Key highlights of the 1QFY25 Result

Strong rebound in performance; Upgraded the guidance for FY25

The company during the quarter witnessed strong rebound in performance as sales/EBITDA/PAT were up 33.7%/64.5%/48.4% YoY to Rs 493.6 cr / Rs 71.7 cr/ Rs 48.9 cr respectively. The EBITDA margin improved 270 bps YoY to 14.5%. The growth in sales is led by 39% growth in volume even though pricing environment is still soft. However, it is showing signs of bottoming out and have largely stabilized. The company has upgraded the sales guidance at 18-20% for FY25 versus earlier 18%.

Strong responses to recently launched products:

The company has launched 3 new 9(3) molecules viz Lanevo (insecticide), Purge (Herbicide), Mycore Super (Fungicide) earlier and all the products have been showing strong demand traction. The total potential market size of this product is Rs 1,000 cr. In next 2 months Dhanuka will launch 2 new 9(4) and overall, over next 2 years, it has plans to launch 8 new products under 9(3) segments.

Exploring tie-up with patented technical makers for CRAMS:

The commercial production of Dahej plant has commenced and management expects it to turn EBITDA positive once utilization picks up. It has generated sales of Rs 14 cr during the quarter and for FY25, management is targeting Rs 70 cr -100 cr sales. The company also plans to add 1 more product and is also exploring the tie-ups with patented technical makers for CRAMS.

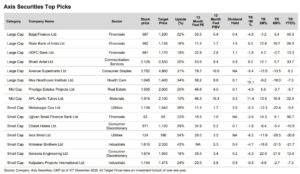

Maintain buy rating- Target Rs 2,223.0/-

At the current price, the stock is trading at P/E multiple of 28.0x/24.1x of its FY25E/FY26E earnings respectively. The company has announced Rs 100 cr buyback at the maximum price of Rs 2,000 per share. The promoters will also be participating in buyback process. We maintained our buy rating on the stock with upgraded price target of Rs 2,223/- thus providing an upside potential of 21%.