Scaling profitably with consistent execution

Awfis Space Solutions (AWFIS) reported revenue grew a strong 44% YoY to INR318cr led by a 52%/35% growth in the rental/design and build (D&B) segment. Growth in the rental segment was driven by a 52% YoY growth in operational inventory and 73% occupancy. Average monthly realisation per seat stood flat YoY. EBITDA (excluding Ind AS 116) grew 114% YoY to INR45cr, with margin expanding by 402bp to 14.2% on strong occupancy, operating leverage benefits, and greater revenue share from long tenure clients. Reported EBITDA grew 59% YoY to INR107cr. RPAT (excluding exceptional items) scaled up to INR14cr as against a net loss of INR6cr in Q3FY24. Sequentially, revenue grew 9% on a 10%/1% growth in seat inventory/ realisation while occupancy was flat.

With 38,933 seats under fitout and in the LoI stage, we expect it to comfortably reach 1.35lk operational seats by FY25-end. Thereon, we see it adding 30,000–40,000 seats annually to capture the growing demand and expand its market share. Over FY24–27, we see the rental space clocking 37.8% revenue CAGR to INR1,619cr on sharp inventory additions, a 6% annual price hike, and steady occupancy. Strong demand and a marginal increase in market share will enable the D&B segment to clock 46% revenue CAGR over FY25–27 to INR692cr. We expect an EBITDA/ PAT CAGR of 39%/103.5% over FY25–27. We value the rental segment using DCF and D&B at 13x FY26E EV/EBITDA to arrive at our SoTP-based TP of INR1,004. Maintain ‘BUY’.

Robust growth with a strong rental and D&B performance

Revenue grew 44% YoY on a 52%/35% growth in the rental/D&B segment (INR243cr/INR73cr). Growth in the rental segment was led by: i) a 52% YoY growth in operational inventory to 121,732 seats, and ii) 73% occupancy on rising demand. Competitive positioning and timely execution drove growth in D&B. Higher occupancy and operating leverage benefits led to a 402bp YoY expansion in EBITDA margin (excluding Ind AS 116) to 14.2%. RPAT, at INR15cr, included an exceptional gain of INR1cr. Excluding the one-off, APAT stood at INR14cr against a net loss of INR6cr in Q3FY24. Sequentially, EBITDA grew 7% while margin fell by 47bp.

Accelerates asset-light expansion, enters Tier II markets

With 20,965 seats under fitouts and 17,968 seats signed for, we see AWFIS closing FY25 with an inventory of 1.35lk seats. It expanded into Lucknow, a Tier II market, in Q3FY25. To capture the strong demand, it will add 30,000–40,000 seats annually. This addition will be aided by healthy cash flows (cumulative net OCF of ~INR950cr over FY25–27E), its asset-light expansion strategy, and a robust Balance Sheet (net cash of INR175cr). By FY27-end, we expect inventory to cross 2lk seats. We see 65% of these additions occurring under the managed aggregation model where the landlord shares 40–80% of capex with AWFIS for a profit share in the centre. Overall, we see the company incurring INR130–150cr annually on capex to support this expansion.

Expect EBITDA/PAT CAGR of 39%/103.5% over FY25–27

Led by a robust inventory growth and 6% CAGR in the seat rate, we see the rental segment clocking 37.8% revenue CAGR to INR1,619cr. Growth in seat rentals will be aided by the introduction of super-premium brand Elite. The D&B space is set to deliver 50% revenue CAGR over FY24–27 to INR692cr on a 1% rise in market share from 0.5% at present. We expect a revenue/EBITDA/PAT CAGR (Ind AS 116) of 34.3%/39%/103.5% over FY25–27 to INR2,336cr/INR790cr/ INR295cr

Maintain ‘BUY’ with a SoTP-based TP of INR 1,004

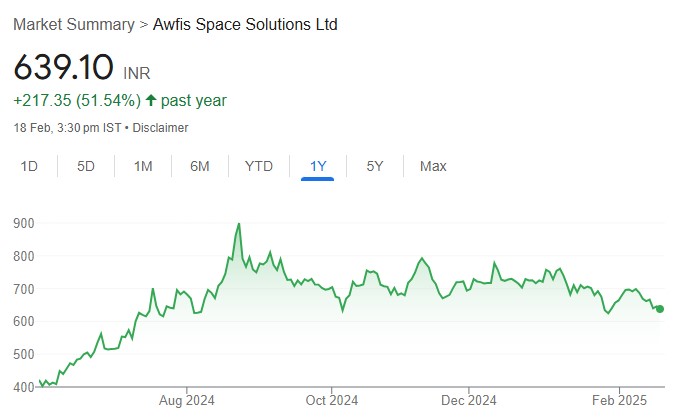

We are bullish on AWFIS’ long-term growth prospects given the: i) favourable demand-supply gap, ii) strong inventory additions, iii) improving occupancy, iv) capital-light growth, and v) robust Balance Sheet. We remain confident in the management’s ability to deliver profitable growth. At the CMP, the stock trades at a FY27E P/E of 14.9x. Maintain ‘BUY’.