Key Points

Meteoric rise in returns by Defence stocks in NBIE coverage

The Defence stocks within our coverage universe have delivered 58% returns in the last three months, 75% returns in the last six months, 148% returns in the last 12 months and 776% returns in the last three years, buoyed by healthy order books, revenue expansion and the government’s major push for indigenization in the Defence sector.

Most stocks have delivered supernormal returns since our IC

The stocks have delivered phenomenal returns in the last three months: AMPL – 43%, BDL – 76%, BEL – 43%, BEML – 46%, DPIL – 17%, HAL – 42%, MDL – 136% and PDSTL – 92%.

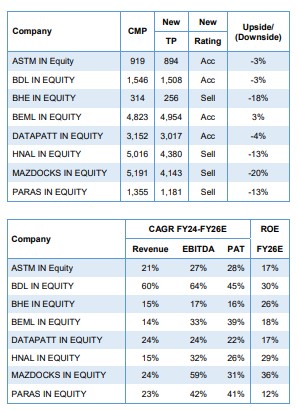

Justifying Defence valuations; The order book backlog conundrum: We believe that the exuberance around the Defence sector has been built solely around strong order books for assigning high valuations. Therefore, the conventional financial metrics do not fully capture the industry’s true value, particularly cyclicality, profitability and efficiency. While we remain structurally positive on the Defence sector, the current steep valuations (stocks are trading well above their +2SD valuations despite assuming extremely aggressive earnings growth) do not take into account the risks from execution hiccups, rise in raw material costs, competitive pressures and cash flow generation. Despite assuming extremely strong earnings growth, ROE estimate for FY26 remains ~10-30% for coverage stocks, making it difficult for us to justify exorbitant multiples. We prefer to remain on the sidelines until valuations return to reasonable levels. We therefore downgrade the Defence sector to SELL. Our new target multiples of around +2SD for most coverage stocks adequately capture the growth opportunities in the sector.

Long-term outlook positive:

During FY18-FY24, our coverage’s Order Book/Revenue/EBITDA/PAT have clocked a 6-year CAGR of 6%/8%/17%/20% and we are forecasting Revenue/EBITDA/PAT CAGR of 20%/27%/25% during FY25E-FY26E. Given the huge opportunity (domestic as well as exports) and potential long-term growth (as highlighted in our IC report released in April’24), the Defence sector remains wellpositioned. Recent conflicts closer to India, Europe and other regions of the world have enhanced the need and necessity to expand Defence capex and localize Defence manufacturing.

Potential risks to the sector:

Changes in the global economic and political order: Any changes in the US presidency and inward-looking policies may lead to a cut in global defence spending. Tighter government budgets may also affect defence spending plans. This could translate into reduced or delayed orders for defence companies, hindering growth.

Delays in project execution, caused by technical complexities or bureaucratic hurdles, can disrupt cash flows and impact profitability. This could lead to fall in stock prices and dampen investor sentiments.

Changes in Govt policies: Shift in government priorities or changes in leadership could alter defence procurement policies, creating uncertainty for the Defence sector.

Geopolitical uncertainties: They can be a double-edged sword. While heightened tensions might lead to increased defence spending in the short term, prolonged instability can create uncertainty and hinder long-term growth prospects