Pundits do a somersault on Bajaj Finance’s prospects

It is unbelievable but true that during the depths of the CoronaVirus crash, some Pundits on Dalal Street had pronounced the death sentence for all NBFC stocks, including Bajaj Finance.

Its target price was lowered to a laughable Rs. 1740 from Rs. 4820.

Ye shahar me naye hain, pehle ek sahab Canada wale the

— NEERAJ BAJPAI (@NeerajCNBC) March 27, 2020

At that stage, Saurabh Mukherjea had come rushing to warn us not to act on the advice.

“Don’t get caught up in the near term forecasts, focus on long term,” he had said in a stern tone, looking at us straight in the eye.

Saurabh Mukherjea says don's get caught up in the near term forecasts, focus on long term. Bajaj Finance, HDFC Bank, Kotak Bank look incredibly 'juicy', attractive at this level

Premium financials in NBFC space, auto look very attractive— avanne dubash (@avannedubash) May 11, 2020

The amusing part is that the same Pundits, who had earlier written-off Bajaj Finance, are now singing its praises.

#BajajFinance

Classic case why never trust brokerage reports.They change their colour faster then

chameleons..Don't believe??

Check the report of #Bernstein on Bajaj finance..??? pic.twitter.com/nj4bMSAhbA— Darshit Patel? (@darshitpatel84) January 21, 2021

What a change in 1 year sell @ 1800 & now BUY@6500 ?? https://t.co/ls8IptutJp

— sanjiv (@sanjiv_bhasin) July 13, 2021

Bajaj Finance: The Enigma Is Set For Another Transformation

Anyway, now the question is about the future and whether more gains are due from the powerhouse.

In the latest newsletter, Saurabh and his ace team at Marcellus have pointed out that BajFin has transformed itself from being largely a captive vehicle financier to India’s most diversified NBFC which now offers over 40 lending products and has established housing finance and broking subsidiaries.

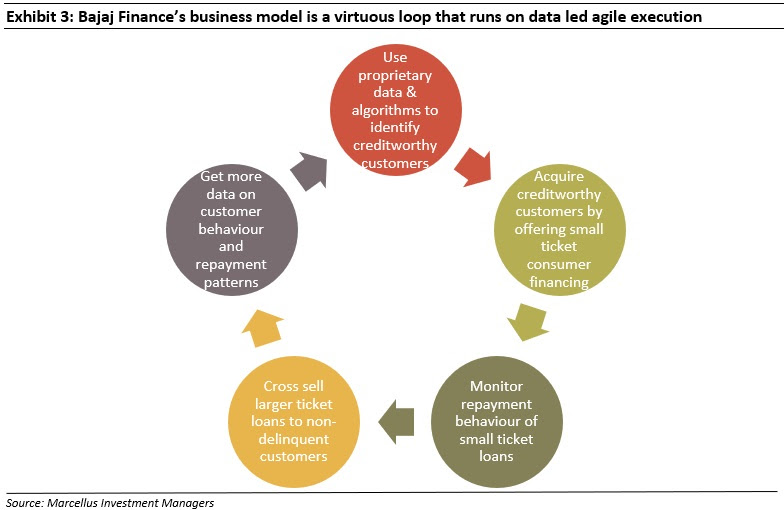

They point out that the Company’s success has been underpinned not just by its unique use of technology but also by access to low cost of funding courtesy its Bajaj group parentage.

It is also stated that while business transformation 1.0 over the past decade has resulted in the Company building a customer franchise of ~50 million customers, business transformation 2.0 is likely to be one of the most radical transformations for an Indian listed company. Transformation 2.0 will enable BAF to not only double its existing customer base but also mine the wallet share of its existing customers in a cost-effective manner.

It is difficult for other lenders to replace Bajaj Finance

The newsletter points out that there are significant execution related challenges for a new entrant. The advantages of scale that Bajaj Finance enjoys in this business are:

– Geographical presence: A manufacturer such as a Samsung, LG, Sony, etc. would want to deal with a consumer financier which has the widest geographical presence so that all its retail touch points are able to benefit from the sales boost of a 0% EMI scheme. Today, Bajaj Finance offers the widest geographical presence to any manufacturer. Bajaj Finance offers a simple plug and play model financing model across hundreds of locations to large manufacturers such as Samsung, LG etc.

– Ability to approve a large proportion of loans: The retailer/ manufacturer would also want the financier to approve a large percentage of loans at a high velocity so as to convert customer footfall in their stores to actual sales. A conservative financier with a high loan rejection rate would not be preferred by the manufacturer/ retailer. It is difficult for most banks and NBFCs to not only a approve a high percentage of customers but also to know which customers to approve at a high velocity. Bajaj Finance offers the highest approval rate because it is focused on the customer’s overall wallet share and does not look at the consumer durable loan in isolation – once BAF acquires the customer it is able to cross sell multiple other products to the customer. Bajaj Finance’s extensive database allows it to access underwriting analytics on prospective borrowers faster and make underwriting decisions faster than any other NBFC.

– Collection infrastructure to collect small ticket loans: Because these are small ticket unsecured loans, it is extremely important to have a delinquency bucket wise granular collections infrastructure which is able to collect overdues in a cost-efficient manner. As seen in Exhibit 2, because EMIs in consumer durable financing are of a few thousand rupees, if the unit cost of collection exceeds a few hundred rupees then this becomes an unviable business to run at scale. Over 25% of Bajaj Finance’s staff of over 25,000 employees is in the collections team. These employees in turn work with hundreds of collection agencies across India.

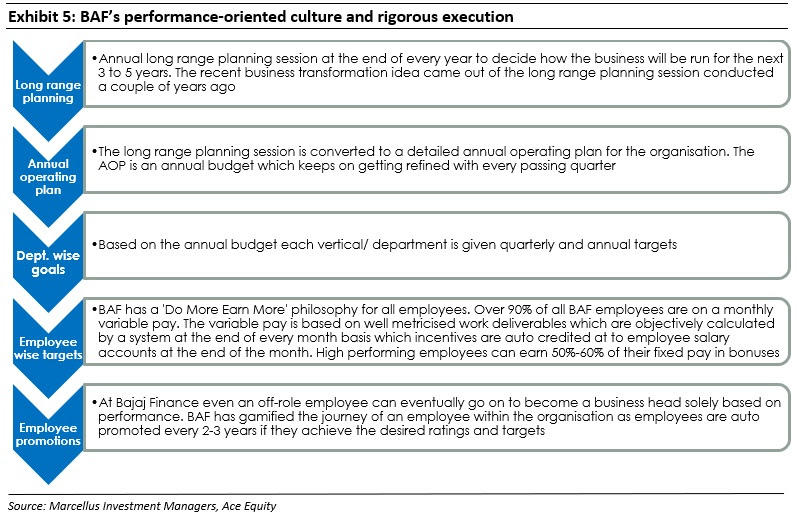

It is also stated that Bajaj Finance’s ground level execution and meritocratic culture is hard to replicate. The ground level execution and employee empowerment is driven through the process described below:

Business transformation 2.0 likely to be one of the most radical transformations

Team Marcellus has given further meticulous detail about Bajaj Finance’s business game plan.

Ultimately, it is stated that:

“While business transformation 1.0 over the past decade has resulted in BAF building a customer franchise of ~50 million customers, in this newsletter we discuss how BAF’s business transformation 2.0 is likely to be one of the most radical transformations for an Indian listed company. Transformation 2.0 will enable BAF to not only double its existing customer base but also mine the wallet share of its existing customers in a cost-effective manner“.

Conclusion

It is quite obvious from the brilliant exposition by Team Marcellus that we cannot even dare to think of selling Bajaj Finance in case we have it in our portfolios. Instead, we have to look for sharp corrections to add more of the stock!