“Is raat ki subah nahi, Mitron!!🥃”

A few days ago, when the stock markets had plunged due to the Israel-Hamas conflict, Ashish Kacholia had lamented the steep fall in his portfolio of small and mid-cap stocks.

“Dabba gul, Doston! Waat lag gayi…aaiii ggggggggg. Kya dhulaayi ho rahi hai subah subah,” he said, obviously joking.

Portfolio is sparkling with multibagger gains

However, the reality is that Ashish Kacholia’s portfolio is actually sparkling with hefty multibagger gains.

The portfolio is presently as follows:

| Ashish Kacholia Portfolio | ||

| Company | Nos of shares | Portfolio Value (Rs Cr) |

| Safari Industries (India) | 500,000 | 223.2 |

| PCBL | 7,084,990 | 185.7 |

| Gravita India | 1,484,399 | 159.2 |

| Garware Hi-Tech Films | 968,322 | 136.5 |

| Beta Drugs | 1,203,644 | 134.9 |

| NIIT Learning Systems | 3,000,000 | 120.4 |

| Fineotex Chemical | 3,135,568 | 102.3 |

| Ador Welding | 595,400 | 90.5 |

| Ami Organics | 776,474 | 84.8 |

| Vaibhav Global | 2,000,000 | 84.7 |

| Carysil | 1,000,000 | 83.6 |

| Yasho Industries | 475,394 | 76.0 |

| Aditya Vision | 239,506 | 74.1 |

| Xpro India | 808,550 | 73.5 |

| TARC | 6,544,917 | 73.4 |

| La Opala RG | 1,767,433 | 67.4 |

| ADF Foods | 3,013,025 | 64.1 |

| Faze Three | 1,317,554 | 62.3 |

| SJS Enterprises | 1,003,891 | 62.1 |

| Agarwal Industrial Corporation | 597,977 | 55.4 |

| Zaggle Prepaid Ocean Services | 2,129,269 | 53.6 |

| Balu Forge Industries | 2,165,500 | 51.9 |

| HLE Glascoat | 958,010 | 49.6 |

| Best Agrolife | 532,526 | 46.3 |

| Knowledge Marine & Engineering Works | 300,000 | 44.8 |

| Ugro Capital | 1,445,936 | 38.2 |

| Repro India | 460,528 | 37.9 |

| Vasa Denticity | 609,000 | 36.5 |

| Aeroflex Industries | 2,315,935 | 36.2 |

| Barbeque-Nation Hospitality | 557,510 | 34.3 |

| Virtuoso Optoelectronics | 1,228,070 | 33.2 |

| Raghav Productivity Enhancers | 463,366 | 32.9 |

| Shankara Building Products | 451,140 | 31.8 |

| Shaily Engineering Plastics | 882,696 | 31.7 |

| NIIT | 2,500,000 | 29.3 |

| Dhabriya Polywood | 696,178 | 28.8 |

| Stove Kraft | 576,916 | 27.7 |

| Sastasundar Ventures | 598,902 | 26.3 |

| Universal Autofoundry | 1,034,353 | 24.5 |

| Genesys International Corporation | 618,734 | 22.2 |

| Likhitha Infrastructure | 700,000 | 20.6 |

| BEW Engineering | 139,250 | 19.9 |

| Inflame Appliances | 308,000 | 19.2 |

| DU Digital Global | 2,880,000 | 11.7 |

| Systango Technologies Ltd | 452,800 | 10.9 |

| Total | 2800 | |

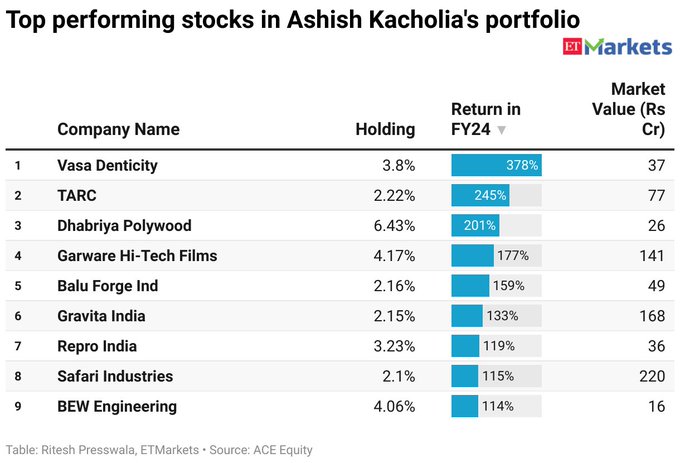

According to a study by the ET, as many as 9 stocks have given returns in excess of 100% in the FY 2023-24. Three stocks have given a return in excess of 200%.

ET has provided a succinct break-down of the best-performing stocks of Ashish Kacholia’s portfolio:

1) Vasa Denticity

Vasa Denticity, which sells dental products through Dentalkart portal, got listed on NSE SME exchange earlier in June. At the end of the September quarter, Kacholia owned a 3.8% stake in the company. The SME stock is the top gainer with a 378% return in FY24 so far.

Mukul Agrawal also owns about 2.56% stake in the multibagger.

2) TARC

TARC Ltd, a premium real estate developer in Delhi and NCR region, has Kacholia as one of the top shareholders with 2.22% stake. The multibagger has so far yielded a 245% return in FY24.

3) Garware Hi-Tech Films

Shares of Garware Hi-Tech Films, which manufactures polyester films, are up 177% so far in the fiscal year. Kacholia owns a little over 4% stake in the company.

Garware management expects to post a 20% CAGR to achieve revenue of Rs 2,500 crore in the next 2-3 years, led by strong growth in SCF, PPF and recovery in the IPD division.

“Capacity expansion (SCF), product diversification (PPF), and favourable changes in India automotive regulation for safety glazing film along with strong positioning in export markets act as key catalysts for the company’s growth,” broking firm Sharekhan said.

4) Balu Forge Ind

Balu Forge Industries Ltd is one of the leading manufacturers of finished and semi-finished forged crankshafts and components. Kacholia’s 2.16% stake was valued at Rs 49 crore in the multibagger.

5) Dhabriya Polywood

Jaipur-based Dhabriya Polywood, which manufactures PVC & UPVC products, is an indirect play on the real estate boom in India. The company is expecting revenue growth if 20-25% in FY24.

While Kacholia owns 6.43% stake in the company, Mukul Agrawal also has a 4.68% stake.

6) BEW Engineering

Kacholia owned around 4% stake in SME company BEW Engineering, which is listed on NSE Emerge platform. The stock has more than doubled in FY24.

7) Gravita India

Jaipur-based recycling company Gravita India has ambitious plans to diversify into new business verticals and achieve revenue CAGR of 25%, profitability growth of 35% and ROCE of 25%.

Kacholia’s 2.15% stake was valued at Rs 168 crore in the multibagger. Other big investors in the smallcap include Nomura and Goldman Sachs.

Emkay Global, which has a target price of Rs 1,300 on the stock, has revised its FY25 EPS upwards by 10%, assuming a better margin profile.

8) Safari Industries

Luggage maker Safari has outlined a capex plan of Rs 215 crore that would entail doubling its hard luggage capacity from 6.5 lakh pieces per month to 13 lakh pieces per month. The expansion is expected to complete in the next 12-15 months.

Prabhudas Lilladher, which has a target price of Rs 4,752 on the stock, said consistent gain in market share and rising share of indigenous manufacturing is likely to result in sales/PAT CAGR of 24%/31% over FY23-FY26.

Kacholia’s 2.10% stake is worth about Rs 220 crore.

9) Repro India

Book printing company Repro India is the largest print on-demand player in India with capacity of 50,000 books per day. In Q2, the company reported Q2 revenue of Rs 118 crore to report YoY growth of 30%. The stock is a favourite of not just Kacholia who owns 3.23% stake but also that of Madhu Kela (3.33% stake) and Vijay Kedia (6.36% stake).

Focus on growth, RoCE and valuations rather than on market capitalisation

Somebody asked Kacholia the pertinent question whether he is predominantly a midcap / small cap investor or he also invests in large cap stocks. Kacholia replied that he does not categorise or allocate his investments by market cap criteria. He looks more closely at growth, Roce, valuations. Of course, it is implied that a small and mid-cap stock will have more growth opportunities as compared to a large-cap stock.

Someone also asked Kacholia whether he prefers managements that give guidance. Kacholia replied in the affirmative that he prefers managements that give realistic and achievable guidance.

He also clarified that he does not aim for multibagger gains of 100% but even a relatively modest return of 25% would be awesome.