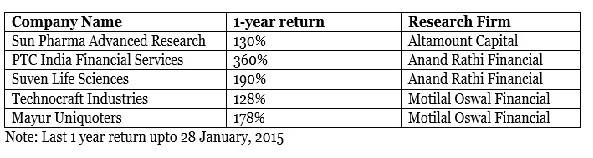

Kshitij Anand of ET has written a report in which he has spoken to leading stock market experts and collated their opinion on the stocks that have a chance to become multi-bagger stocks.

(Image Credit: ET)

Mayur Uniquoters Ltd – 25% CAGR in profits over FY14-17E and beyond along with core ROE of 30%:

Over the years, Mayur has successfully created its moat within a competitive industry and is working towards widening it. Mayur is a professionally-run company investing in R&D with a focus on value added products, while the other 5-6 organized players have languished much like the unorganized sector, Motilal Oswal said in the report.

Over the last 4 years, Mayur has acquired clients such as Ford and Chrysler in the US and is currently in discussions with Mercedes, BMW, Toyota and GM. The top 6-7 auto OEMs in the US purchase synthetic leather worth INR5b each annually which translates into an addressable market of INR30b.

Given the robust revenue visibility with global OEM clients coming on board, improving realizations with rise in share of exports and visionary top management, Motilal Oswal believes that Mayur can sustain 25% CAGR in profits over FY14-17E and beyond along with core ROE of 30%.

They value the business at 25x FY17E EPS (PE/G of 1x) and recommend a BUY rating on the stock with a target price of INR600/share.

Suven Life Sciences – high-growth, high-margin business, superb balance sheet, huge monetisation opportunity:

Suven Life Sciences is an excellent high-growth, high-margin business which operates out of the new chemical entity-based, contract research-manufacturing space.

Typically, it is a pharma stock which enjoys very high margins. In addition, it has a huge monetisation opportunity for one of its molecule – SUVN-502. The molecule is in the advance stage.

Other than this, the company has no working capital issues; it has superb balance sheet, and good return ratios.

“We feel that this stock can probably be a dark horse going forward. We have a very conservative price target of around Rs 336 for Suven Life Sciences,” says Devang Mehta of Anand Rathi Financial Services.

Technocraft Industries Ltd – market dominance and attractive valuations:

Technocraft commands 36% market share of the Global (ex-China) steel drum closure industry having a size of INR 700 cr. With the largest player being Greif, having over 50% market share, the top two players together command over 86% of the global (ex-China) market share, thus making the industry a duopoly.

Given Technocraft’s superior industry positioning in drum closures, incremental growth being driven by the scaffolding division and increasing contribution from the IT division, we believe Technocraft is available at attractive valuations of 4.7x FY17E EPS, Motilal Oswal said in a report.

“Our SOTP-based price target for Technocraft is at INR 300 providing for an upside of 54% over the next one year,” added the report.

PTC India Financial Services – fantastic return ratios, hugely undervalued:

This stock, ‘PFS’, is one of the best among non-banking financial services (NBFC) names. The company saw healthy set of numbers last quarter, with disbursements rising to around 70 per cent. In addition, the renewable space in which the company is a master is growing at an excellent space.

The parent of this company, PTC, which is into short and long-term power trading, will ensure that its financing arm would tend to get a lot of new projects going forward. If the company’s NIMs were at around 6.2 per cent, it has capital adequacy ratio of 26 per cent. The return ratios are fantastic.

“We expect 21 per cent return on equity (ROEs) by FY2016-17, and we feel that the stock is currently hugely undervalued. At Rs 87 per share, which is our target price, the stock would be somewhere around 2.5 times its price to book value,” says Devang Mehta of Anand Rathi Financial Services.

Sun Pharma Advanced Research Ltd – highly risky and highly rewarding:

This is closest that you can get to a stock which is into something as risky and rewarding as oil exploration. The stock has already doubled investors’ wealth so far in the month of January alone.

Even if one out of something like 27 molecules make it commercial, they would actually get rewarded for all that efforts. The best part is that the promoter has been funding the business from its own wealth consistently, because it needs money, wages to be paid out etc.

“Also, there is nothing much in infrastructure, but if you see the facility, it is a very small facility which moved out of Baroda when the group split itself and came to Andheri and they still operate out of the same place,” says Prakash Diwan, Director, Altamount Capital Management.

“It was fascinating to see that there is nothing else except for just believing that they will get rewarded, and that started happening. This could continue to be a multibagger even many fold from here. So it is not like a limit,” he adds.

Pl help me with investment opportunities in Multibagger stocks