Macro Remains Watchful; Focus Continues on Earnings Recovery

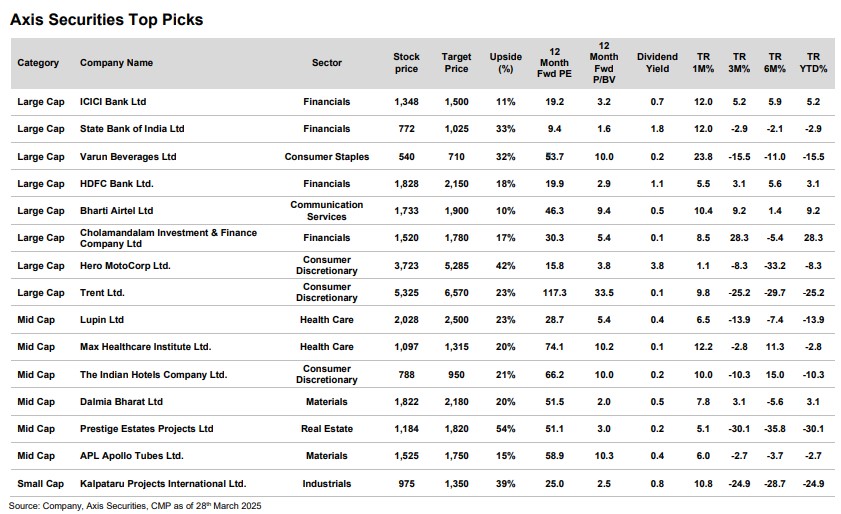

The Axis Top Picks Basket delivered an excellent return of 8.9% in Mar’25 against the 6.3% return posted by the Nifty 50, thereby beating the benchmark by a wide margin of 2.6%. Over the last one year, the basket has gained 9.5%. Moreover, it gives us immense joy to share with you that our Top Picks Basket has delivered an impressive return of 298% since its inception (May’20), which stands well above the 154% return delivered by the NIFTY 50 index over the same period. In light of this, we continue to believe in our thematic approach to Top Picks selection.

2025 Starts Volatile; Rebound Witnessed in March: Nifty 50 reached an all-time high of 26,216 on 26th Sep’24. The benchmark then corrected by 16% from its peak until 28th Feb’25. However, the market experienced a rebound in the last month, and the Nifty 50 bounced back by 6.3% in Mar’25. The majority of the bounce back was driven by 1) Reduction in overall trade uncertainty, 2) Cool-off in bond yields and Dollar index, 3) Technical recovery from the oversold territory, 4) Reduction in the FII selling and 5) Expectations of the earnings recovery in sync with the economic recovery. The broader market also witnessed a recovery, with the Mid and Smallcap indices bouncing back by 8-9% over the last month. FIIs, which had been net sellers of the market, also showed some buying interest during Mar’25. Nonetheless, the current rally is premature in nature, and more concrete development will be visible once we approach FY26, when the expectations for earnings recovery are likely to be better than those in FY25.

Domestic concerns are addressed, and macroeconomic development remains watchful: A series of domestic events is indicating better days in FY26 compared to FY25. These events are 1) A 50bps CRR cut by the RBI in Dec’24, 2) Consumption boost in the Union Budget, 3) A 25bps Rate cut by the RBI in Feb’25 MPC, and 4) Improved liquidity measures by the RBI. These events indicate better days ahead in FY26, with improved credit growth and overall consumption improvements. However, in the near term, macroeconomic risks such as trade policy uncertainty (risk of a global market slowdown due to reciprocal tax), relatively expensive valuations even after the correction, and the absence of a concrete positive trigger will continue to pose challenges to the market direction. Going forward in this regard, we believe the positioning in the Indian market will likely be divided between the domestic-facing and export-facing sectors. We believe that at the current juncture, the risk-reward balance favours domestic-facing sectors due to the nil to low impact of the reciprocal tax, and export-oriented sectors will be in a wait-and-watch mode, based on the impact and development related to the reciprocal tax.

We still believe that at the current juncture, the macroeconomic risks like 1) Trade policy uncertainty, 2) Global growth rate, and 3) The direction of the US 10-year bond yields and dollar index will continue to pose a challenge to the market direction and market multiple. Keeping this in perspective, the market needs to sail through another couple of months smoothly before entering into a concrete direction of growth. We expect near-term consolidation in the market, with breadth likely to remain narrow in the immediate term. Hence, the focus remains on style and sector rotation along with the earnings recovery. The key domestic events that will further shape the direction of the Indian market going forward are: 1) Decision of RBI MPC during the second week of Apr’25, 2) Q4FY25 earnings season, where the key monitorable will be the guidance on margins and growth for FY26.

Nifty is currently trading at 19x on 12m fwd earnings, which is slightly above its 5- year average of 18.8x. Nonetheless, valuations appear attractive for the Largecaps vs. the broader market, where the margin of safety is still missing. Against this backdrop, we believe that the large cap stocks, ‘quality’ stocks, monopolies, market leaders in their respective domains, and domestically focused sectors and stocks may outperform the market in the near term. Against this backdrop, 1) we continue to like and overweight Largecap private banks, Telecom, Consumption, Hospitals, and Interest-rate proxies. 2) Following the recent price correction and based on the growth visibility in the domestic market for FY26, we prefer certain Capex-oriented plays that look attractive at the current juncture. 3) We downgrade the IT sector, as we foresee a slowdown in overall IT spending in the US market, and a probable delay in discretionary spending may pose a downgrade risk in upcoming quarters. These downgrade risks could pose a challenge to the valuation of the IT sector in the near term.

Based on the recent developments, we have made multiple changes to our Top Picks recommendations. This includes profit booking in HCL Tech and Healthcare Global, and the addition of Kalpataru projects and APL Apollo tubes. Our modifications reflect the changing market style and a slight shift towards consumption and domestically oriented play.