Defence stocks are “recession-proof”

The unfortunate rise in conflict across the Globe such as the escalation of the Russia-Ukraine War and the US-China-Taiwan tension has put the manufacturers of defence equipment like guns, fighter jets, missiles, grenades, ATGM etc in great demand.

US Defence stocks like BAE Systems, Lockheed Martin, General Dynamics and Northtrop Drumman are witnessing heavy buying from investors.

British defence stocks are also doing well in response to Putin’s announcement of a partial mobilisation of Russia’s reserve forces to support its invasion of Ukraine.

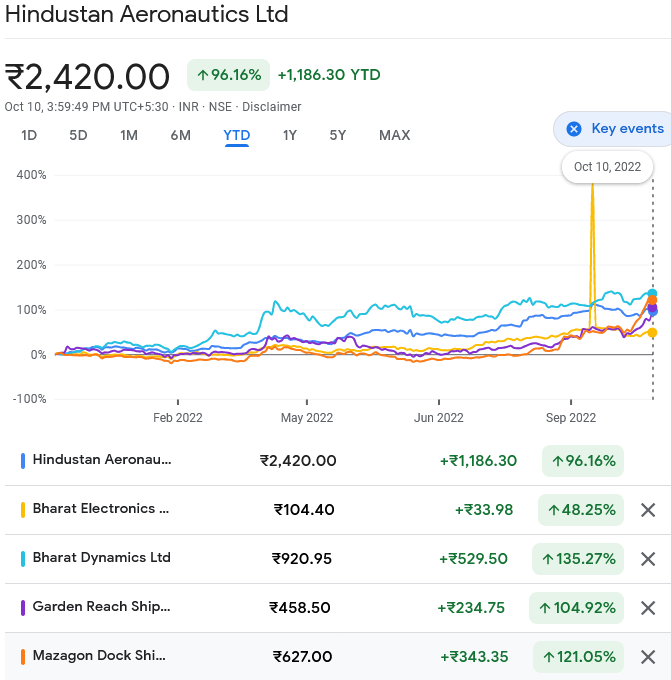

Thrust on indigenization has caused Indian defence stocks to rally – Production of Public & Private Sector Defence Companies has increased Rs. 84,643 crore from Rs. 79,071 crore in last two years

Indian Defence stocks have a special advantage over other Defence stocks because of the Government’s thrust on indigination i.e of developing and producing defence equipment within the country to achieve self-reliance and reduce the burden of imports.

According to a press release, the Government has taken several policy initiatives to encourage indigenous design, development and manufacture of defence equipment in the country, thereby reducing import of defence equipment. These measures have yielded positive results as is evident from the fact that the expenditure on defence procurement from foreign sources has reduced from 46% to 36% while the Value of production of Public & Private Sector Defence Companies has increased from Rs. 79,071 crore to Rs. 84,643 crore in the last two years i.e. 2019-20 and 2020-21.

There is a $60Bn opportunity, stocks are at 10-15x FY24e PE

According to a report by Mangalam Maloo of CNBC TV18, the total size of the opportunity is a colossal Rs 9 Lakh crore which is divided into various segments such as Field Artillery & Tanks, Helicopters, Combat Aircraft, Navy Vessals etc. The shipyard segment is itself worth Rs. 4.5 lakh crore or $60Bn. This is because the Indian Navy plans to increase its fleet size to 200 by 2027. It is also stated that the Defence stocks are trading at 10-15X FY24e PE, which is quite reasonable given the scale of the opportunity.

“India has the third largest Defence budget compared to the GDP. Defence stocks are available at good valuation“, Ramesh Damani opined in the embedded video interview.

It is worth noting that Ramesh Damani holds 12,51,156 equity shares (1.09 per cent) of Garden Reach Shipbuilders & Engineers (GRSE). GRSE is one of India’s leading shipyards that builds and repairs commercial and naval vessels. The company has also started building export ships in a mission to expand its business.

The company listed on bourses in October 2018 and its shares have rallied more than 250 per cent since. The YoY return is 181 per cent.

Best to buy the PSUs as they have a virtual monopoly which is likely to remain for another 8-10 years at least

Ravi Dharamshi of ValueQuest Investment Advisors advised that the the best way to approach the defence sector is by sticking with the PSU leaders like HAL, BEL, Mazagon Dock etc.

“At this juncture, there is no choice but to play the defence PSUs but the good part is the defence PSUs are in a far better shape than some of the other PSUs and there is a kind of virtual monopoly likely to remain for another 8-10 years at least,” he said.

He explained that apart from the fact that there are steep entry barriers as to who is permitted to produce the defense equipment, the ability to develop an aircraft and Helicopters is only with the PSUs like HAL.

“The capability monopoly is likely to remain for another 8-10 years at least. Our air chief mentioned that at least 42 squadrons need to be modernised, we have just developed light utility helicopter so all these things are pointing to the fact that the orders are going to flow to these companies only, it is a question of when and it is not a question of if. Whether this order comes one year down the line or three years down the line is the only question,” he added.