ACT BEFORE ITS TOO LATE

• The outcome of the 18th Lok Sabha election is set to be announced on June 4th . Exit polls are anticipated to commence on the evening of June 1st following the conclusion of the final phase of the election. Consequently, market volatility is expected to escalate from June 3rd onwards, contingent upon the results of the exit polls. Another surge of volatility is anticipated on the vote counting day, i.e. June 4th.

• Election results hold immense significance for Indian markets. We are not psephologists and do not claim to have any unique insights into how this cookie will crumble. Over the past four election (2004, 2009, 2014, 2019), the Nifty experienced considerable volatility, with fluctuations of 30%, 30%, 14%, and 8%, respectively in the election month period.

• History does not repeat itself but rhymes! We anticipate a similar scenario this time around.

Market expectations of volatility have propelled the India VIX to levels between 20-22%. Depending on the election outcome, Nifty may swing wildly on either side. Nifty has moved up by 25% in last one year(From 28 April 2023).

• Therefore if you are a long term investor with a large portfolio and would like to remain fully invested, its advisable to hedge the risk ahead of the binary event like general election outcome. This can be done by buying Index Put Options. However, one should understand that hedging is like an Insurance, that comes at a cost.

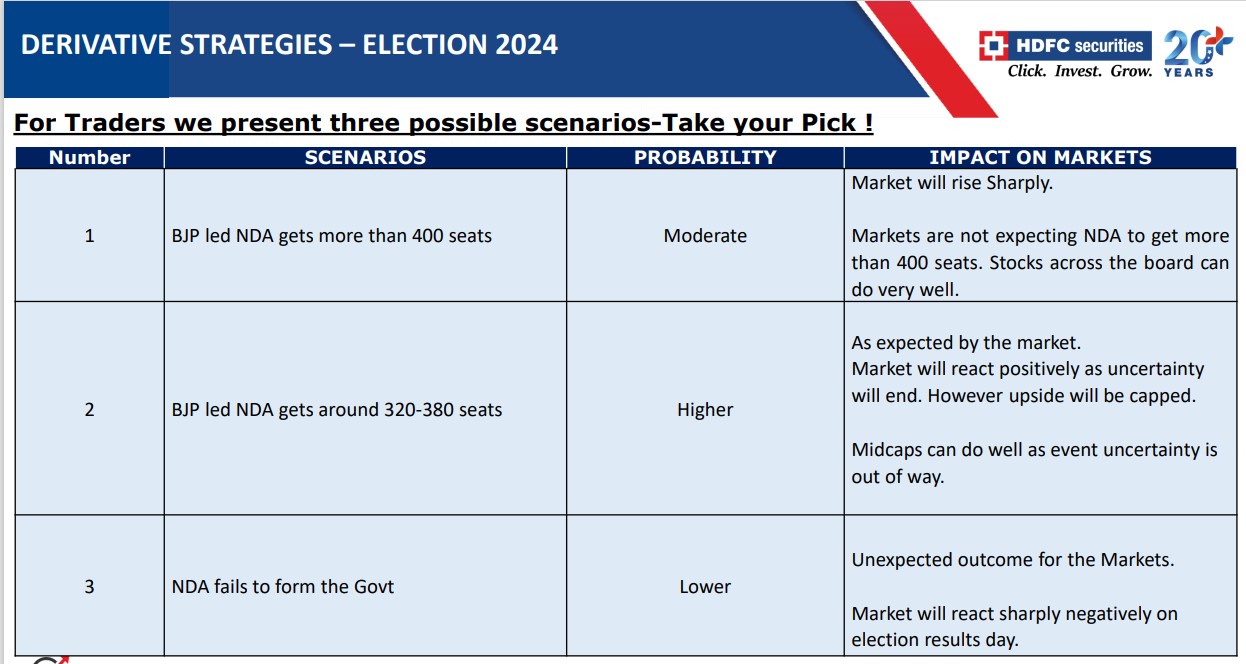

• Traders who understand derivatives (Risks Vs Rewards) and would like to trade this event – We prescribe different trading strategies that can be implemented according to three possible scenarios – take a pick according to your choice

Click here to download HSL DERIVATIVE STRATEGIES ELECTION 2024