The Motilal Oswal Wealth Creation Study points out that ‘Consistents’ & ‘Volatiles’ are the two dimensions of Wealth Creation. Two broad patterns that comprehensively cover the entire corporate sector, Consistency and Volatility. Consistent companies are described as “Consistents” and the volatile companies as “Volatiles”.

The sole basis of the definitions is the growth trend in PAT (Profit After Tax) of companies and sectors. For a company to be deemed a Consistent, it should meet the following 3 criteria –

1. Over a 15-year period, its annual PAT should not fall by over 10% more than thrice (twice if the period is 10 years);

2. No fall in PAT should be greater than 50%; and

3. The terminal year PAT should not be lower than the initial year PAT

All companies that are not Consistents are Volatiles. This way, the entire corporate sector can be divided into just two categories of companies – Consistents and Volatiles.

The Paints sector is an example of a consistent sector because the demand for paints is highly stable. So, most paint companies like Asian Paints are Consistents. In contrast, the demand for commercial vehicles (CVs) in India is highly volatile. Hence, Tata Motors and Ashok Leyland are both Volatiles.

Indian oil marketing companies (OMCs) are perennially subject to both favourable and unfavourable government regulation on product pricing. As a result, all of them are Volatiles.

Similarly, at a global level, enhanced surveillance of the USFDA has led to many hitherto pharma Consistents turn into Volatiles.

There are 18 sectors that are consistent and 35 sectors which are volatile.

FMCG, Banks – Private Sector, Cement Chemicals and IT are examples of consistent sectors while Airlines, Banks – Public Sector, Construction and Fertilizers are examples of volatile sectors.

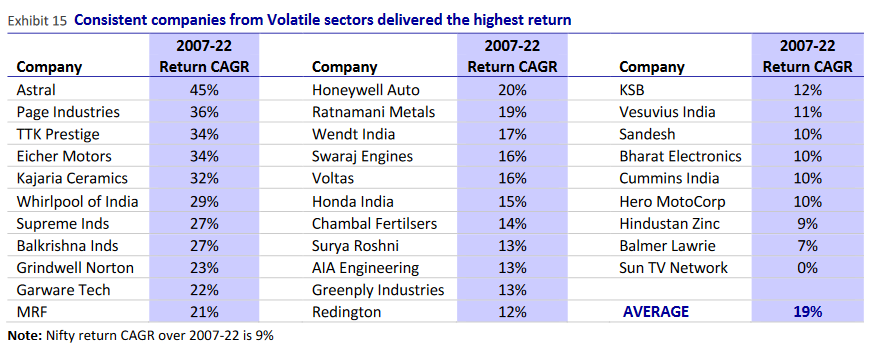

It is also pointed out that 31 Consistent companies from Volatile sectors have delivered the highest return of as much as 45% CAGR in the period from 2007 to 2022. Intuitively, one would expect Consistent companies from Consistent Sectors to do so. It is notable that the Nifty return CAGR over 2007-22 is only 9%

These 31 companies are listed below.

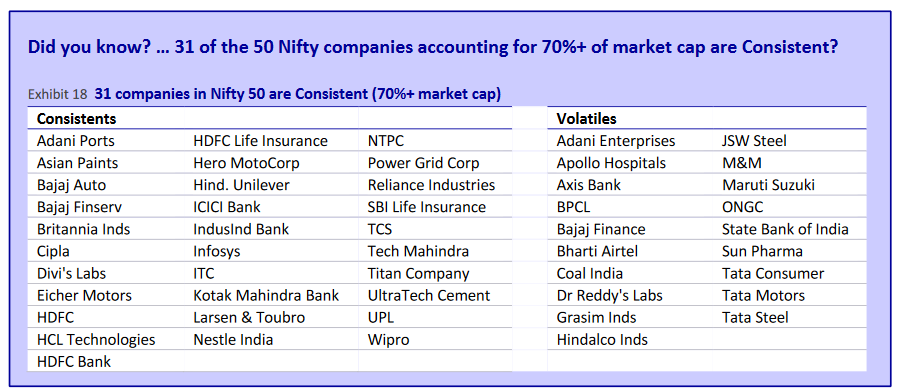

It is also worth noting that 31 of the 50 Nifty companies accounting for 70%+ of market cap are Consistent. These are companies like Adani Ports, Asian Paints, Bajaj Auto, HDFC Bank etc. The volatile companies in the Nifty are companies like Adani ENterprises, Apollo Hospitals, Axis Bank etc.

How to create wealth from Consistents & Volatiles

The Wealth Creation Study also deals with the important question of how to create wealth from Consistents & Volatiles by using the Entry strategy and the Exit strategy.

As regards the Entry into these stocks, Consistents have predictable cash flow and earnings and so can be valued using the P/E ratio. Volatiles are best valued using metrics like Price-to-Book-value (P/B), Price-to-Sales, Price-to-Capacity (e.g. market cap per tonne of capacity for steel, market cap per room for hotels, etc).

We should aim to buy these stocks when their P/E or P/B is below the 10-year median.

As regards an exit strategy to create wealth, the report advices that in the case of Consistents, given earnings consistency, investors can practice “Buy-and-Hold” as interim “quotational losses”, if any, are likely to be recouped over time. However, in the case of Volatiles, investors must exit at an appropriate price, typically significantly higher than median P/B. Failing to do this can lead to prolonged no or low return, it is warned.

Examples of future consistent and volatile stocks that may be investment worthy

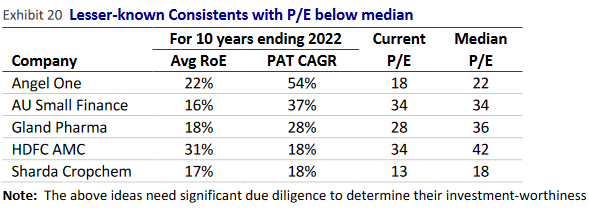

The Report has identified 5 lesser-known Consistents with P/E below median. “Lesser-known” companies are those that have a listed history of less than 10 years, but financial history of at least 10 years. These are Angel One, AU Small Finance, Gland Pharma, HDFC AMC and Sharda Cropchem.

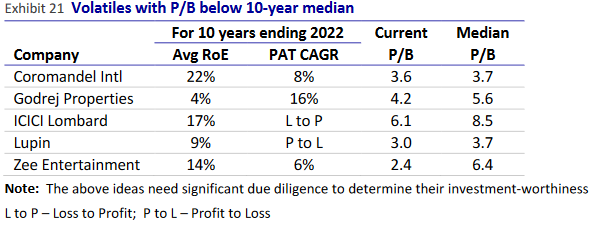

Similarly, 5 Volatiles with P/B below 10-year median is also given.

Consistency at reasonable valuations creates significant wealth

The findings in the Wealth Creation Study are nicely summed up as follows:

There are only two types of companies – Consistents & Volatiles

► This makes the practitioner’s job significantly easy. Having bucketed a stock as either Consistent or Volatile, the next major steps are clear –

► For Consistents –

1. Determine whether it is likely to remain Consistent over the next 3 years at least

2. If yes, check whether its current P/E is below its long-period median

3. If yes, Buy.

► For Volatiles –

1. Determine whether it is likely to hit a Consistency Patch over the next 3 years

2. If yes, check whether its current P/B is below its long-period median

3. If yes, Buy.

► Consistency is the source of Outperformance; Volatility is the source of Under-performance

► Consistents outperform only as long as they remain Consistent; they underperform if they turn Volatile.

► Likewise, even Volatiles outperform when they hit a Consistency Patch

► Excellence in execution is non-negotiable for Consistency

► As seen earlier, there are cases of Consistents even in Volatile sectors. This is possible only through excellence in execution.

► Buying below median valuations tilts the odds in favour of investors

► The key words are “tilts the odds”. In investing, no methodology can assure a 100% guarantee of success