Awfis Space Solutions (AWFIS) reported a strong 40% YoY revenue growth to INR292cr led by a 42%/36% growth in rental/design and build (D&B) segments. Growth in the rental segment was driven by: i) a 48% YoY growth in operational inventory, and ii) a 200bp rise in occupancy. Average monthly realisation per seat fell 4% YoY. EBITDA (excluding Ind AS 116) grew 163% YoY to INR42cr, with margin expanding by 664bp to 14.4% on strong occupancy, operating leverage benefits, and greater revenue share from long tenure clients. Reported EBITDA grew 67% YoY to INR100cr. RPAT (excluding exceptional items) scaled up to INR15cr as against a net loss of INR4cr in Q2FY24. Sequentially, revenue grew 13% on a 10% growth in seat inventory, a 200bp rise in occupancy, and 7% higher realisation.

With 40,471 seats under fit outs and in the LoI stage, we expect it to comfortably reach 135,000 operational seats by FY25-end. Thereon, we see it adding 30,000–40,000 seats annually to capture the growing demand and expand its market share. Over FY24–27, we see the rental space clocking 37.8% revenue CAGR to INR1,619cr on sharp inventory addition, a 6% annual price hike, and steady occupancy. Strong demand and a marginal increase in market share will enable the D&B segment to clock 50% revenue CAGR over FY24–27 to INR692cr. We upgrade our FY25/ FY27 EBITDA margin estimate to 11.6%/16% from 10.1%/14.6% earlier to account for better-than-expected operating leverage benefits and sale of AWFIS Care. We expect an EBITDA/PAT CAGR of 74.1%/100.1% over FY24–27. We value the rental segment using DCF and D&B at 13x FY26E EV/EBITDA to arrive at our SoTP-based TP of INR1,013. Maintain ‘BUY’.

Maintain ‘BUY’ with a SoTP-based TP of INR1,013

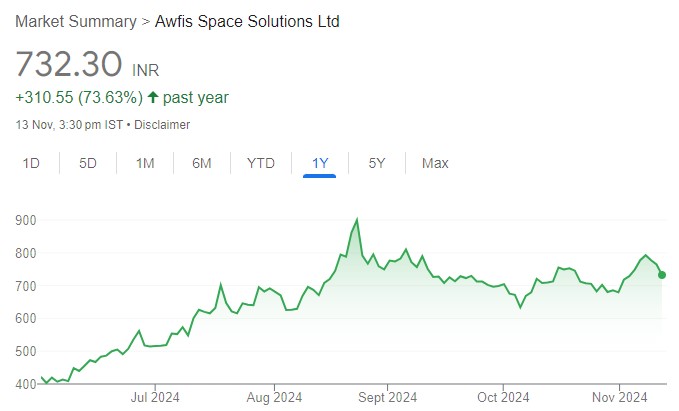

We are bullish on AWFIS’ long-term growth prospects given the: i) favourable demand-supply gap, ii) strong inventory additions, iii) improving occupancy, iv) capital-light growth, and v) robust Balance Sheet. We are confident in the management’s ability to deliver profitable growth. At the CMP, the stock trades at a FY27E P/E of 17.6x. Maintain ‘BUY’.