Result Highlights of Q2FY25:

• In tandem with historical trend of seasonality, DCX delivered a muted H1FY25 but slew of order wins was the showstopper in Q2FY25 with a total order worth of INR.30,000 Mn. For the Q2 in specific, higher material cost continued to weigh on margin and resulted into a miss on earnings.

• Though the gross margin improved for the quarter sequentially but it continues to be under pressure. Similarly, EBITDA margin continues to be in negative territory but it improved on a sequential basis.

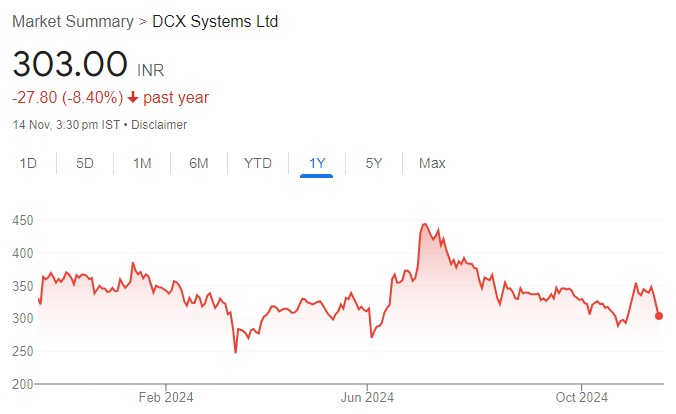

• The recent order wins add confidence on the revenue visibility for the near to medium term. However, lack of clarity on the recovery of increased raw material costs and persisting margin pressure have caused us to revise down our EPS estimates for FY25E and FY26E by -34%/-10%. Overall, we continue to hold our conviction on DCX’s ability to become a key player in EMS space with huge potential lying ahead in the railway and defence space. Consequently, we retain our P/E multiple of 36x on FY26E EPS and maintain our BUY rating on the counter with the target price of INR 466 (Previously: INR 519)

Robust Order Wins from Leading U.S. Defense Player Lockheed Martin

DCX has an order book of INR 30,000 Mn as of 12th Nov’24 vs 19,370 Mn as of 30th June’24. The order book also includes INR 4,603 Mn from Lockheed Martin and also another order worth of INR 3,796 Mn (through Raneal Advanced Systems) from Lockheed Martin for supply of electronic assemblies.

The massive jump in order book has arrested the concerns around DCX’s ability to secure large orders. Additionally, inclusion of key clients such as L&T and Lockheed Martin underscores DCX’s ability to deliver high value complicated and critical products for leading defense players.

Margin Pressure Continues to Persist amid Tepid H1

DCX reported -37%/+42% YoY/QoQ revenue growth during the quarter to INR 1956 Mn in Q2FY25 and the earnings were further aggravated aided by lower gross margin . The gross margins reduced by -485 bps to 3.4% in Q2FY25 vs 8.3% in Q2FY24.

The EBITDA margin improved sequentially to -1.9% in Q2FY25 vs -3.5%% in Q1FY25. However, it delivered 77% QoQ growth in PAT to INR 52 Mn on account of lower finance cost and higher other income.