Auto Component Industry

In a sweet spot

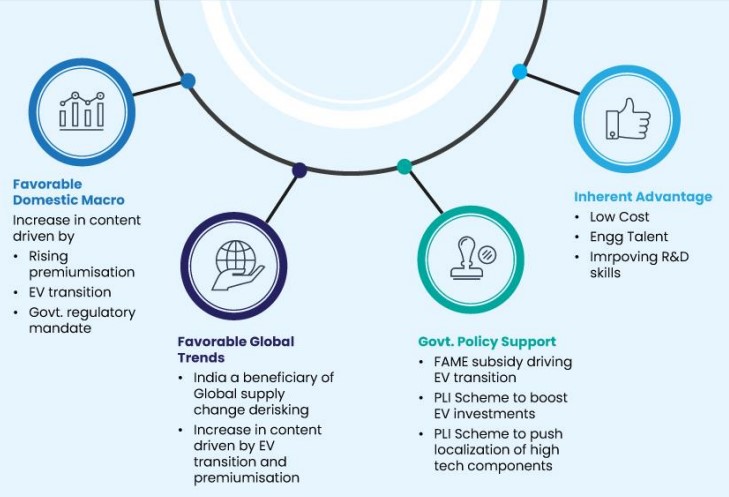

The domestic auto component industry appears to be in a sweet spot as several tailwinds collude to drive a sustainable long term growth opportunity which include: 1) Indian component industry emerging as one of the beneficiaries of the supply chain derisking strategy by global OEMs post continued supply chain disruptions over the last 3-4 years 2) outperformance to core likely to sustain going forward driven by rising content led by premiumization and EV transition 3) favorable Government policies advocating “Make In India” 4) India emerging as an auto hub for global OEMs. On the back of these tailwinds and its inherent core strengths (global quality at low cost + improving R&D skills), the auto component industry is expected to invest around USD 6.5-7bn over next 5 years, which is 2x of what they invested in the previous 5 years. Post the recent strong rally in the sector, companies that can outperform from here on the back of the above tailwinds include: SAMIL, Sansera and Suprajit (Initiate with Buy on all 3). We also Initiate on MSWIL with Add rating.

Auto Ancillary sector set to sustain strong outperformance to core led by:

(1) Derisking strategy of global OEMs: Given the multiple supply chain disruptions over last 3-4 years, global OEMs seek to derisk their supply chain and India seems to be emerging one of the key beneficiaries of this trend

(2) Rising content driving sustainable outperformance: Over the last few years, the auto component industry is seeing rising content supplied to OEMs which in turn is being driven by: 1) ever rising premiumization trend across segments in India, which is here to stay 2) Government regulatory push which is pushing up avg ASP 3) EV transition. We expect these trends to help drive a sustainable outperformance of the industry relative to core even going forward

(3) Favorable Government policies: Indian Government is strongly advocating “Make In India” across categories and has framed favorable policy incentives including PLI schemes to drive rapid localisation.

(4) India emerging as an auto hub: Given each of these tailwinds above and the fact that Indian emissions now are in line with many global markets, India is now emerging as an auto hub for global players, which in turn would benefit the Ancillary sector.

Given the above trends and its inherent core strengths (global quality at low cost + improving R&D skills), the auto component industry is expected to invest around USD 6.5-7bn over next 5 years, which is 2x of what they invested in the previous 5 years. We hence expect the Auto ancillary industry to continue to outperform core industry growth in the foreseeable future.

Sector has done well, selective bets to drive outperformance from here-on

Given the sector tailwinds and the domestic market exuberance, many ancillary companies have seen a sharp rally over the last 12 months. In light of the above, one needs to look at businesses which are fundamentally sound and have equally strong long-term potential but may have relatively underperformed peers in the recent past due to some macro/micro near-term issues. We Initiate with Buy on SAMIL (key beneficiary of premiumization trend + inorganic growth), Sansera (seems on track to achieve its ambitious Vision 20:20:20 by FY26) and Suprajit Engineering (one of the key beneficiaries of the global supply chain consolidation trend + strong orders from new products division). We Initiate with Add on MSWIL (key beneficiaries of the rising premiumization trend) but doesn’t qualify amongst our top picks due to Valuation discomfort.

Click here to download report on Auto Ancillary Jan24 by HDFC Securities