Outlook for the wind industry is positive over the medium to long term, given...

investments

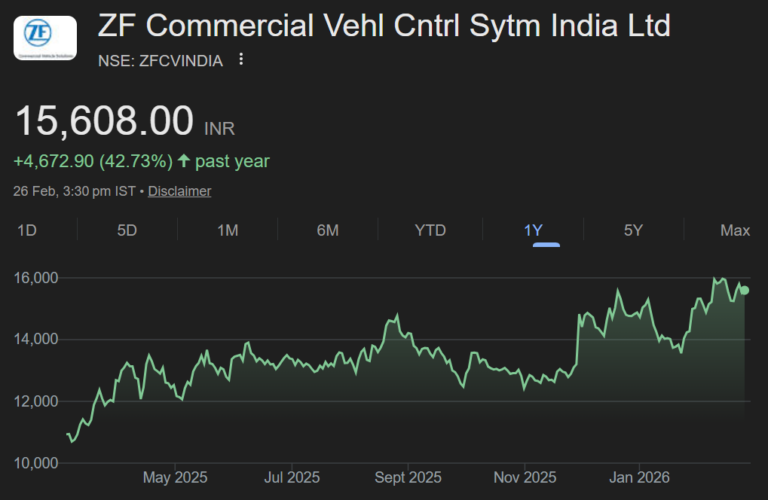

ZF combines high margin technology products with a stable and growing aftermarket business, providing...

Asset quality remains a key strength for Capri Global, supported by its predominantly secured...

A key inflection in NACL’s evolution has been its calibrated yet decisive transition from...

Volume growth expected at ~13% CAGR over FY25-28E; Doubling capacity by FY29E

The company has taken significant steps to enhance operational efficiencies including improvements in sourcing,...

In the Union Budget 2026-27, announcements were made for 7 new bullet train corridors,...

SHL has the capability to manufacture oral liquids, tablets, injectables, dry powder & inhaler...

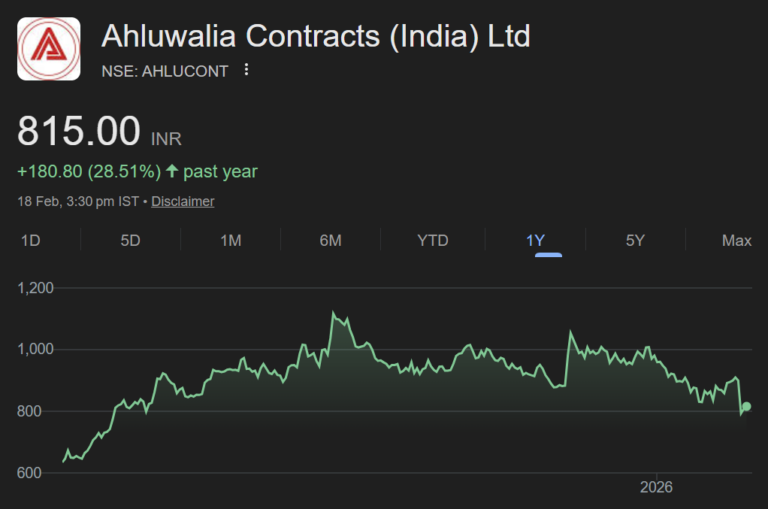

With robust inflows of c.INR 59bn (ex GST) in 9MFY26, ACIL’s backlog strengthened to...

Ahluwalia enjoys a healthy balance sheet and is a net cash company