Beyond its core lead recycling franchise, Gravita has steadily diversified into adjacent recycling streams,...

investments

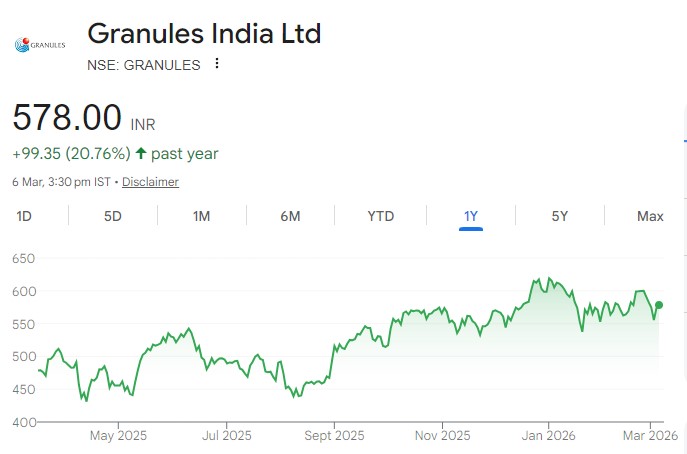

GRAN has evolved from a high-volume API manufacturer into a vertically integrated formulations...

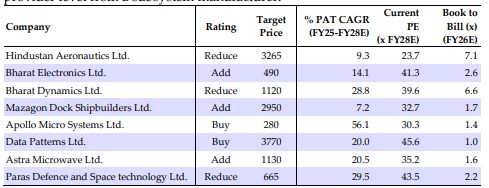

Elevated orderbook to sales ratios, led by a large pipeline of complex platforms, ensure...

We estimate revenue CAGR of ~17% over FY25-28E with EBITDA margin improving gradually to...

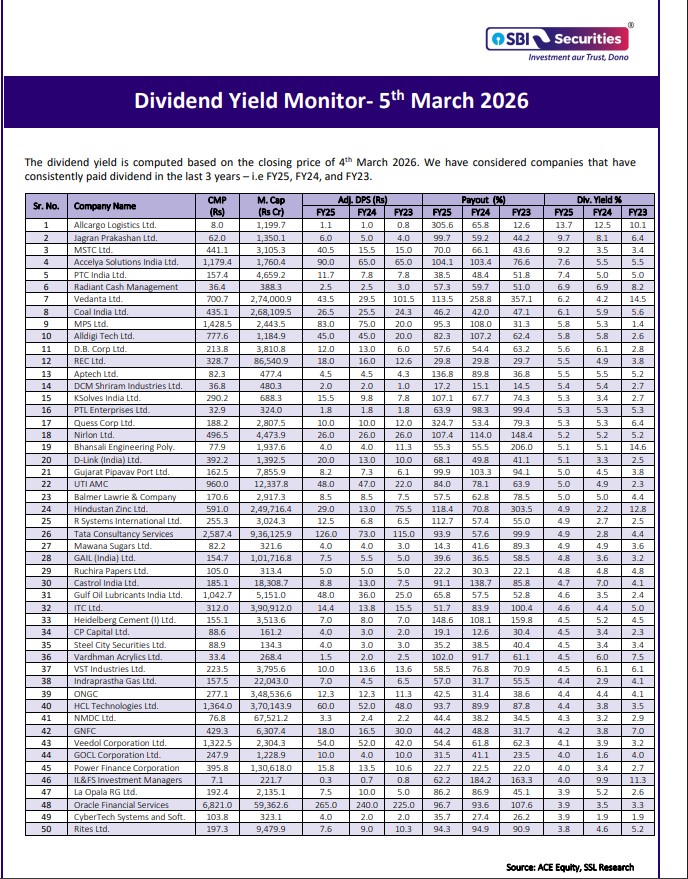

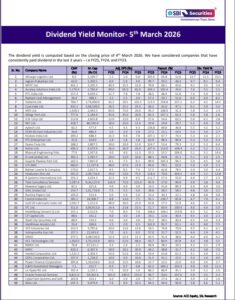

The dividend yield is computed based on the closing price of 4th March 2026

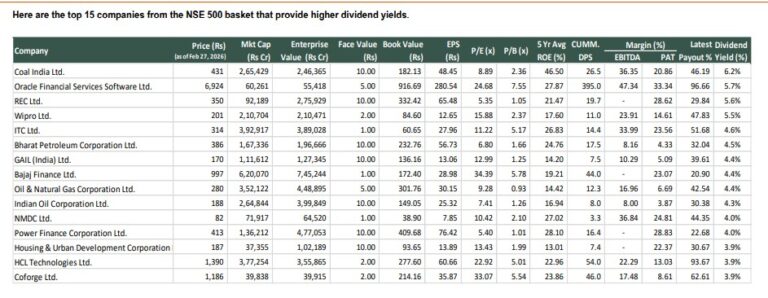

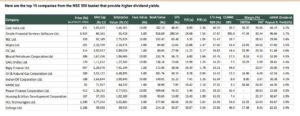

High Dividend yield of up to 6.2%

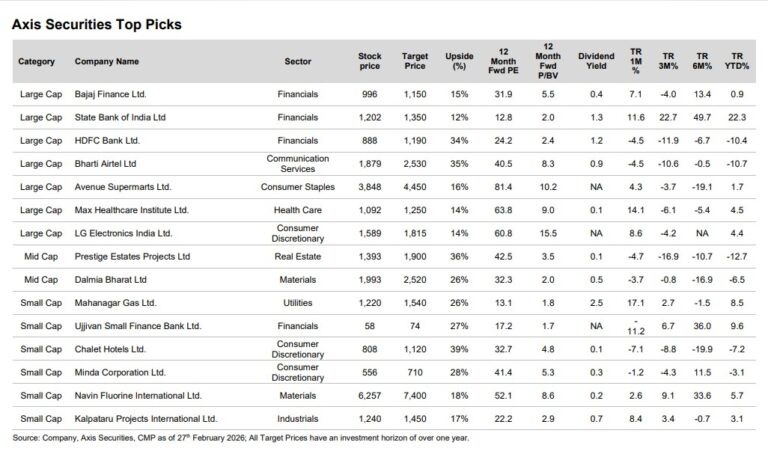

Investors may benefit from maintaining a balanced approach, focusing on quality companies aligned with...

RACL has recently announced an ambitious capex plant amounting to ~₹77 crore for FY27E,...

Apar has repurposed its cables portfolio to dominate niche segments and export markets

MTARTECH is firmly positioning itself as the indirect beneficiary of the global AI infrastructure...