Three legs of a capex cycle. Two are already in play

Daljeet Kohli pointed out that there are three legs of a capex cycle. The first leg is the personal capex which is reflected in real estate. This theme is presently playing out and real estate stocks are already surging.

The second leg is the industrials part where the private capex comes into play. We can see that private capex is selectively coming back in steel, power and solar.

The third leg is government capex. Despite the fact that the government has had some challenges on tax collections, fiscal deficit etc, capital expenditure has been maintained and revenue expenditure has been cut and there has been some sluggishness there but capital expenditure has been maintained.

MNC stocks Honeywell, ABB and Siemens will thrive

Daljeet explained that his basic premise is that the next leg of industrial capex will be not just capacity expansion but improvement in efficiency. Because of a lot of competition, companies are looking for automation and looking for ways of bringing more productivity.

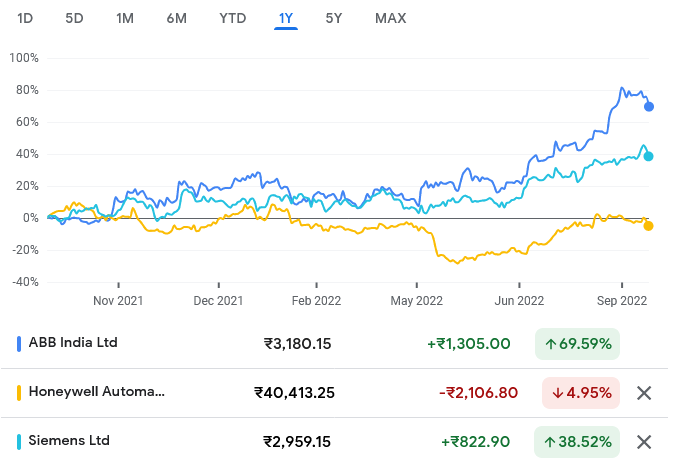

He opined that companies like Honeywell, ABB and Siemens will play a very major role in Industry 4.0 and all those efficiency related investments will come.

“That is a big play which is what we are banking on,” he emphasized.

Avoid Metal stocks

Daljeet cautioned that the fact that government capex will increase does that mean that one can be bullish on metal stocks.

He opined that the best in terms of metals is already behind us and the major rally is over. He explained that it is a very common misnomer that capex is related to metals. Normally it is not that way because the metal part or the contribution of metals is very small.

He pointed out that this time we are not talking of a large number of factories which are going to be built up. What we are talking about is more efficiency and more automation which will come up and the roads and ports and infrastructure projects will be built.

“So whatever demand comes for metals, that would be there and stock prices have already moved to the all-time highs. I do not think it is giving a very good earnings scope for further appreciation,” he advised.