Apollo Hospitals Enterprise Ltd.

Hospitals business to drive growth

Q4FY24 revenue was in-line with our estimates, however higher employee cost led to deviation in EBITDA by 4%. Hospitals revenue grew 17% YoY driven by volume growth, network expansion, and improved payer mix. Hospitals EBITDA grew 19% on YoY basis. The overall hospital occupancy remained steady at 65%, supported by a strong increase in patient flows across facilities. This increase in occupancy was achieved even after recalibrating some beds for specific specialty clinical needs and optimized realizations. ARPOB grew by 12% and stood at Rs.59,523. The Pharmacy distribution segment registered a growth of 17% YoY with revenues of Rs 20.2 bn during the quarter due to increased patient’s base and 35% YoY growth in GMV. The pharmacy distribution segment recorded EBITDA of Rs. 117 Mn in the quarter on account of optimization of cost and growth in operational revenue coming from Offline Pharmacy distribution. Apollo plans to add 1860 beds by FY26 with capex of Rs 21.3 Bn, contributing to hospital business revenue growth. With anticipated declines in the losses of the 24*7 diagnostics business, the overall EBITDA margins are expected to improve in the future. The company is implementing cost optimization measures, coupled with the growth in surgical volumes, these measures are expected to improve hospital business margins by 150 bps. The next leg of growth will come from 1) Addition of Beds in hospital segment with further improvement in payor and case mix 2) Significant growth in GMV 3) Cost optimization, reduction in losses of 24*7. On an overall basis, we are positive about the prospects of Apollo. We maintain our Buy rating on the stock.

Decent topline growth lower losses from digital business led to improved margins

The company registered revenue growth of 14.9% on YoY basis and was flat (+1.9%) on sequential basis to Rs. 49.4 Bn. This was mainly due to higher growth hospital business which has witnessed growth of 17% YoY, whereas pharmacy distribution revenue grew 13% YoY to Rs. 20.2 Bn.

EBITDA margin for Q4FY24 increased by 161 bps YoY and by 30 bps QoQ to 13%. The YoY improvement in margins was due to reduced losses of 24*7 from 1.8 Bn in Q4FY23 to loss of Rs. 1.4 Bn in Q4FY24.

Occupancy across the group was 65% in Q4FY24. ARPOB was Rs 59,523 in Q4FY24 as compared to Rs 57,488 in Q4FY23 registering growth of 12%. ALOS was 3.3 days.

Healthcare services posted an EBITDA margin of 23.1%, Pharmacy has margin of 0.6% (after adjusting for 24×7 operating costs) and AHLL—10.1%.

Inpatient volume grew by 6.1% YoY to 142K whereas outpatient volume grew by 4.4% to 479K.

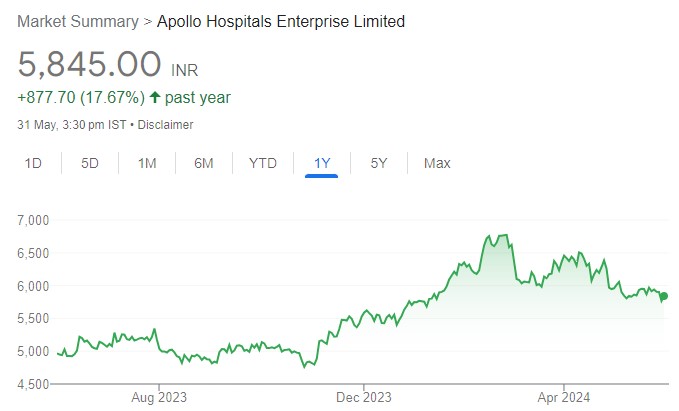

Outlook and Valuation: We hold a positive outlook on Apollo’s future, driven by favourable demand dynamics. We anticipate strong performance in both healthcare services and the pharmacy segment. Furthermore, we anticipate AHLL to achieve remarkable outcomes. Based on SOTP valuation we arrive at target price of 7,230 (implied EV/EBITDA multiple of 25.5 on its FY26E EBITDA), offering 24% upside from current levels. Buy.