The Government in Budget 2025-26 has tried to balance the three cornerstones of the economy in their order of preference: a) Income Tax relief to the public at large in order to address the consumption moderation, b) Maintain Fisc discipline thereby containing macro variables and c) Allocation to capex, albeit some moderation. We believe revving up consumption in the near term would provide additional triggers for both central and private capex to revive in the medium to long term.

Key highlights of Budget:

❑ On the fiscal deficit front, Government exhibited disciplined path with deficit target revised down for FY25RE at 4.8% versus earlier estimate of 4.9% and to 4.4% for FY26BE, as against market expectation of ~4.5%. While the fiscal deficit in absolute terms in FY26BE remain at similar level of FY25RE at ₹15.7 lakh crore, gross market borrowing has been increased to ₹14.8 lakh crore versus ₹14.0 lakh crore in FY25RE.

❑ The subsidy allocation has remained unchanged for broader heads. Government has kept a strict vigil on its subsidy allocation which for FY26E is estimates at ₹ 3.8 lakh crore, flat on YoY basis, however down as a % of GDP basis to 1.1% of GDP in FY26E vs. 1.2% in FY25E.Government has also broadly maintained allocation towards it flagship DBT schemes namely Mahatma Gandhi National Rural Employment Guarantee Program (MGNREGA) and Pradhan Mantri Kisan Samman Nidhi (PM-Kisan)

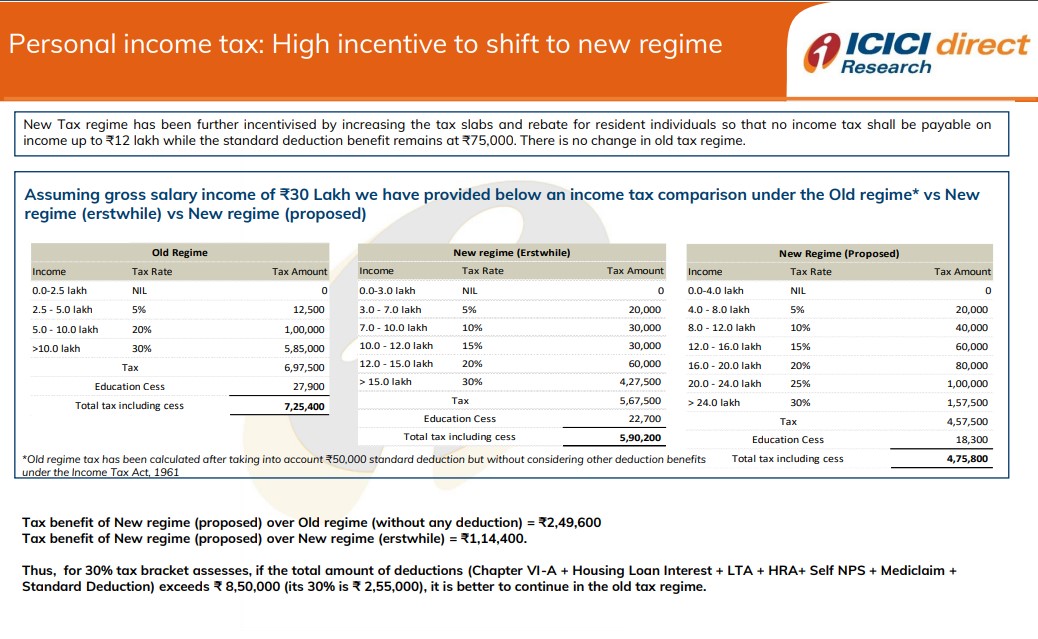

❑ The major focus of the budget has been to revv up consumption via income tax reliefs: Exemption on personal income tax upto Rs 12,00,000 and addition of new tax slab will lead to higher income in the hands of middle-income group. Further the government has increase allocations under various scheme to improve rural economy. This will boost consumer sentiments in the urban and rural demand in India, which lead to uptick in the consumer demand going ahead (likely from Q1FY26).

❑ Capex intensity has been maintained despite capex spending growing at a CAGR of 20% over FY22-FY26BE. The Government has budgeted growth at 10.1% YoY in FY26BE to ₹ 11.21 lakh crore. The capex to GDP is pegged flat at 3.1% in FY26BE vs. 3.1% in FY25RE. Allocation in key segments like Roads and Railways has been flat over FY25-26 whereas, Defence and Housing (PM Awaas Yojna) has seen allocation rising double digit ~13% and ~19% respectively thereby creating a high base. Implicitly in our view the runrate of monthly capex spent will average at ₹ 97000 crore from Q4FY25-FY26E vs. ₹ 76000 crore spent in 9MFY25.

Biggest Ever Personal Tax Savings: booster for Auto space

• Government has announced biggest ever overhaul in personal income tax structure thereby increasing the tax exempt income from ₹ 7 lakh to ₹ 12 lakh in Union Budget 2025-26

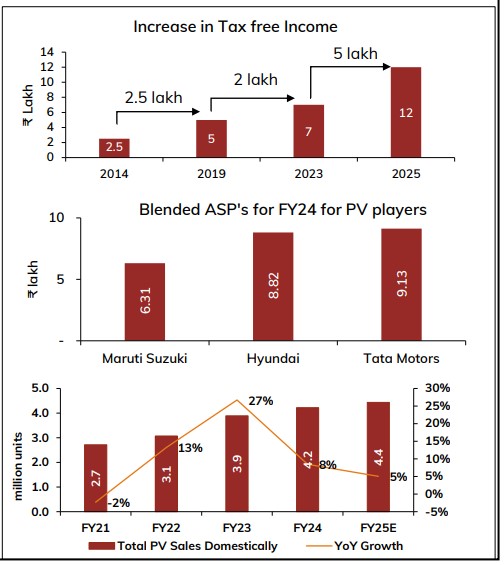

• This tax relief, is expected to increase disposable income in the range of ₹ 30,000 –1,10,000 in the hands of tax payer, thereby providing a big booster for the auto space given people will upgrade their standard of living by potentially buying new vehicle which can either be a 2-W or PV

• We expect it to be directed more towards 4-W/PV space given low car penetration in India at ~30 cars per 1000 people

• The timing of this relief cannot be more appropriate given the growth was tapering for the domestic automotive space.

• Given the recurring nature of this tax relief, this potentially raises the purchasing power of a consumer by ₹ 1.2 -4.3 lakh by way of easy affordability of incremental EMI to the tune of ₹ 2,500-9,200 per month (annual outgo at ₹ 30,000-1,10,000)

• This can benefit in two ways; (i) rise in sales volume of entry level Cars – More first time buyers can now afford small cars, (ii) Premiumization Trend – Existing buyers may stretch their budgets, upgrading from hatchbacks to compact SUVs

• Key beneficiaries of this move in our universe will be Maruti Suzuki, M&M, Tata Motors, Bajaj Auto and Eicher Motors.