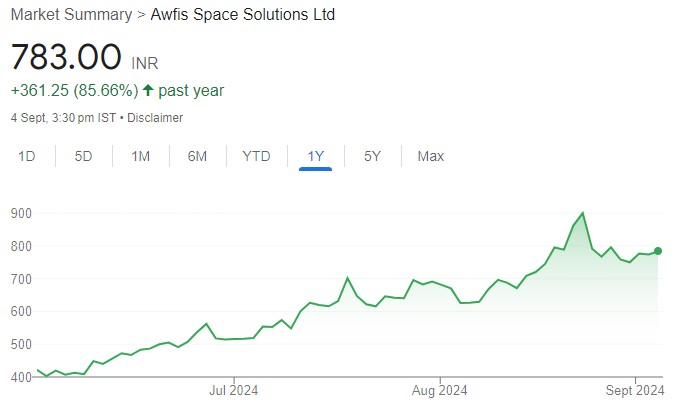

Combining aggression with capital efficiency

We recently hosted Mr Sumit Lakhani, Deputy CEO, Awfis Space Solutions (AWFIS). He sees a strong undercurrent in the demand for flexible office space in coming years and expects it to clock 25–27% CAGR due to the need for managed offices, shift to opex from capex, a growing startup culture, and decentralisation. To capture this growth, it is set to add 40,000 seats in FY25. By FY27, we see seat inventory touching 203,030. Despite the strong competition in the sector, the management expects 5–6% growth in annual pricing. The design and build segment is likely to deliver robust growth on a small base. We expect higher realisation, operating leverage benefits, and efficiency to aid profitability. Over FY24–27, we expect a revenue/EBITDA/PAT CAGR (excluding Ind AS 116) of 40.1%/68.6%/92.3%. We maintain ‘BUY’ with a TP of INR1,013.

Maintain ‘BUY’ with a TP of INR1,013

We remain confident of AWFIS’ ability to deliver profitable growth on the back of: i) favourable market dynamics, ii) capital-efficient expansion, iii) improving cost management, iv) strong Balance Sheet, and iv) stable management. We value the stock using SoTP valuation and maintain ‘BUY’ with a TP of INR1,013.