One perplexing aspect is how, despite our 24×7 vigil on the stock market, so many multibagger stocks have managed to slip past us without our even knowing of their existence. Instead of basking in the riches that these stocks effortlessly gave, we are living a hand-to-mouth existence and barely making ends meet.

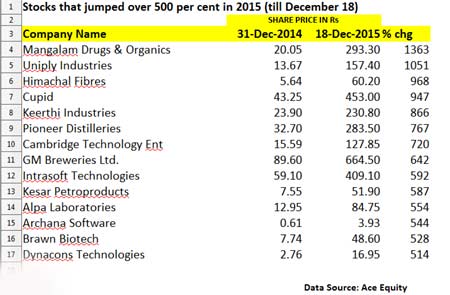

FE points out that as many as 296 BSE stocks surged over 100 per cent and that, of this list, 14 stocks have given returns in excess of 500%.

(Image Credit: FE)

Leading the list of winners is Mangalam Drugs & Organics, a micro-cap which rocketed a mind-boggling 1,363% in 2015. The stock surged from Rs 20.05 on December 31 last year to Rs 293.30 on December 18 this year.

Uniply Industries, a micro-cap backed by legends like Radhakishan Damani, Ramesh Damani and Vallabh Bhanshali was close behind. It has given a return of 1,051% this year.

Himachal Fibres and Cupid have come third and fourth with 968% and 947% returns respectively.

Some other micro-cap stocks that qualified for the top-10 ranking include Keerthi Industries, Pioneer Distilleries, Cambridge Technology Enterprises, GM Breweries, Intrasoft Technologies, Kesar Petroproducts, Alpa Laboratories (up 554 per cent), Archana Software (up 544 per cent), Brawn Biotech (up 528 per cent) and Dynacons Technologies (up 514 per cent).

Several of the stocks in the list are unknown to most rank and file investors like you and me.

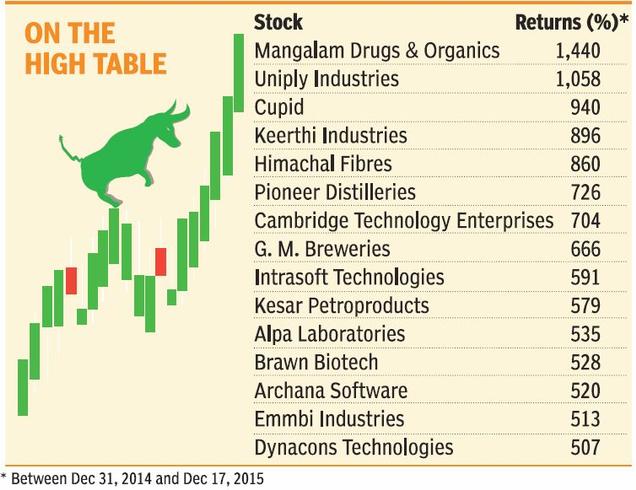

(Image Credit: BL)

Anand Kalyanram of Business Line (who has conducted a similar exercise of finding big winner stocks) sounded a note of caution that such micro-caps are risky bets and that their mammoth gains could be a sign that the market (for micro-cap stocks) is getting overheated. He also pointed out that the P/E of some micro-caps such as Mangalam, Cupid, Uniply etc are about 37 times, which is much higher than their bigger peers. Such exorbitant valuations may not be sustainable, he warned.

So, if you are among the lucky ones to have bought any of these stocks, you need to keep an exit strategy ready!

Hey yo. Listen up. Don’t feel bad if you did not invest in any of these stocks. I ha e personally looked at all of them, and none apart from Emmbi tech is a reasonable stock. None of the other stcksm have a right to command such valuations. There are easily stocks out there which are undervalued and command such valuations. Look for those stocks as they are both liquid and will return actual money into your bank account. That’s it.

Hi,

please check the story cupid and you will realize its potential .

Thanks,

So prepare to lose 50% or more in most of the speculative shares in year 2016.Take first flight to safety in fundamentaly strong quality stocks for a Long Journey.Bumpy ride ahead for speculators.

WTF !!! How does investors flock into such stocks ? Quick money huh ? Recently saw few posts in moneycontrol about a boarder Arvind, I still havent understood the logic behind his recommendations but all stocks are daily in upper circuit. Thanks to the huge fan following. Sometimes I too feel like trading on those stocks based on the uptrend but then somehow try and curb that.