Strong cash flow despite higher BD, launch pipeline intensifies

DLFU delivered steady pre-sales in FY24 on a high base, with record collections and operating cash flows and strong earnings growth. Pre-sales stood at INR14,777cr (down 2% YoY) on strong response to its launches (launched 6mn sq. ft. in FY24). Nearly 83% bookings accrued from launches. In FY25, it amped up its launch pipeline to INR36,000cr (11.6mn sq. ft.) from INR32,000cr guided earlier. In Q3FY24, it had added a 29-acre (7.5mn sq. ft.) parcel with a GDV of ~INR20,000cr on Golf Course Extension Road in Gurugram.

Collections stood at a record INR8,655cr in FY24, up 53% YoY, resulting in a 68% growth in operating cash flow to INR4,385cr. Net cash strengthened to INR1,547cr from INR1,246cr QoQ. Revenue from its annuity portfolio under DCCDL grew 9% YoY to INR5,903cr aided by higher occupancy and the addition of leasable area.

In Q4FY24, pre-sales dipped 83% YoY to INR1,462cr on a high base and lack of launches. Collection/OCF grew 14%/6% YoY to INR2,205cr/INR1,105cr. We are upbeat on DLFU’s growth story given its robust launch pipeline, brand recall, favourable dynamics in its home turf, improving annuity income, and market consolidation. Led by a robust launch pipeline, steady project acquisitions, and higher sales velocity, we upgrade our TP to INR1,081 (earlier INR1,021). Maintain ‘BUY’.

Steady annual pre-sales, launch pipeline intensifies on project addition

Pre-sales fell 2% YoY on a higher base to INR14,777cr in FY24. Launches (~6mn sq. ft.) constituted 82% of pre-sales, led by DLF Privana South (INR7,200cr), Chandigarh Tri-City (INR1,200cr), One Midtown (INR1,280cr), shop-cum-offices (INR1,240cr) and Independent floors (INR1,215cr). The remaining bookings were from existing projects (The Camellias/others: INR1,580cr/INR1,063cr). For FY25, it has enhanced its launch pipeline to INR36,000cr (11.6mn sq. ft.; luxury/premium/ commercial: INR33,385cr/INR2,115cr/ INR500cr) from the earlier guided INR32,000cr (10mn sq. ft.) on the back of the newly added 7.5mn sq. ft. (GDV – INR20,000cr) project in Gurugram. Post FY25, it plans to launch 25mn sq. ft. (INR58,000cr). It has a total pipeline of ~INR94,000cr (36.6mn sq. ft.), to be launched in the next four years. Additionally, it has a land bank of 132mn sq. ft. for which it is yet to finalise the development plan. Strong launch pipeline, with an extensive land bank, ensures continuity in growth.

SEZ occupancy improves, leasable area expands

DCCDL reported a revenue of INR5,903cr (up 9% YoY) in FY24, with rental income growing 9% YoY to INR4,325cr on greater office occupancy and a higher leasable area. Gross/net leasing stood at 6.7/3.5mn sq. ft. in FY24. Retail revenue grew 18% YoY on higher consumption. Office revenue grew 7% on new net leases. Office/retail occupancy improved by 300bp/100bp YoY to 92%/99%. EBITDA grew 8% YoY to INR4,484cr, with a margin of 76% (FY23: 76.5%). Pre-leasing of under-development properties (3.1mn sq, ft.) stood at 87%. Rentals from the newly commissioned Downtown Chennai is expected to flow in from Q1FY25. With the floor-wise denotification now in force, DLFU saw a 200bp QoQ improvement in occupancy of SEZ assets to 86%. We expect this improvement to continue.

Cash flows impress, DevCo’s cash position strengthens further Led by strong pre-sales, DLFU reported record collections of INR8,655cr (up 53% YoY), resulting in an annual OCF (post-interest) of INR4,177cr (up 56%). This aided the DevCo in improving its net cash position to INR1,547cr as of March 31 from INR1,246cr as of December 2023. Cost of debt rose 8bp QoQ to 8.19%. Net debt in DCCDL fell 5% YoY to INR17,903cr.

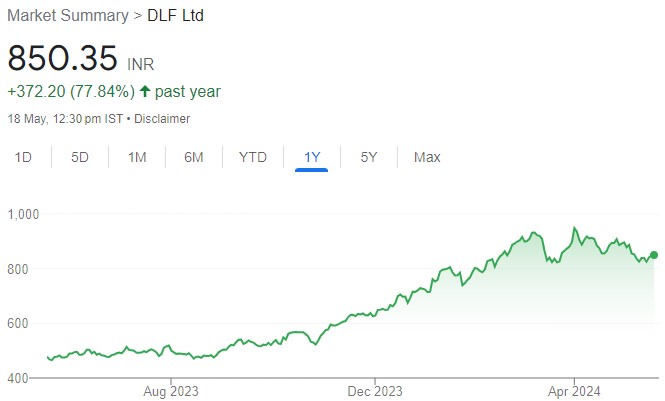

Maintain ‘BUY’ with a SoTP-based TP of INR1,081 We are upbeat on DLFU’s growth prospects driven by strong sectoral tailwinds (record low inventory in its home market, industry-wide consolidation, and a greater preference for branded luxury inventory), an extensive launch pipeline, and expansion of its annuity portfolio. A strong Balance Sheet, with consistent cash flow, lends comfort. We upgrade our TP to INR1,081 (from INR1,021) to account for project additions and an expanded launch pipeline. Maintain ‘BUY’.