Bajaj Finance

Medium-term outlook intact; attractive entry point, reiterating a Buy

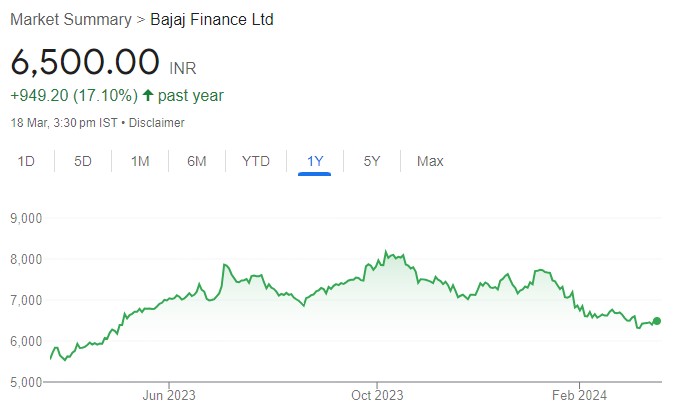

met Bajaj Finance’s management. The company is on track to achieve its medium-term targets and gain market share. Despite competition from other large corporate-backed NBFCs, we reckon that it is one of the fastest growing proxies for the Indian premiumisation theme. The recent correction of 22% from its 52W high is an attractive entry point. Reiterate Buy. At the CMP, the stock trades at 3.5x FY26e BV and 18x FY26 PE, with regulatory overhang priced in at this point.

Regulatory tightening positive; loan growth premium to endure. Riskweighted changes for personal loans have reduced competition in CD loans, which could be extremely beneficial to the company. Management aims to follow all suggestions made by the RBI about EMI cards by the quarter’s end. The recent clarification regarding credit-card partnerships should also be beneficial. Only three of the top 12 upper-layer NBFCs are to be listed, including Tata Sons. Keener competition would only spur innovation in the sector. The company’s loan-growth premium to peers is likely to be high. This, and deep tech and product knowledge, leads us to believe that it is the best franchisee to play the Indian premiumisation theme.

Medium-term outlook unchanged; insignificant impact of the embargo. Despite the embargo on issuing new EMI cards, our channel checks suggest that growth has not been affected. Management maintains its medium-term outlook in terms of market-share gains and long-range profitability. We factor in a ~26.6% loan CAGR over FY24-26 and 4.5% RoA.

Valuation. At our 12-mth TP, the stock would trade at 4.7x FY26e BV and 23x FY26e EPS. It has traded at higher valuations in the past. Risks: Key-man risk, regulatory changes.

Click here to download research report on Bajaj Finance by Anand Rathi