to integrate its specialty chemicals expertise into SiC semiconductor business, achieving cost efficiencies and a streamlined supply chain to meet growing demand in high-growth markets like EVs and renewable energy.

• ACI has also signed a binding term sheet for strategic investment of USD 12 million for a 21% stake in Offgrid Energy Labs, a company specializing in zinc-bromide battery technology under its patented ZincGel® brand. This investment aligns with Archean’s strategy to enter the energy storage sector, leveraging synergies with its bromine business to support Offgrid’s production scale-up and meet growing demand in renewable energy and industrial storage applications.

• We believe these are pivotal strategic moves by ACI which might not yield immediate results, undoubtedly set a strong course for the company’s future growth. These initiatives align with Archean Chemical’s focus on entering the semiconductor space, targeting high-growth sectors such as EVs, renewable energy, industrial power electronics, and data centers. Additionally, the investment in Offgrid Energy Labs enables ACI to actively participate in the rapidly expanding energy storage sector by leveraging its specialty chemical capabilities to meet battery storage requirements.

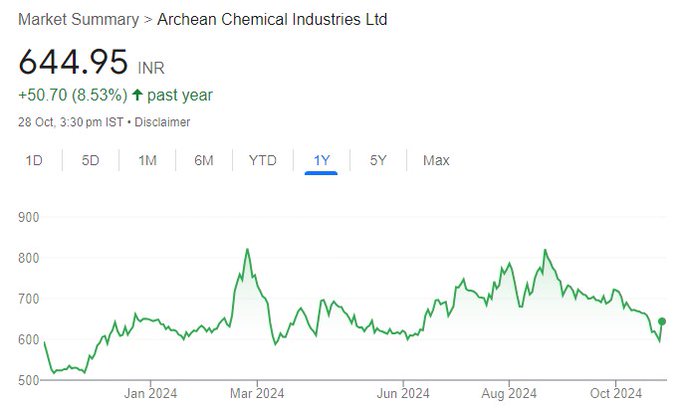

• We firmly believe ACI is on the right track to expand into more critical, value-added products. On one hand, the expansion into bromine derivatives, and on the other side, the recent strategic investments into semiconductor and energy storage system, highlight the company’s intent to move deeper into the value chain and gradually transition away from commodity-type business. We reiterate our “BUY” rating on the stock, valuing it at a P/E multiple of 19x on FY26 EPS, with a target price of 943.