Bajaj Housing Finance Ltd.

An HFC to Own

Second largest, fast growing, most diversified and profitable

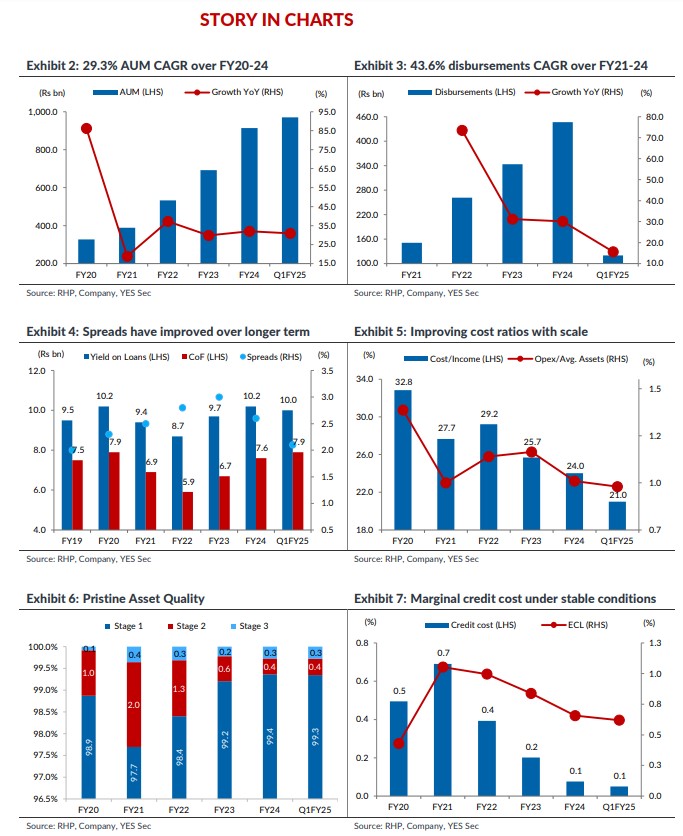

With an AUM of Rs971bn as of June 30th 2024, Bajaj Housing Finance (BHFL) is the second largest HFC in the country and is owned 100% by Bajaj Finance. BHFL’s AUM has witnessed a CAGR of 33% in past three fiscals with stable underwriting metrics. Notably, franchise diversity has increased reflected in a) significant increase in contribution of LRD and Developer Finance, 2) increase in share of SENP customers within Home Loan and LAP portfolios, and 3) broadening of borrowing mix with improved share of NHB refinance and NCDs. Strong growth along with focus on improving direct sourcing of Home Loans and increase in ATS across products has bettered Opex/Asset ratio in recent years. The shift in AUM/Product mix helped BHFL in limiting the impact of a sharp rise in funding cost on the portfolio spread. Prudent customer/project selection and robust underwriting, portfolio/risk management and collection framework underpins a marginal delinquent pool (lowest among HFCs) and a negligible credit cost (even as Stage 2/3 coverage was strengthened). Improvement in cost efficiencies and credit cost and increase in leverage drove RoE to 15%+ in FY24.

Evolving strategy for growth

Home loan business strategy is predicated on a micro-market approach, aimed at deepening market penetration by capitalizing on developer finance funded projects and nurturing existing developer finance relationships. BHFL has been increasing retail home loan presence directly at developer counters and expanding reach by onboarding new APF partners outside the developer finance ecosystem. Expanding customer profile to cover SENP segment has been driving growth too in recent years. Launch of a new near-prime and affordable home loan product for first-time home buyers from lower income segment would further widen growth base. Growth of LAP portfolio is driven by onboarding of new intermediaries, improving engagement/business share with existing ones, and cross-selling to current salaried customers.

Substantial growth in LRD book has been underpinned by broadening of geographic footprint and diversification of product suite (warehousing and industrial properties). The introduction of commercial construction finance in FY22 also supplemented LRD growth by not only broadening the sourcing mix but also fostering a synergistic ecosystem through backward integration. Developer financing strategy has been to widen customer base, deepen existing relationships and geographical expansion with an approach to onboard micro-market, regional as well as national developers.

Strong asset quality guardrails

BHFL has an in-house four-tier collections infrastructure comprising tele-calling, field collection, legal recovery, and settlement. As on March 31st 2024, the collections team was of 356 personnel comprising a specialized team to manage overdue collections and a separate team focusing on resolution of cases through SARFAESI. Collection efficiency stood at 99.5% in FY24 and 30+ dpd pool stood at just 60 bps at year-end. Company has well-defined credit evaluation framework and underwriting process to ensure that risk performance across all products remain within the defined thresholds. Focus on prime home loan segment (ATS of Rs4.6mn at origination), stronger credit profiles (higher bureau scores and incomes) and safer properties (developer financing and APF relationships) underpin robust asset quality in home loans portfolio. Emphasis on self-occupied residential properties as collateral, keeping origination LTV near 55% and cash flow backed lending underscores a lower risk profile of the LAP portfolio.

BHFL is coming with an IPO of Rs65.6bn which includes an OFS of Rs30bn by Bajaj Finance. As per market sources, the co. could be valued/priced near Rs600bn on post-money basis in the IPO. Significant value could get added over next 12-15 months as 25-30% AUM/Earnings growth and 14-15% RoE is likely in next couple of years. Key strengths of BHFL are growth execution, risk management and operating efficiencies.