The current stock price has factored in most of the negatives.

investments

Noticees collectively generated an amount of alleged ill-gotten gains totaling over ₹172 crore from...

Leela is also working towards obtaining regulatory approvals to demerge the office business from...

Simplifying Business Spends Zaggle is a home-grown SaaS-fintech platform that helps businesses digitise spending...

We expect double digit earnings growth to resume from FY27E onwards, which should ensure...

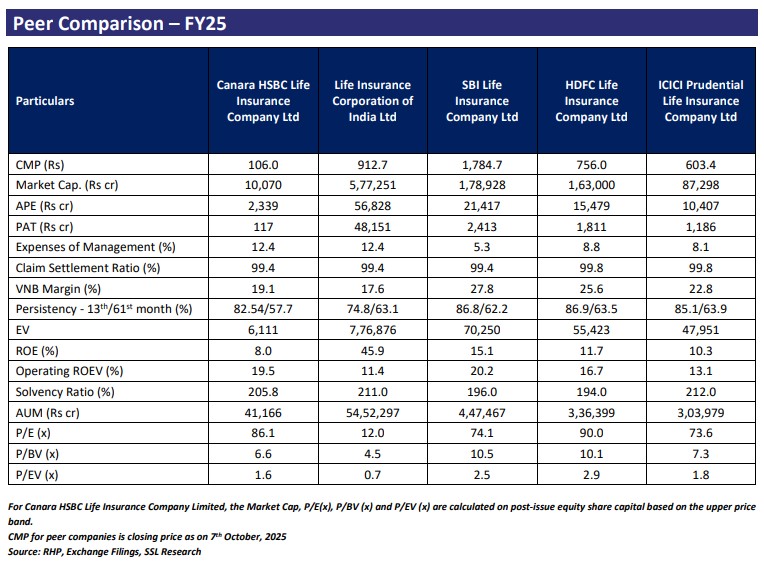

CHLICL remains focused on building sustainable long-term value through consistent growth, strong underwriting standards,...

Delhivery is well-positioned for future growth, supported by strong momentum in its core transportation...

Ganesh Consumer is a well-known FMCG name in eastern India, particularly West Bengal, with...

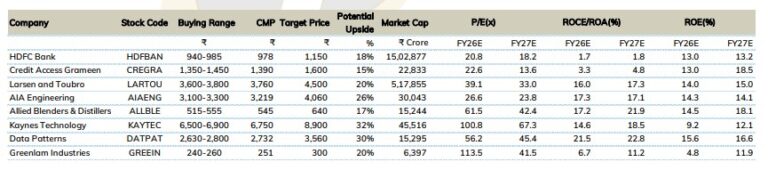

The country’s macro set-up continues to be positive and the fundamentals of Indian corporates...

The rally in Tata Communications comes in the wake of TCS’ announcement of a...